SocialFi & Decentralized Social Media for the Masses: The Role of Smart WaaS Tools.

Table of Contents:

The history of decentralized social media is one of trial and error.

Also referred to as “DeSo” or “DeSoc”, decentralized social media emerged as early as 2010 to create an alternative to traditional social platforms, which unilaterally curate user-generated content while profiting from it while appropriating users’ data. As social media grew in power and presence, DeSo’s values of free expression, non-profit, and voluntary contribution aimed to bring equilibrium to the playing field.

A breakthrough for DeSo occurred with the emergence of Web3 smart contract platforms. With similar values, networks like Ethereum represented the perfect financial rails to build the new generation of social platforms, rewarding stakeholders for maintaining, monetizing, and distributing the proceeds from platforms. And so Social Finance, or SocialFi, was born.

Over the years, many DeSo and SocialFi platforms have appeared, showcased promising growth among enthusiasts, and disappeared again. However, recent events like Friend.tech’s (somewhat short-lived) explosion demonstrated that there is still an appetite for SocialFi products. They also showcased that, when combined with creative design to leverage Web3’s unique advantages, SocialFi platforms can still cause ripples outside the Web3 echo chambers.

Let’s examine the journey of Social Fi, its unique challenges in appealing to the mass market, and how developers can use Smart Wallet-as-a-Service (Smart WaaS) tools to build the SocialFi platforms that onboard the next billion users to Web3.

History and evolution of decentralized social media and SocialFi

At its emergence, DeSo was closer to Wikipedia than to modern alternatives. Platforms were maintained by enthusiasts and users and managed in a decentralized way through “federated” approaches.

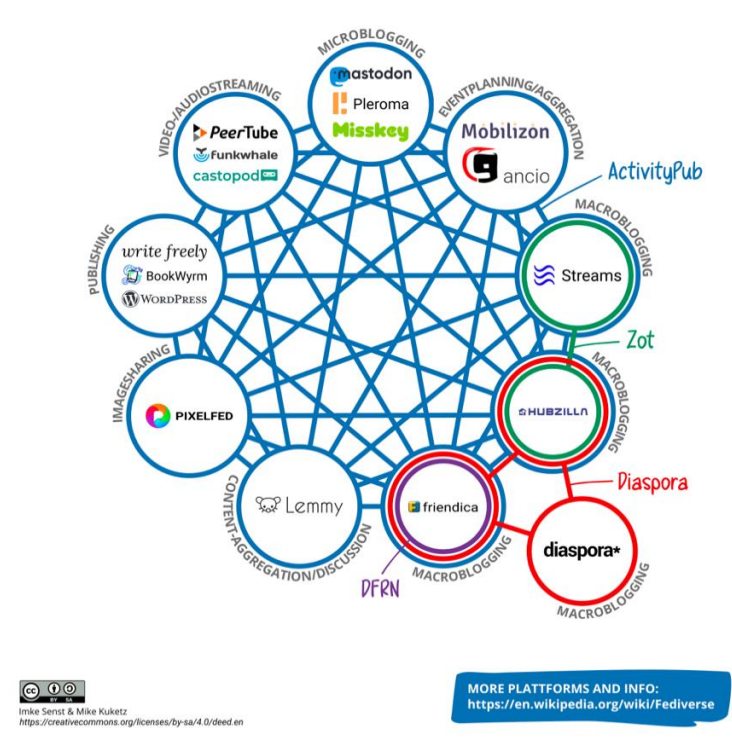

Federated approaches rely on a network of independent servers following a common standard, rather than a monolithic structure where all data resides on corporate servers. For example, each server, or "instance," in Mastodon's case, is self-hosted and managed, enabling different communities to establish their norms and guidelines. Importantly, servers remain interconnected, allowing users on different servers to interact, as shown below:

Pioneering DeSo platforms like Mastodon and Diaspora relied on open-source contributions and followed the default federated approach of DeSo. They sustained themselves through community funding, donations, grants, and volunteer work, purposefully cutting out revenue streams –such as advertising– for ideological reasons. However, as you may imagine, configuring sustainable models that scale is hard when relying on donations. It limits platforms’ ability to compete with for-profit giants, which have the ability to reinvest their earnings to attract new talent, advertise themselves in different ways, fund R&D, and iterate quickly.

However, the missing piece of the puzzle would soon emerge on its own.

The arrival of Web3

The arrival of Web3, in many ways, represented a way for DeSo platforms to capture and distribute value and streamline their economic capabilities. Web3 presents unique advantages such as:

- Users translating their interest into economic shares, becoming platform stakeholders.

- Communities forming around shared incentives.

- Better privacy and security for users and platforms alike.

- New monetization strategies for users.

- Enabling decentralized governance.

- The ability to take advantage of Web3’s composability (a highly important feature we’ll cover in depth in a separate sub-section).

- Distributing profits automatically.

- Platforms directly rewarding users for creating content..

The very first implementations of Web3 social media, such as Steemit and Minds, were based precisely on the latter. They allowed users to earn tokens through content creation, curation, and community engagement. This fostered a direct rewarding relationship between platforms and users.

Web3’s capability for decentralized governance also meant that platforms could for the first time be directly governed by users. This approach democratizes platform management and Treasury allocation, making it community-driven. Remarkably, we have also seen the first successful implementations of profit redistribution –albeit outside conventional SocialFi– with Basic Attention Token (BAT): Integrated with the Brave browser, BAT aimed to change the dynamics of online advertising. Users could earn BAT tokens by opting into viewing ads, with the token also serving to reward content creators.

Slowly acquiring the speed and tools needed to become truly competitive, Web3 also allowed SocialFi platforms to increasingly grow in sophistication and new features, incorporating functionalities like DeFi and NFTs, marketplace features, diverse content monetization options, and enhanced user-to-user interaction models. Strengthening through different approaches, competitiveness, and iteration, this opened way for one of the first truly industry-shaking releases.

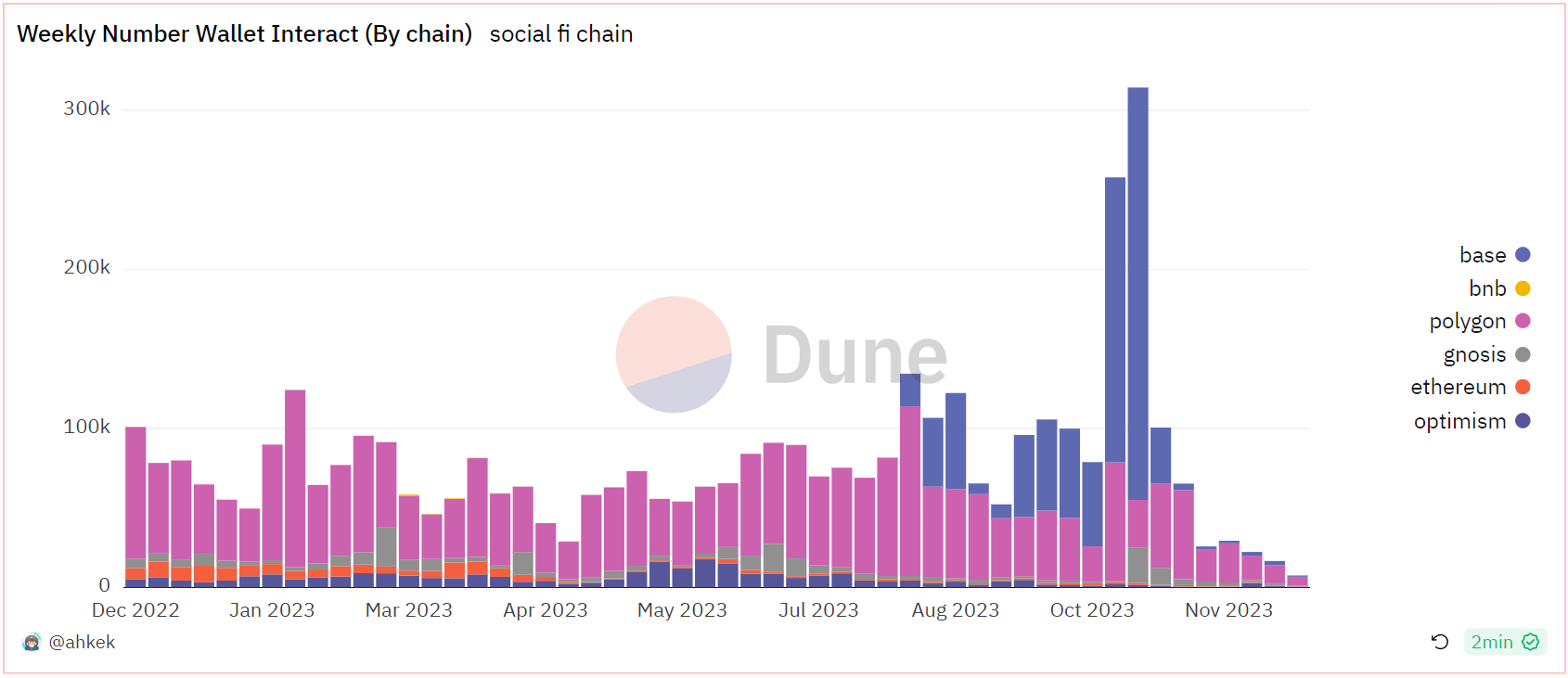

Friend.tech, composability, and the validation of the SocialFi model

At a somewhat low point of engagement and activity within the Web3 social realm, the release and near-immediate success of Friend.tech on the Base chain represented a breath of fresh air into the scene. Within just a fortnight of its launch, Friend.tech amassed over 100,000 users and generated an impressive $1.68 million in protocol fees, surpassing many established on-chain protocols in terms of revenue. Its trading volume reached an astonishing $57,101,116, translating to over 34,320 Ether, showcasing the platform's extensive reach and activity.

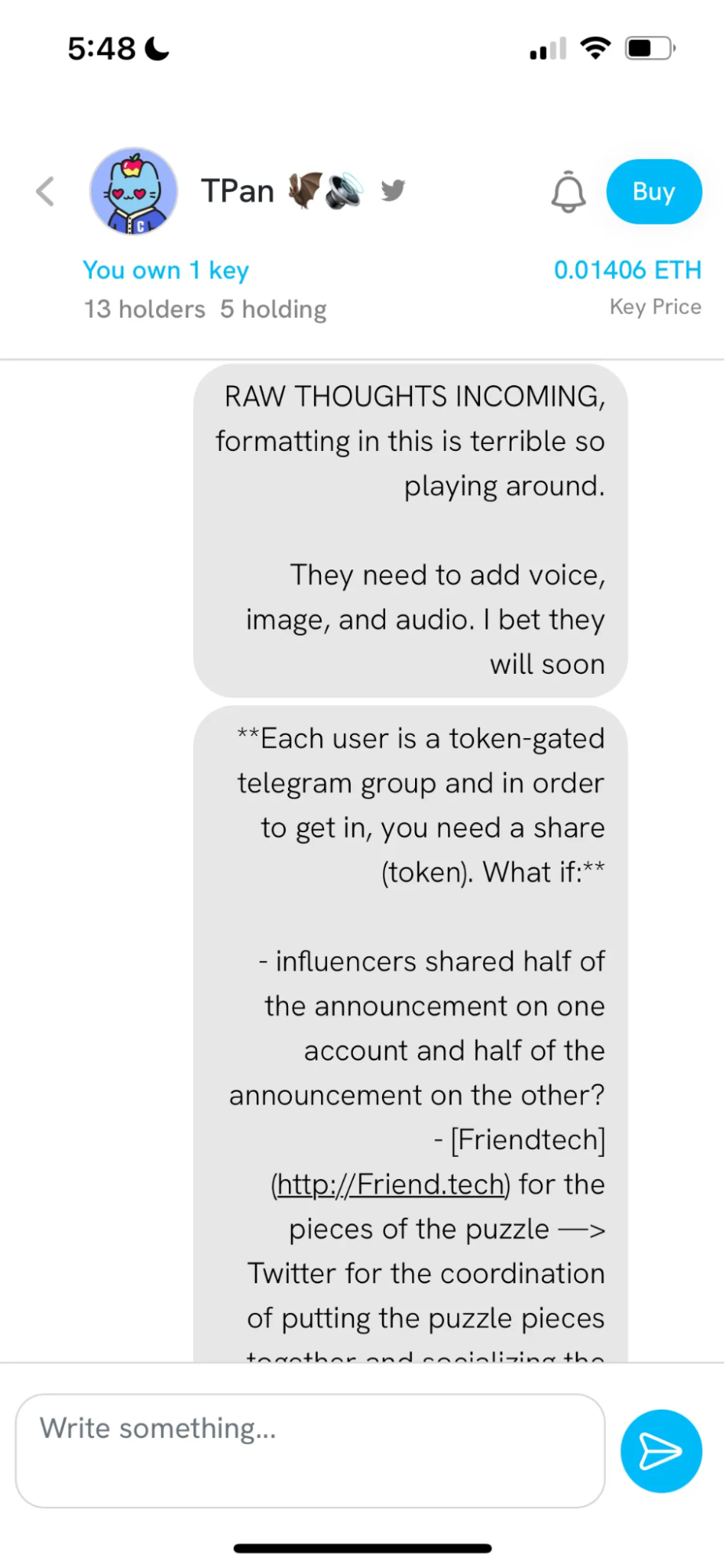

As a phenomenon, there is much to be said about Friend.tech. The dApp blended social interactions with financial incentives with a genuinely new approach, enabling creators to sell scarce “keys” granting users access to private chat spaces and interactions. Due to their scarcity, keys are then subject to appreciation and depreciation dynamics based on supply and demand (a bonding curve), essentially monetizing the influence and reputation of individuals on the platform.

Importantly, Friend.tech also sent a strong signal towards the non-Web3 world, attracting creators beyond Web, from OnlyFans models and eSports influencers to regular celebrities. Only time will tell whether FT eventually makes a comeback, but the following insights can be collected from its success:

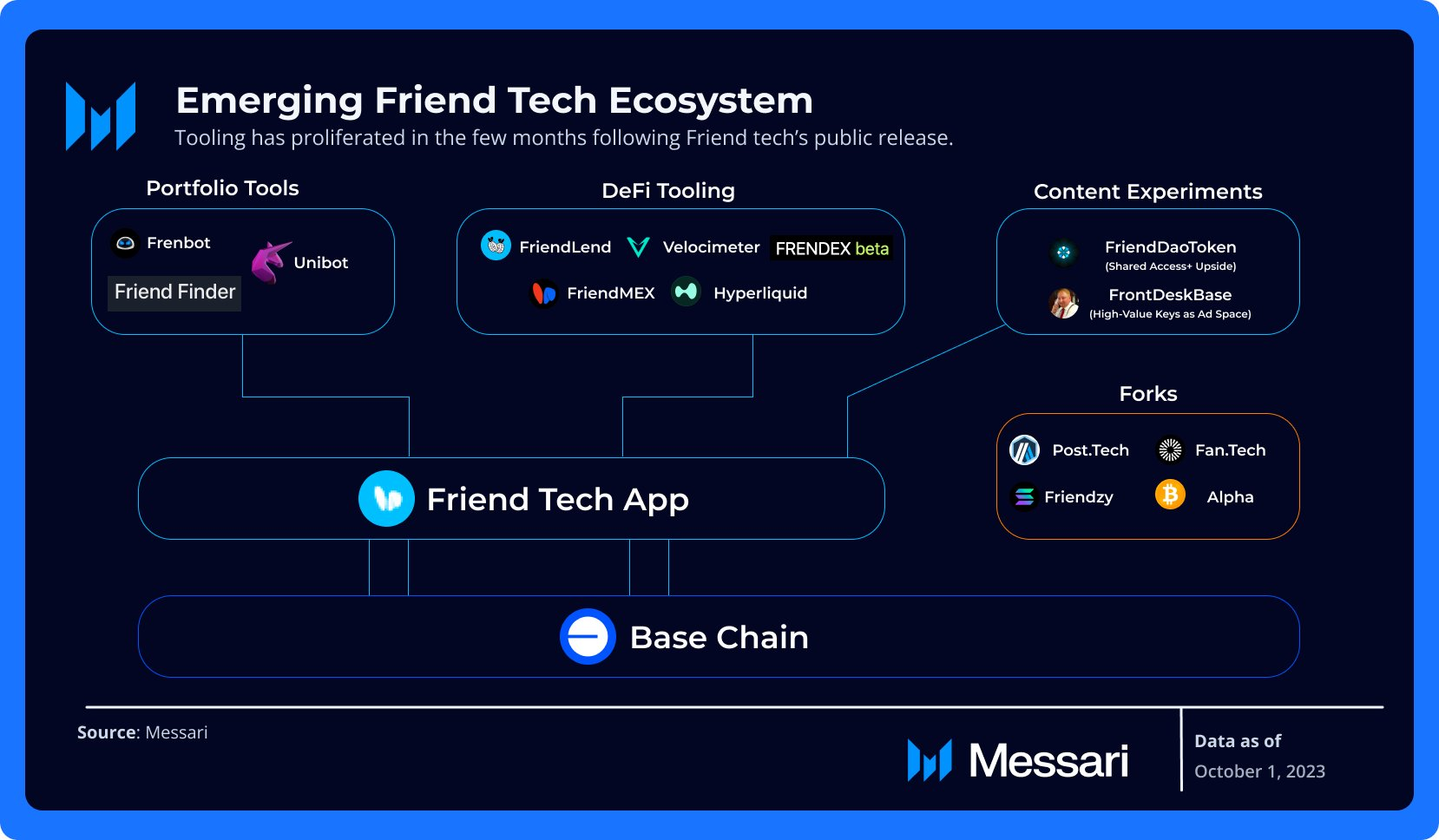

- The importance of composability in Web3. Inspired by Friend.tech’s success, a market of applications built on top of it quickly developed, allowing users to trade keys, collectively hold them, create their own versions of the dApp, lend them, and much more. Composability is an often-cited benefit of Web3 that hadn’t ever reached its full potential within SocialFi, and the Friend.tech ecosystem quickly showcased that, with a successful app, developers’ creativity can quickly spark growing innovation. As SocialFi evolve, developers might want to have this in mind in order to build applications that are inherently suited to spark their own ecosystems, and possibly release them simultaneously to achieve greater outcomes.

- Building on top of, instead of to replace Web2 socials. By leveraging digital social status/social currency (established social relationships on Twitter), FriendTech lowered the threshold for users to issue their assets. Compared to conducting an ICO on Ethereum, pricing one's social status is easier to understand and manage for most users with such a point of reference than starting from scratch, also creating an incentive to port over. Critically, this initial audience with the highest incentives (Twitter influencers), also brought along their own traffic and networks, making it easier for the product to accelerate its growth.

- Web3’s ability to “create” markets. While some players in the SocialFi scene have tried to downplay the “Fi” factor, Friend.tech fully embraced it. It created a straightforward path for the NFT-trader/degen mentality to integrate into social media, to great success. This innovation not only introduced a new type of digital asset but also transformed social influence and engagement into concrete, tradable commodities, creating dynamics of its own and tapping into the existing needs of creators and users.

- The significance of Web2-like UX. Friend.tech's rapid explosion can be attributed in part to its intuitive onboarding process, based upon and resembling familiar Web2 platforms. Thanks to the usage of Wallet-as-a-Service solutions, Friend.tech users could create an account and start using the app directly with their phone number, Apple, or Google ID, without the need for a wallet. This approach lowers the barrier to entry for users unfamiliar with Web3 technologies, enabling a seamless transition. Moreover, the platform’s interface taps into a familiar chat design, rather than trying to “reinvent the wheel”.

Like its predecessors in the SocialFi space, Friend.tech experienced considerable decay after its initial surge. Despite its early success and innovative market creation, Friend.tech's decline highlights the enduring challenges within the SocialFi ecosystem. This reality sets the stage for an in-depth exploration of the obstacles that SocialFi still needs to address. The following section will delve into these challenges, examining the complexities of regulatory compliance, user retention, market volatility, and the ethical implications of monetizing social interactions, which are pivotal for the future stability and growth of SocialFi platforms.

Challenges of SocialFi dApps

Like its precursors in the SocialFi space, Friend.tech saw considerable decay after its initial surge. Its journey, nonetheless, served as a powerful demonstration of the potential within this space. Despite its early success and innovative approach, Friend.tech's decline highlights the challenges within the SocialFi ecosystem. These are as follows:

- Scalability and infrastructure: As SocialFi platforms grow, they must address scalability challenges to ensure smooth operation and user experience. This is particularly relevant to FT’s case, which saw most of its success still within an invite-only beta phase. It’s important to note here that modern L2 chains make it easier to manage the high transaction loads of social dApps, while account abstraction (covered below) can help provide the infrastructure needed for this kind of dApp.

- Onboarding and user experience: Particularly for newcomers unfamiliar with the intricacies of handling wallets and private keys and obtaining tokens, onboarding to these dApps can be tricky. Similarly, navigating the complexities of Web3 technologies, such as cryptocurrency transactions and gas payments can also be daunting. As such, SocialFi platforms must provide a straightforward learning curve, to ensure that newcomers feel comfortable and confident as they engage, or ideally abstract these concepts as much as possible.

- Financial complexities and sustained incentives: During the early stages of growth, financial incentives can accelerate the user growth and commercialization capabilities of a product. However, since early incentives cannot last indefinitely, this can result in speculative initial growth that eventually shortens the lifecycle of regular users. In this regard, financial complexities also result unattractive for the mass market –which might not be the greatest beneficiary when competing with advanced financial players— but is expected to be the primary audience and value driver. The existing business model of the trading market isn’t necessarily wrong, but it's clear that more attention needs to be paid to the incentive experience of long-tail users as a whole.

- Retention and adoption: Besides addressing in-product complexities, social dApps also need to focus on attracting new users and creating ongoing activity by offering better or more innovative solutions than existing market offerings. This strategy is vital not just for drawing in new audiences, but also for fostering synergies and dependencies across the social ecosystem. Therefore, maintaining user engagement over the long term, particularly in a landscape where the allure of novelty can quickly fade, is essential for the sustained growth and vitality of these platforms.

While there are other challenges (such as the puzzling lack of clear regulations around the space in most jurisdictions), the above create a clear place to start for our ecosystem. And, happily, at this point in time, they can all be addressed in one way or another by the combination of multiple technologies under a common tool: Modular Smart WaaS.

Modular Smart WaaS tools in SocialFi and Beyond

As we mentioned above, the hyper-competitive nature of social media platforms only presents difficulties for decentralized versions of them. However, one way to break free from these constraint seems to be by fully embracing the financial aspects of SocialFi while providing a seamless user experience.

In this context, Modular Smart WaaS (Wallet-as-a-Service) tools can play a significant role in facilitating the SocialFi experience. To better understand how, let’s deconstruct the term “Modular Smart WaaS,” starting with “WaaS.” We’ll examine these concepts in the light of SocialFi development, presenting relevant examples and use cases.

Wallet-as-a-Service and SocialFi

WaaS tools simplify the integration of Web3 functionalities into SocialFi applications by serving two key functions:

- Embedding wallets directly into platforms, enhancing the user experience. Instead of requiring a separate wallet application for transactions or message signing, users can perform these actions within the SocialFi platform itself. This integration is crucial in SocialFi applications, where frequent and seamless interactions are necessary, reducing friction and creating a smoother user journey.

- Allowing users to create or access their wallets via social logins, bridging the gap between conventional Web2 experiences and the Web3 ecosystem. This feature is particularly useful as it enables Web2 users to transition easily to Web3 products without the complexities of managing private keys or installing additional tools, leading to better conversion rates and faster user onboarding.

- Critically for Social Fi products, Social Logins can not only provide a quick login experience akin to Web2. Their benefits lie in helping SocialFi products rapidly leveraging users' Web2 social identities and social graphs. This facilitates a more efficient establishment of decentralized asset categories or relationship chains.

In terms of security and autonomy, WaaS tools can maintain full self-custody while offering user-friendly access through advanced cryptographic techniques like Multi-Party Computation Threshold Signature Schemes (MPC-TSS). This method enhances security by distributing risk and ensures that users retain control over their assets.

The below chart compares different private key management mechanisms commonly used in WaaS tools:

Moreover, WaaS tools like Particle Network’s are designed for customization, allowing developers to tailor the wallet experience to their dApps’ and user base’s needs, and to integrate their branding.

Modularly and natively integrating AA into WaaS: Modular Smart Wallet-as-a-Service

Modular Smart Wallet-as-a-Service is a framework allowing developers a customizable and flexible approach to integrate AA (Web3’s latest paradigm shift in UX terms) into SocialFi dApps. The combination of AA and WaaS means developers can now build a new generation of dApps with enhanced functionality and user experiences. Let’s explore both these factors:

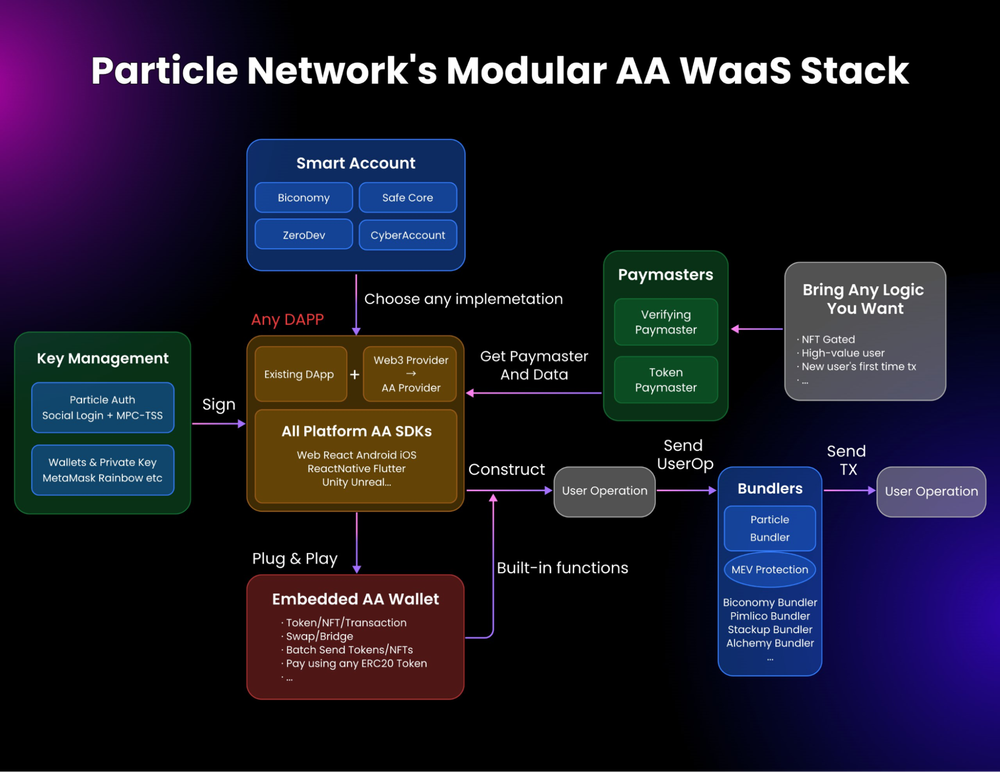

Smart WaaS tools, such as Particle Network’s modular AA stack, are Smart because of their native integration of account abstraction. They offer developers various pathways to leverage WaaS + AA in their applications, regardless of complexity or features. Native AA integrations create familiar mechanisms for developers to interact with smart accounts, such as transaction structures and account management, all handled seamlessly by the SDK.

Particle Network’s AA Stack ecosystem, with upcoming support for more implementations, is likely to evolve further.

Ultimately, Smart WaaS empowers builders to select services and tools that best suit their application’s needs, which in the context of SocialFi could mean:

- Transaction Simplification: AA allows for streamlined interactions within SocialFi platforms by embedding custom transaction logic directly into user accounts. This can simplify operations like content monetization, user-to-user transactions, or fee distribution models.

- Fee Handling: High gas costs can be a barrier in Web3. AA can mitigate this by enabling gasless transactions or transaction batching, optimizing gas consumption and abstracting away constant gas payments from the UX.

- Enhanced Security: Security is crucial in SocialFi, especially with assets involved. AA can enhance security through sophisticated permission systems within a smart contract wallet, like daily spending limits or multi-signature approvals.

- Modularity: Modularity ensures developers can select and integrate desired components while maintaining essential onboarding functionalities. In the context of AA, modularity means developers can choose specific implementations that meet their project's specific needs, such as different smart account implementations or paymasters.

Modular Smart WaaS in SocialFi

When it comes to the main challenges of SocialFi, as outlined above, Modular Smart WaaS tools can address these issues while maximizing the most important components for SocialFi ecosystems

- Scalability and infrastructure: These tools can bolster the infrastructure of growing SocialFi platforms, crucial for maintaining smooth operation and user experience, especially in high-traffic environments. Furthermore, account abstraction capabilities can play a pivotal role in managing transaction loads and providing the necessary infrastructure for social dApps.

- Onboarding and User Experience: By simplifying wallet management and token acquisition processes, Modular Smart WaaS tools can significantly ease the onboarding process for newcomers. They help in abstracting complex Web3 technologies like transactions and gas payments, making the user experience more accessible and less intimidating for those new to the ecosystem, which allows developers to focus on crafting a seamless UX.

- Retention and adoption: To attract new users and foster ongoing activity, SocialFi platforms need to offer innovative solutions that outperform existing market offerings. By enhancing user engagement and streamlining in-app experiences, Modular Smart WaaS tools contribute to creating a more dynamic and interconnected social ecosystem, which grows in value as more solutions adopt this vision. This approach is essential to keep users engaged over the long term, especially in a fast-evolving landscape where the novelty factor can quickly diminish.

The full potential of Modular Smart WaaS in SocialFi is still unfolding, with its transformative impact on user experience expected to grow as new solutions emerge. Developers in the SocialFi space should be excited about upcoming features in platforms like Particle Network, which aim to simplify blockchain interactions and preserve user privacy.

We invite developers to explore SocialFi with Particle Network's Modular Smart WaaS and subscribe to this blog for more updates!

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)