Late Into the Memecoin Supercycle: Web3’s Shifting Value Scale In 2025

Table of Contents:

We will forever remember 2024 and early 2025 as the peak of the memecoin mania.

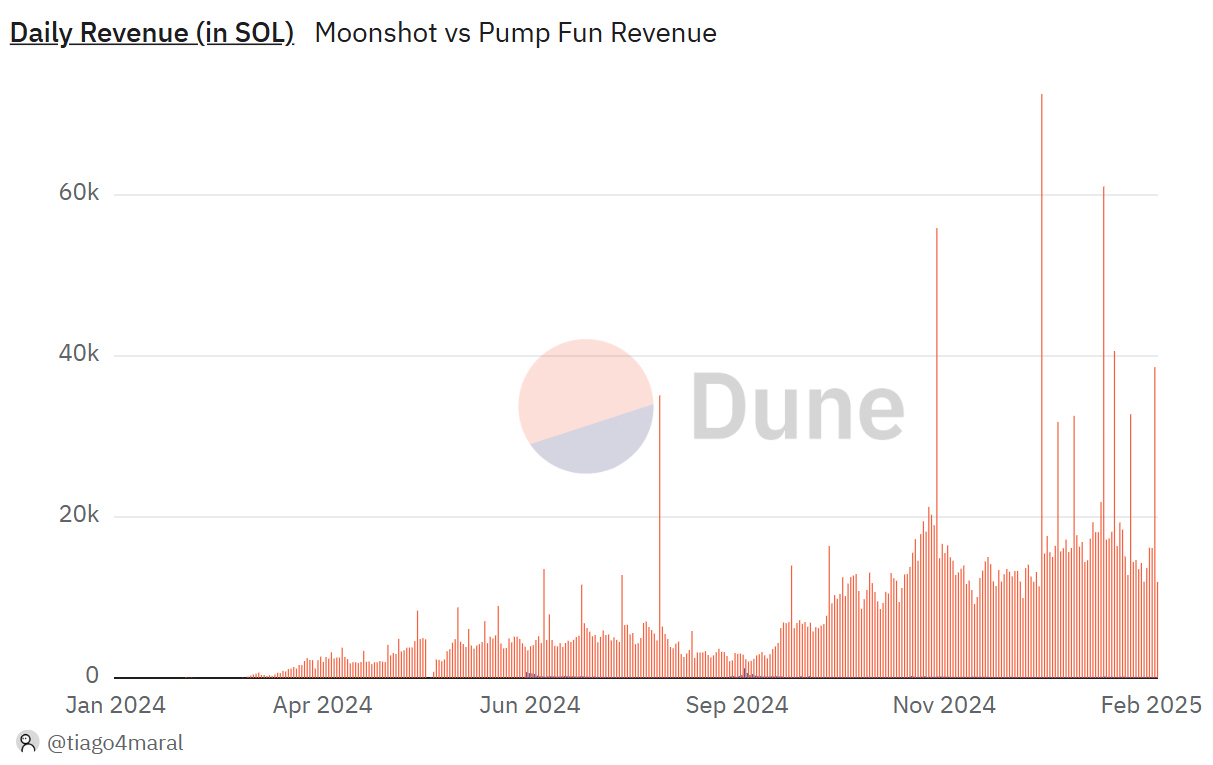

The launch of ecosystems like pump.fun and Moonshot, as well as their equivalents across different chains, accelerated and democratized the memecoin environment. This has given everyone the ability to:

- Create memecoins without any technical knowledge.

- Instantly produce liquidity pools for these memecoins, making them liquid and easy to trade.

- Instantly search and identify opportunities and trends for memecoins launched within these same ecosystems.

- Onboard into memecoin trading even with little or no crypto experience.

The results are obvious: In 2024, memecoins’ market capitalization grew from $20B to $140B, accounting for 5% of the industry’s trading volume, with up to 60,000 new memecoins created daily and interest from 30%´of all investors globally. This is in stark contrast to the larger altcoin market (a proxy for Web3’s technologic advancement and adoption), which’s relative stagnation can be exemplified by a “mere” 150% growth in DeFi TVL.

Because of the above, there are lingering questions in the Web3 air, all surrounding this phenomenon:

- Is memecoin max degeneracy a symptom of a “market top” concluding the crypto cycle?

- Can the lack of interest in Web3’s more innovation-oriented products mean that the industry’s main product is tokens, not technology?

- Consequently, will we ever see a technology-driven market run that cements the industry as a value generator beyond DeFi?

- Does this mean that a lot of projects receiving billions of dollars in funding are merely vaporware?

To answer these questions, let’s look at the historic moment of 2024’s memecoin mania, Web3’s mainstream interpretation of these questions, existing evidence, and try to draw lines toward what the future may hold.

Memecoin philosophy 101

We can begin our analysis by understanding how the industry perceives memecoins and their direction. To do so, a great starting point is TOKEN2049’s Murad Mahmudov Memecoin Supercycle presentation.

Mahmudov’s presentation, which was regarded as visionary, featured points that have proven true throughout recent months. Murad highlights the dominance and anticipates the continued rise of memecoins, emphasizing their outperforming of every other token. He attributes this success to:

- Memecoins being a simplified and low-friction (100% liquid, circulating, exciting) version of every other type of token.

- Tokens, in general, being Web3’s main product (assuming all other Web3 technologies, with the possible exception of DeFi, have failed).

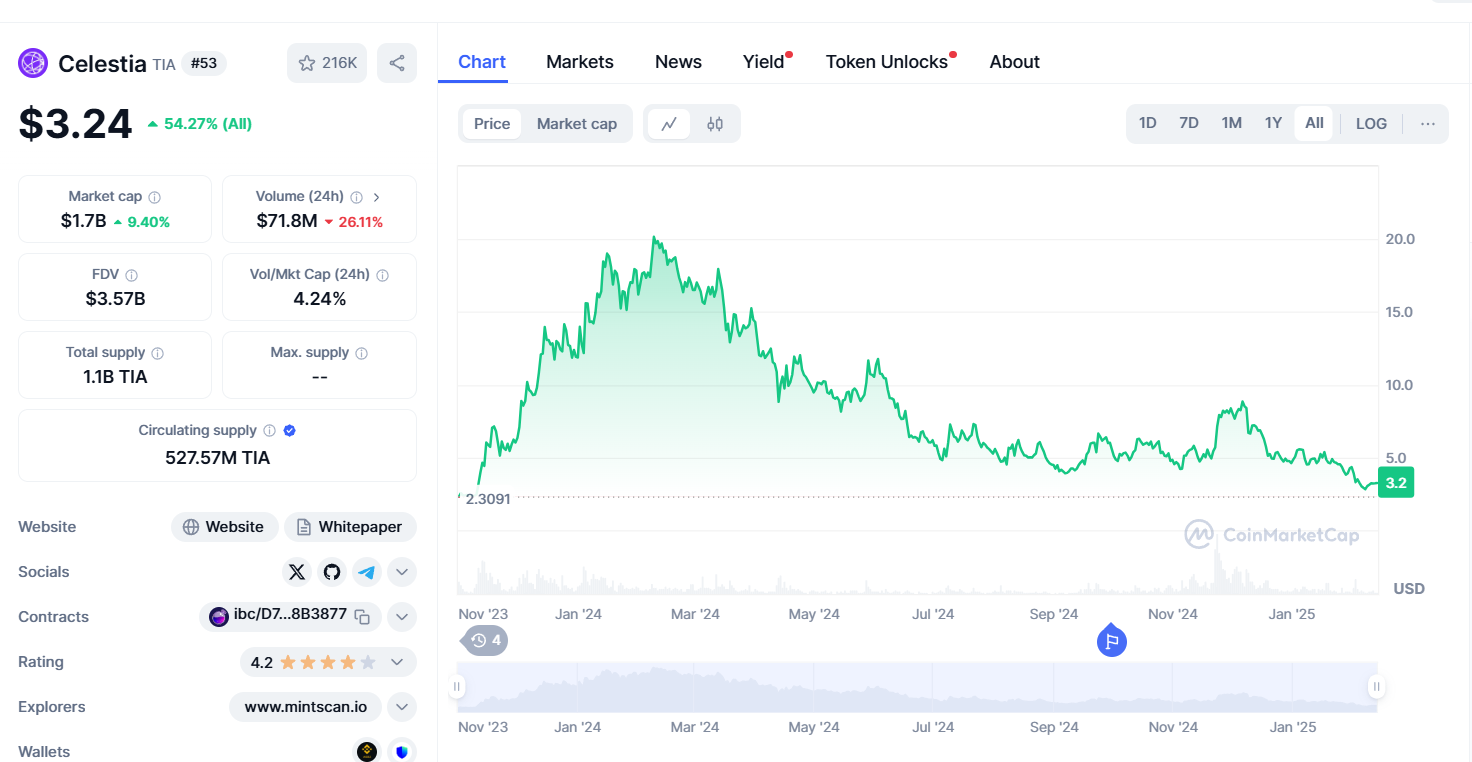

- Altcoins losing the ability to form communities due to their lack of financial upside at launch (due to excessive fundraising, VC compromises, lack of clear value creation, etc.)

- Communities being memecoins main value driver.

Based on the above, Mahmudov predicts memecoins (and other ways of monetizing attention) will grow to become Web3’s main value driver.

The Memecoin Supercycle presentation.

But have these points stood the test of time?

Let’s now review these points one by one, to see if there are potential flaws to them, with the benefit of 2025’s hindsight:

#1: Memecoins as simplified, low-friction tokens driving adoption

This point is undoubtedly true, without much to contest. In general, the onboarding, usage, and excitement of trading memecoins is a self-contained experience that serves as a low-friction, viral on-ramp to crypto.

#2: “The token is the product”

Mahmudov observes: “ordinary investors are gradually realizing that the token itself is the product, not the software”

It is fair to say that, currently, the crypto industry operates more as an “asset production and speculation” business than a traditional tech sector.

Many Web3 projects in recent years have launched tokens without delivering meaningful technology or sustainable use cases. For many protocols, tokens often exist to capture value or incentivize users, rather than to power an application. Tokens are mainly seen as a byproduct for communities to rally and speculate. This is particularly problematic when tokens hit multi-billion-dollar valuations without product-market fit (or, worse enough, as we’ll explore, launch with them before building user demand).

This, combined with other problems we’ve repeatedly highlighted, such as poor user experience, and liquidity fragmentation, results in an ecosystem where tokens are the main product.

#3: Altcoins struggling to build communities

Mahmudov’s thesis is that memecoins are prolific in generating organic marketing because people rally around projects that can make them wealthy. Without incentives, communities fizzle out.

By contrast, many altcoins that never experienced a big price run or launched with already-high valuations failed to cultivate a loyal base. This wasn’t a problem in the “Wild West” early days of ICOs and NFTs but, with mounting regulatory pressure, it’s become increasingly hard for projects to offer early investment rounds to real users and not financial institutions. As such, this leaves retail investors to speculate in memecoins.

To add to this point, Mahmudov cynically notes that it is in the interest of many projects to continue tying their tokens’ value to speculation rather than a profit-and-distribution equation, which might drastically lower their prominence.

Memecoin communities: The argument’s fatal flaw?

It is in the very last (and, to a degree, cornerstone) point of Murad’s argument where a fatal flaw could be found—one that may indicate that perhaps it isn’t all over for “tech” altcoins.

While it is true that cult-ish behavior can be seen around the industry’s top memecoins, we might have entered a stage where the “let the community market the token until we’re all rich” model falters.

The events of 2025 showcase this. In the early-year market downturn, amongst fears of a trade war, crypto assets received a strong shock, with memecoins plummeting faster and further than blue-chip assets. According to market data, the total meme coin market capitalization fell by 14% in a single day, down to ~$11 billion. Hypermemecoinization might work for individual projects during positive momentum, but under stress, investors are reminded of most of these coins’ high risk.

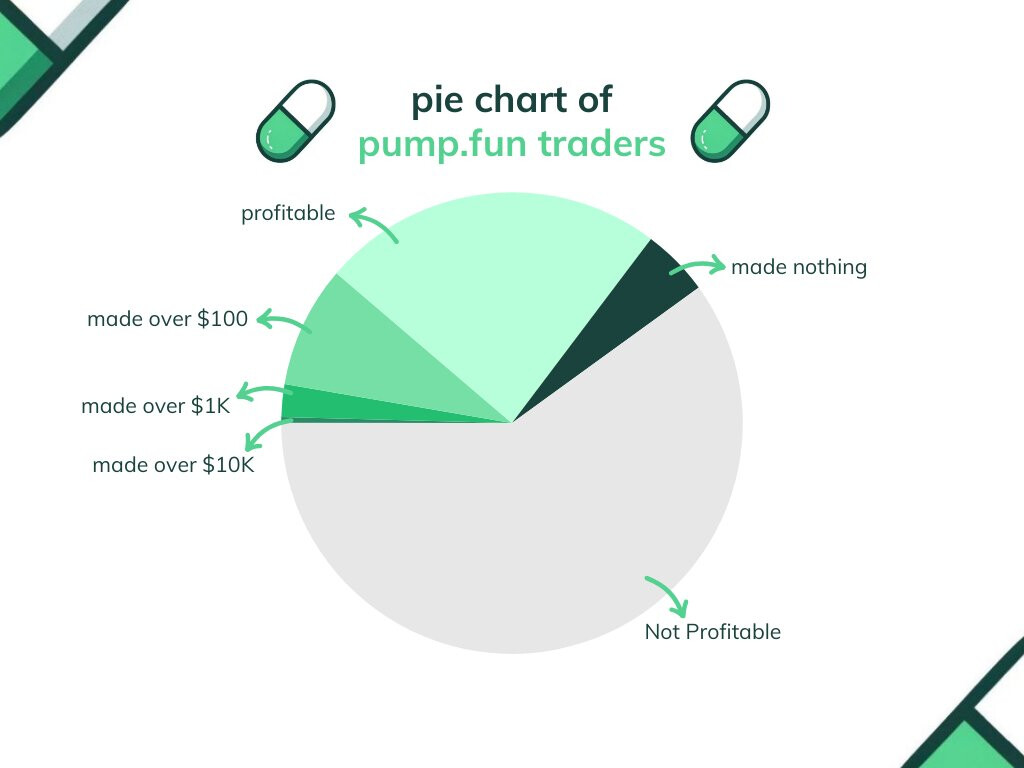

While the above might seem like a minor point, it does expose a critical dilemma: If memecoin communities are mainly profit-driven, and their profits are mostly derived from short-term hype from a community looking to make quick gains, can they be fairly compared to “tech” altcoins?

We believe not, due to a unique social dynamic taking place within the larger memecoin community.

PvP dynamics in memecoins—announcing a decline?

It could be argued that, since memecoins rely only on social factors to generate (ideally, great and short-term) profits, they depend on a seemingly collaborative, but actually adversarial environment.

It’s not uncommon for memecoins traders to experience rugpulls or be victims of pump-and-dump schemes. Furthermore, even in fair situations, memecoins tend to benefit trends’ earlycomers, punishing latecomers by “turning them into exit liquidity”. Numbers also show that very few users profit from memecoin trading, driving the argument that most retail users (particularly less experienced ones) are hurt by their contact with the ecosystem.

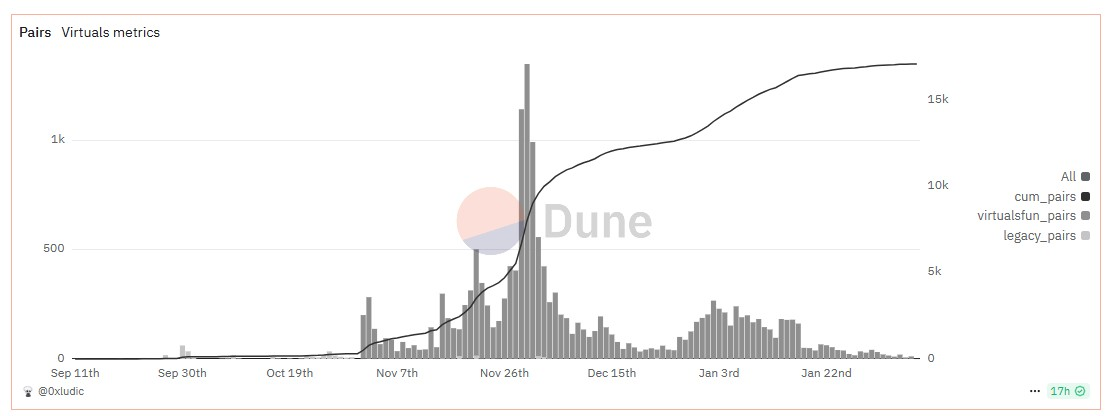

Another crucial factor is the saturation of options. With multiple launchpads launching in every ecosystem, options aren’t just many but also fragmented, creating exhaustion for users… saturating the market of creators and lowering the quality of opportunities.

A crucial example of this occurred just this week as Binance’s founder CZ announced his dog’s name reveal—an event that drove much speculation by the memecoin community. The foreshadowing of the dog’s meme-ability led to the creation of hundreds of memecoins at once across BNB and multiple other chains, showcasing the high competition of attention markets and leading to disappointing results for most traders.

So, are we saying memecoins should go away?

No.

While this era of memecoins might eventually wane and normalize to more “reasonable” levels of both supply and demand (a phenomenon that’s happened to NFTs, inscriptions, Friend.tech accounts, and recently AI agents), memecoins do play an important role in Web3, both for onboarding new users, spreading virality, and as a purely joyful activity.

Our prediction is that, if anything, retail’s exhaustion with memecoins’ short-term nature—combined with other factors— should combine to further differentiate two concepts:

- The “decentralized casino” of tokenized attention, where users might speculate on the short-term growth of not only memecoins, but other vehicles like “keys” (friend.tech-style), collectibles, etc.

- The “utility” Web3 market, where tokens with a direct use case and function are traded according to their value—ideally, a value that can be quantified due to real usage.

To finalize this article, we’ll dive deeper into this second model, breaking down the different things that can or need to happen in order for a utility market to reach its maximum potential.

Predictions and conditions: What needs to happen for a better ecosystem for “tech” altcoins?

Several key factors may help nurture a healthier ecosystem for technology-centric projects and, ultimately, propel Web3 into a more solid financial stage:

Chain abstraction and a unified ecosystem

Currently, users and developers juggle multiple chains, each with its own wallets, tokens, and bridges. Achieving chain abstraction would make it less obvious (and less cumbersome) that an application sits on top of one or more blockchains. As underlying technologies become invisible, users can focus on applications’ individual value, not the complexity or value of its underlying ecosystem. ChA will enable developers to build dApps that leverage the best features of multiple chains, resulting in more reliable, accessible, unique, and user-friendly products.

Clear regulation enabling financial innovation and true utility

The crypto industry still faces confusion about what is permissible. Clear, well-defined rules will allow serious innovators to build responsibly, without fear of arbitrary legal reprisals. This seems like something that might happen sooner rather than later, and carry positive effects for the industry as a whole.

With regulatory clarity, it can be easier for investors to participate in funding projects and vice versa—for projects to offer better investment options to retail users. However, perhaps more critically, financial innovation can take place in the shape of unique revenue distribution models and transmission of products’ value, which in turn can lead to a more robust decentralized financial ecosystem and create a positive innovation flywheel.

Better usage of existing tech for PMF

One truth is undeniable: Web3 infrastructure has only gotten better. Whereas in previous cycles projects needed to build all components of their dApps or products from scratch, it is now possible for them to avoid reinventing the wheel and use existing tools to reach PMF—including new financial models that originate from better regulation.

Furthermore, with chain abstraction and a growingly competitive, scalable ecosystem, Web3 has a better avenue to integrate with traditional fintech, unlocking a borderless universe for new forms of finance like RWA and even consumer products like social media. Lastly, as products better achieve PMF, better sustainable long-term incentives can be set in place, driving more benefits from the decentralized economy to its stakeholders.

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)