State of Web3 Fragmentation: Addressing Web3's Biggest Problem & Its Solution

Table of Contents:

We’ve talked extensively about Web3’s biggest problem: the fragmentation of users and liquidity across siloed blockchain networks.

By now, it should be clear that this is a real problem hurting Web3 users’ experience almost regardless of preferred use cases and individual goals. However, it is rarely discussed that this fragmentation, deeply ingrained within Web3’s culture, is causing inefficiencies that drain value and stagnate the growth of a multi-trillion dollar industry. A fragmented ecosystem not only results in stagnant adoption and poor user experience, but also leads to redundant development, misaligned incentives, and –perhaps most importantly– wasted resources.

This report seeks to showcase Web3’s largest inefficiencies, highlighting the key areas where their monetary impact is greater and can be quantified or discerned from public data. Using these insights as context, it’ll also explore the impact chain abstraction can have on the ecosystem by providing a solution to these problems.

Understanding the system’s inefficiencies

Web3’s fragmentation has led to a number of problems that are plain to see: Users struggle to take advantage of the ecosystem as a whole, a handful of successful use cases are endlessly replicated across blockchains with little innovation, and monetary incentives seem to be the main driver of activity for both projects and end-users –at the cost of long-term thinking, exploration, and experimentation.

The above causes several inefficiencies for the ecosystem, which we can categorize as follows:

- Technologic inefficiencies: Web3’s fragmentation problems are rooted in technological incompatibilities. These are, as has been noted, a direct trade-off of a decentralized ecosystem, only accelerated by its quick modular expansion. These inefficiencies translate to users’ experience and create problems for developers, such as redundant work across ecosystems.

- Incentive inefficiencies: Because new blockchain networks are launched rapidly and have a pressing need to bootstrap their ecosystems, an ever-growing amount of funds is funneled towards incentives for end-users and developers. However, as this analysis will show, these funds are neither efficiently nor effectively spent.

- Ecosystem inefficiencies: Ecosystem inefficiencies can be summarized as “lack of creativity inefficiencies”, a problem driven by the need to build foundational products (AMM DEXs, lending markets, stablecoin minting, etc.) across ecosystems in a context that requires their replication at a growing speed. With a small developer base focusing on a few successful use cases that are endlessly duplicated across ecosystems, litle attention is put on products that can attract users to Web3 en masse. Furthermore, while misaligned incentives steer resources away from these products, the realities of Web3 interactions also silo them within their home ecosystems.

Selecting metrics to focus on

Using the above interpretation as our thesis, it’s possible to find quantifiable data points (to be analyzed individually in the next section) that can confirm or refute it. For this analysis, we’ve decided to focus on:

- The TVL of different chains’ DeFi ecosystems vs. their market capitalization (a proxy for the assets that are actively managed within these ecosystems, versus those that are simply held for gas payments/price speculation).

- The funds raised by different ecosystems and the percentage of these funds devoted towards incentives for developers and end-users, as well as the effectiveness of these methods.

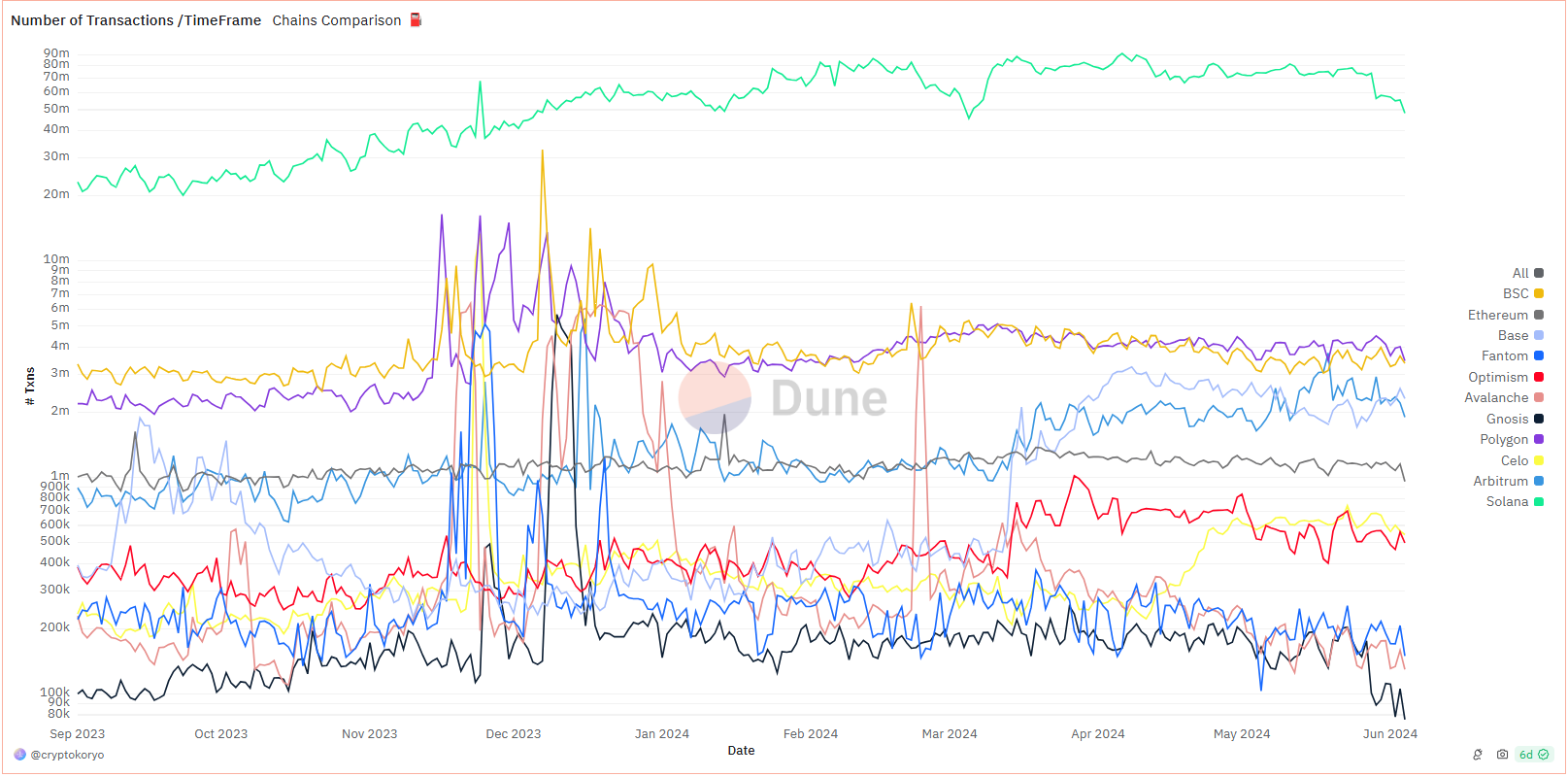

- The total transactions within the ecosystem’s most popular chains over time.

- The total volume of cross-chain bridges and their overall popularity.

- The usual percentage of TVL represented by the top 5-10 dApps on each chain and their general overlap.

- The popularity of products outside the most popular financial applications in each chain and the importance of these products for the ecosystem within their own paradigm.

- The distribution of developer activity across chains over time.

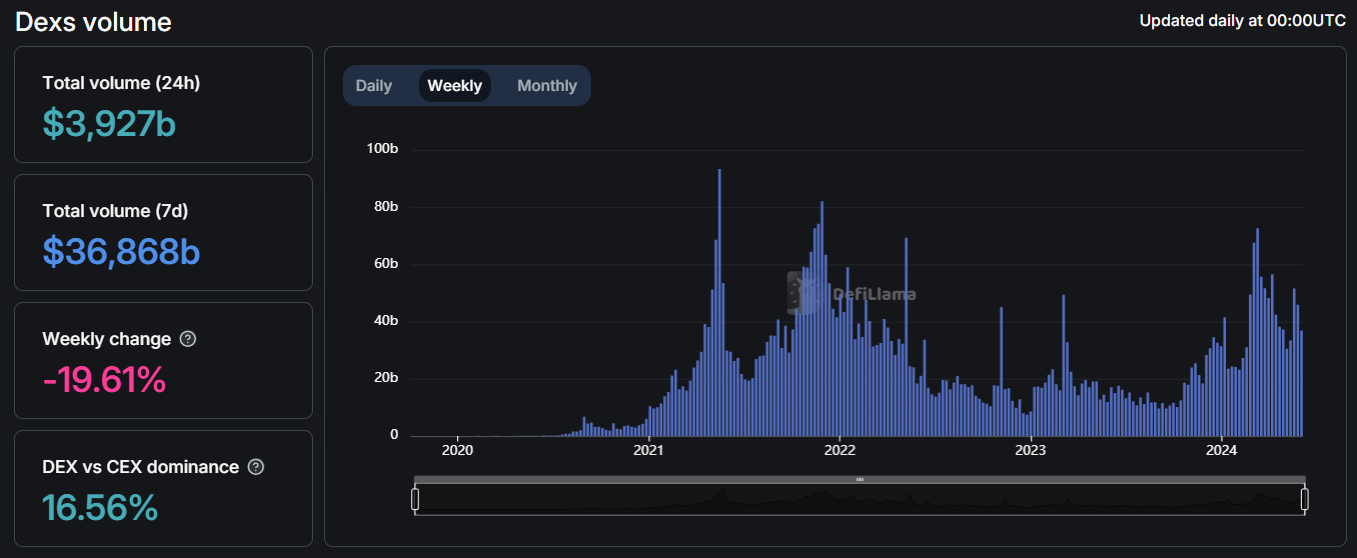

- The dominance of CEXs over DEXs –a useful metric showcasing the convenience of users managing their own assets within a fragmented ecosystem.

Looking at these metrics can help estimate the inefficiencies and wastage caused by fragmentation and establish a reasonable framework to project the potential of a unified ecosystem. While this report does not aim to produce a single figure that encompasses the whole impact of solving Web3’s fragmentation, this can help estimate the size of the inefficiencies across multiple domains, as well as the net benefits of chain abstraction.

It’s also important to point out that any analysis that addresses Web3’s fragmentation is inherently limited by the availability of on-chain data and the impossibility of tracking the consequences of certain underlying assumptions, undoubtedly failing to account for:

- The percentage of assets held by users who simply decide to hold them in spot/cold storage —that is, who have no interest in actively managing them, whether they consider this simple or complex.

- The extent of network effects’ impact on the industry as fragmentation is solved, or as Web3’s adoption grows as a consequence of it.

- The cost of poor composability (i.e. potential compounding revenues missed from the current lack of cross-chain composability.)

- The current opportunity cost for users of having fragmented balances across chains.

- The impact of fragmentation on users’ ultimate level of activity, which can be assumed would be higher should they not need to manually bridge funds, use multiple gas tokens, accounts, etc. to realize cross-chain activities.

- The percentage of trading activity that happens within centralized platforms solely because of a lack of cohesive, decentralized solutions that span multiple chains with sufficient liquidity and are cheap to use.

- Unrealized innovation from projects being unable to build on a maximally decentralized and scalable base layer.

- The popularity and level of adoption of upcoming chain abstraction solutions as they debut in a real-world context.

Considering the above as a theoretical framework, let’s now present the available data for the inefficiencies at hand.

Estimating Web3’s inefficiencies

For the analysis at hand, given that technological inefficiencies are widely known¹ ² and well-documented, we’ll focus on two of the primary categories mentioned earlier in this report, incentive and ecosystem inefficiencies.Incentive inefficiencies

To examine data for incentive-level inefficiencies, we’ll first examine the process different ecosystems follow to bootstrap their growth via developer and end-user incentives. We’ll then look at their efficacy and efficiency to determine how impactful it is, and whether it drives fragmentation or not.

The process usually looks as follows:

- The flow of incentives starts with blockchains themselves. They typically raise funds by selling future or existing tokens.

- Then, they set aside a significant percentage of their tokens to bootstrap their ecosystems via airdrops (requiring users to bridge liquidity and use their ecosystem) and development grants.

- Finally, a portion of the funds issued directly to builders as grants typically makes its way back to end users through other incentivization and airdrop programs for the applications themselves.

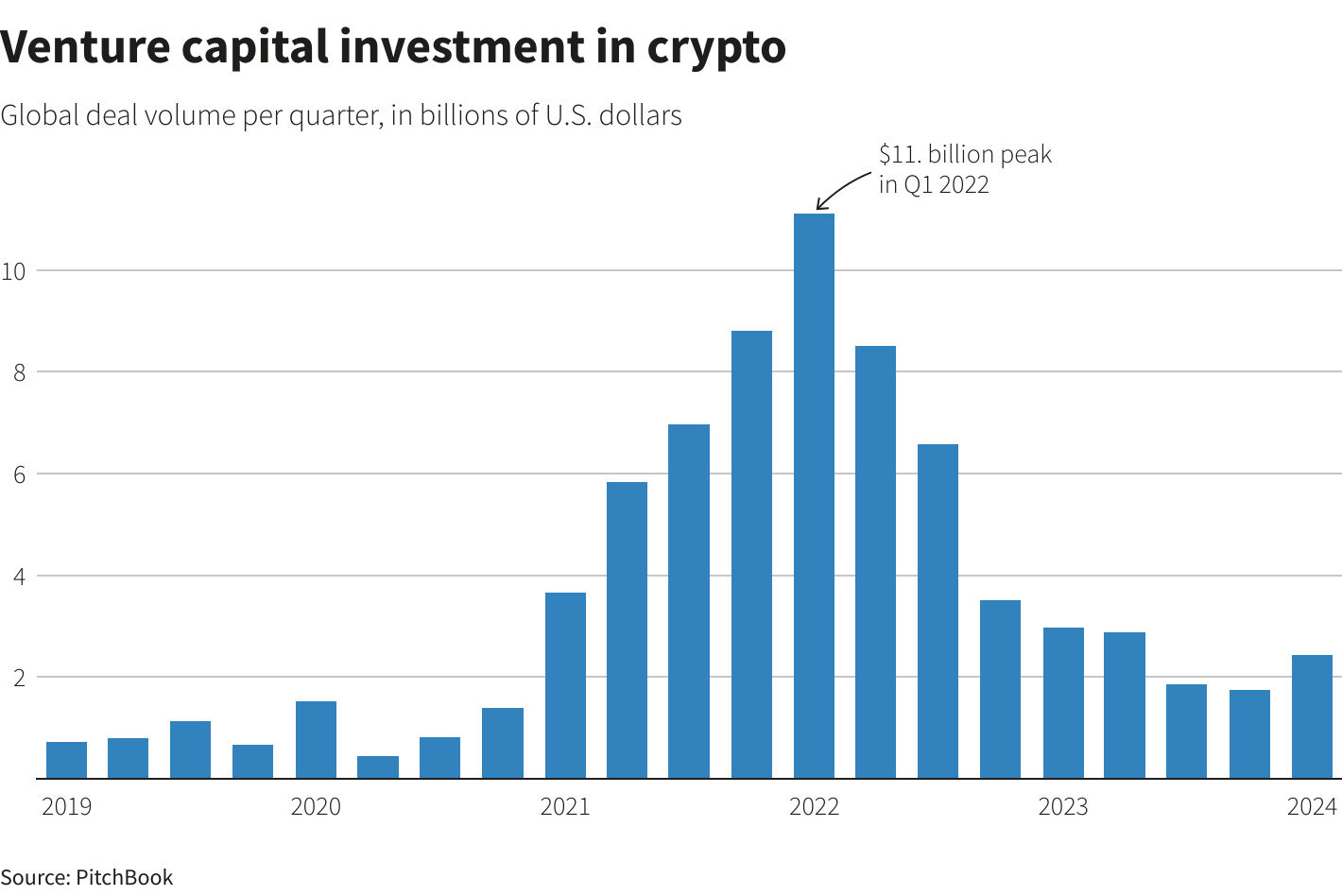

To begin our analysis, let’s look at the total funding going to the crypto industry. This number found a peak of $11B in Q1 2022, and has just begun a recovery process at the beginning of 2024 as a new cycle for the industry confirms itself.

It’s important to note here that, typically, a majority of these VC investments go towards infrastructure solutions. The below table then breaks down the amounts specifically raised by various popular L1 and L2 chains, as well as how much they devoted toward incentives programs:

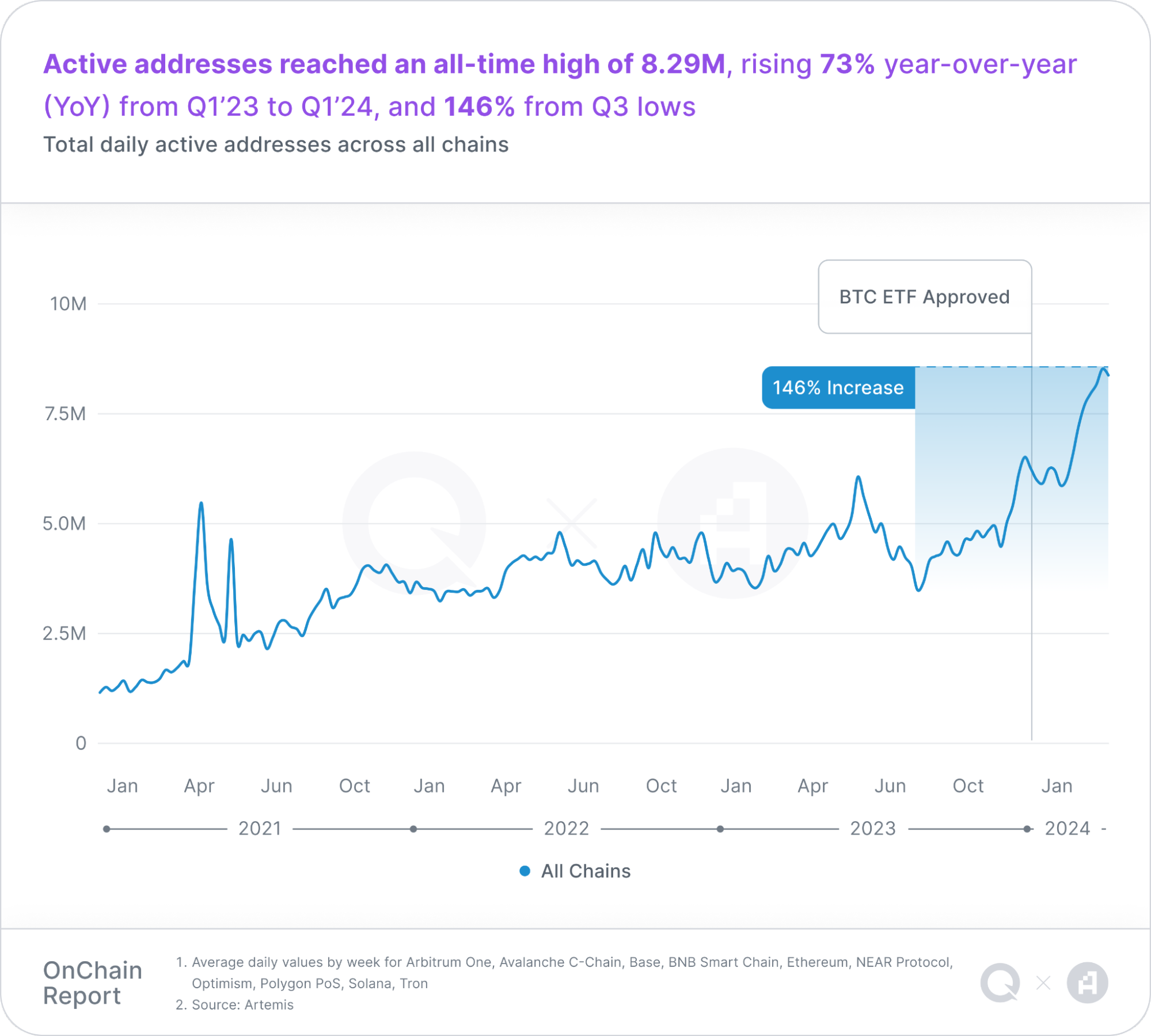

The fact that multi-billion dollar budgets are allocated towards growth and incentives only makes Web3’s total active users (around 8.29M daily, currently) more preoccupying. And, although Web3 is seeing an increase in usage after a period of stagnation, this still denotes an unreasonable user acquisition cost given the amount of resources destined towards it. This can then be attributed to unattractive products, a circular economy, and a poor user experience.

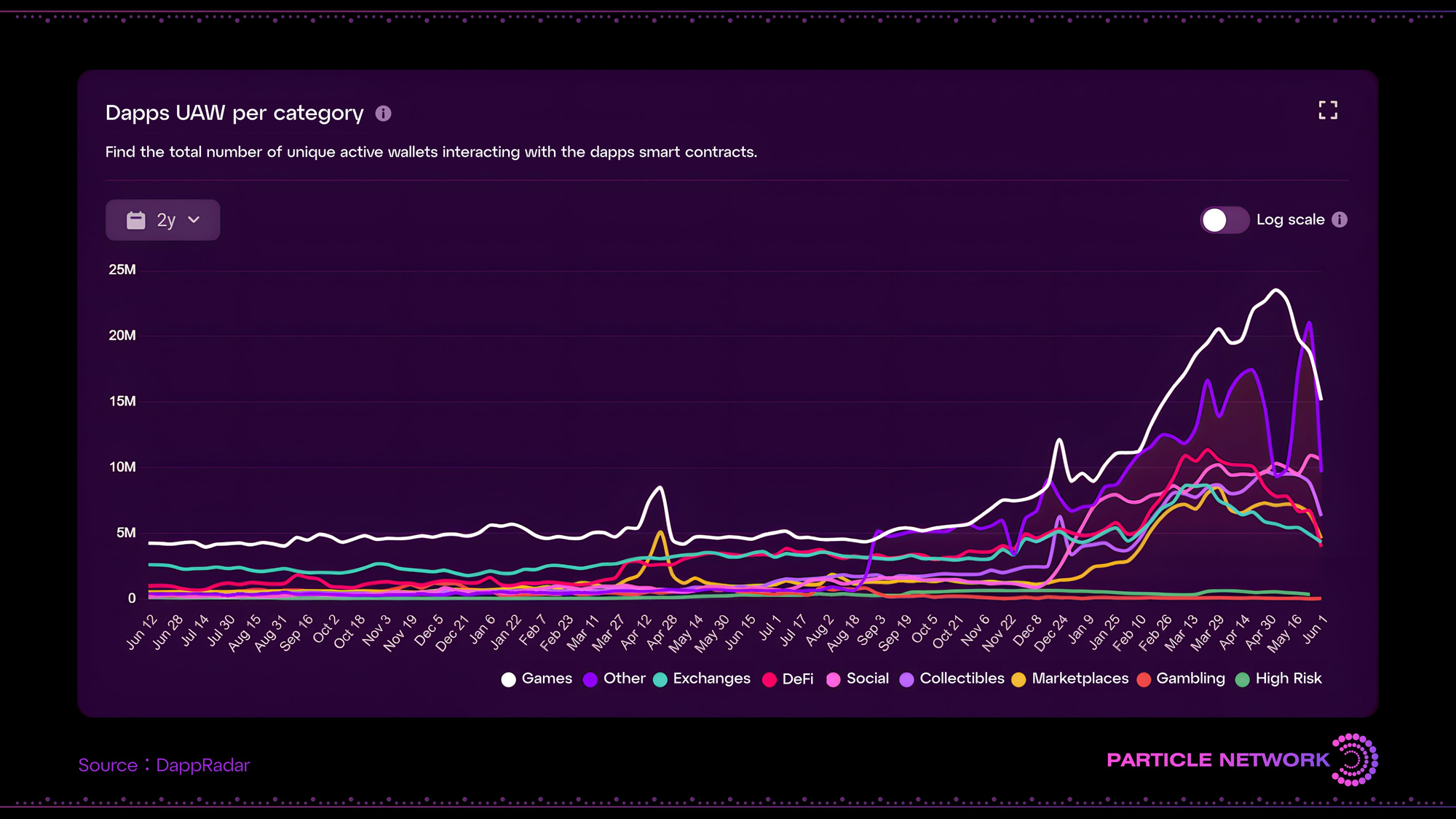

Web3’s growth in active users over time can be seen in the diagram below:

And, although numbers seem to trend up, when isolating different chains to look at their popularity, it’s clear that ecosystem growth is stagnant at best. The graph below demonstrates that very few chains have seen significant gains in the last nine months, with Solana and a couple of Ethereum L2s experiencing growth. However, across the rest of the industry, the graph is either consistently flat or shows only temporary spikes that quickly revert to the norm. This, once again, supports the thesis that established ecosystem’s efforts have primarily driven user fragmentation, rather than growth, and that ecosystems’ tactics primarily attract users from each other, driving fragmentation rather than overall growth. This competitive approach undoubtedly diverts resources from true innovation and development, which will be discussed in the “Ecosystem inefficiencies” section.

The presented data can lead to a preliminary conclusion that, for an ecosystem to grow in prominence, it is key to raise as much money as possible and then allocate a high percentage of tokens towards user rewards. However, it also seems to support that these users aren’t typically new Web3 users or even users completely drafting away from existing ecosystems, but rather fragmenting their own experience. In other words, while the industry has found diverse marketing tactics that work to generate short-term hype, they also seem to primarily lead to further fragmentation –not growth– in the longer term.

Without sustained growth, it’s fair to say that the current incentive system isn’t fully aligned with value creation, and that, at best, there are multi-billion dollar inefficiencies within the ecosystem. The next section will now dive into how, within this context of high fragmentation, ecosystems are forced to incur –or create– inefficiencies of their own.

Ecosystem inefficiencies

There are two key takeaways from the chapter above that translate to ecosystem inefficiencies:

- While well-intentioned, the high sums devoted to ecosystem growth are clearly primarily driving fragmentation across the industry.

- Given the structure of monetary incentives, creating decentralized applications in a new network makes a project more likely to be part of its foundational ecosystem, allowing it to receive higher grants/marketing opportunities and setting it up to capture the users that fragment away from existing ecosystems.

With a technology only used by a small percentage of the population, it can also be assumed that overall, the intrinsic complexities of Web3 and the lack of innovation within it cause its products to cater to mainly technically-minded or “degen” users.

Fragmentation, as such, creates a multi-billion dollar competition for a small pool of users.

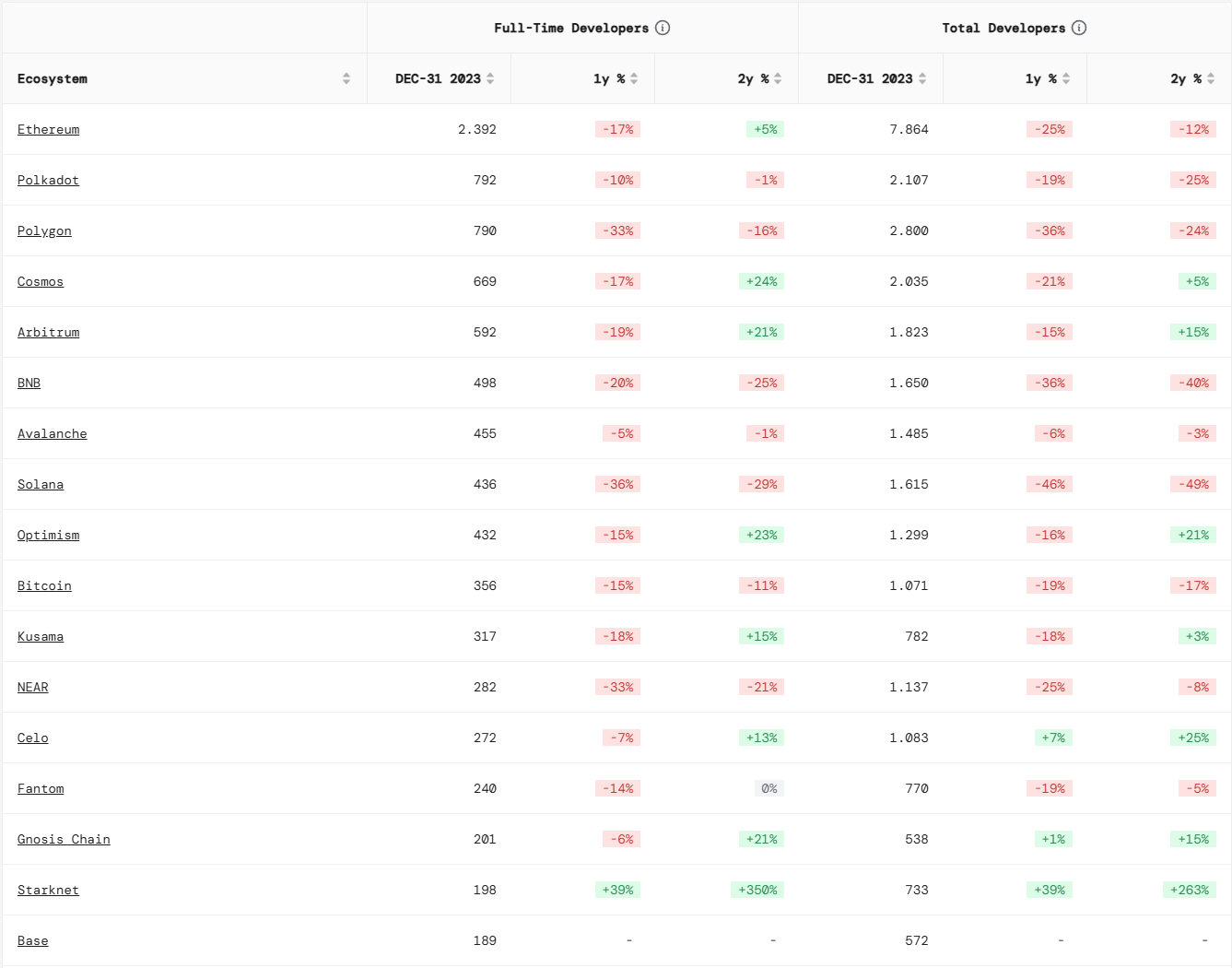

The above problem is exacerbated by how small the pool of Web3 developers is. The chart below tracks open-source contributions, a proxy for the overall size of the talent pool.

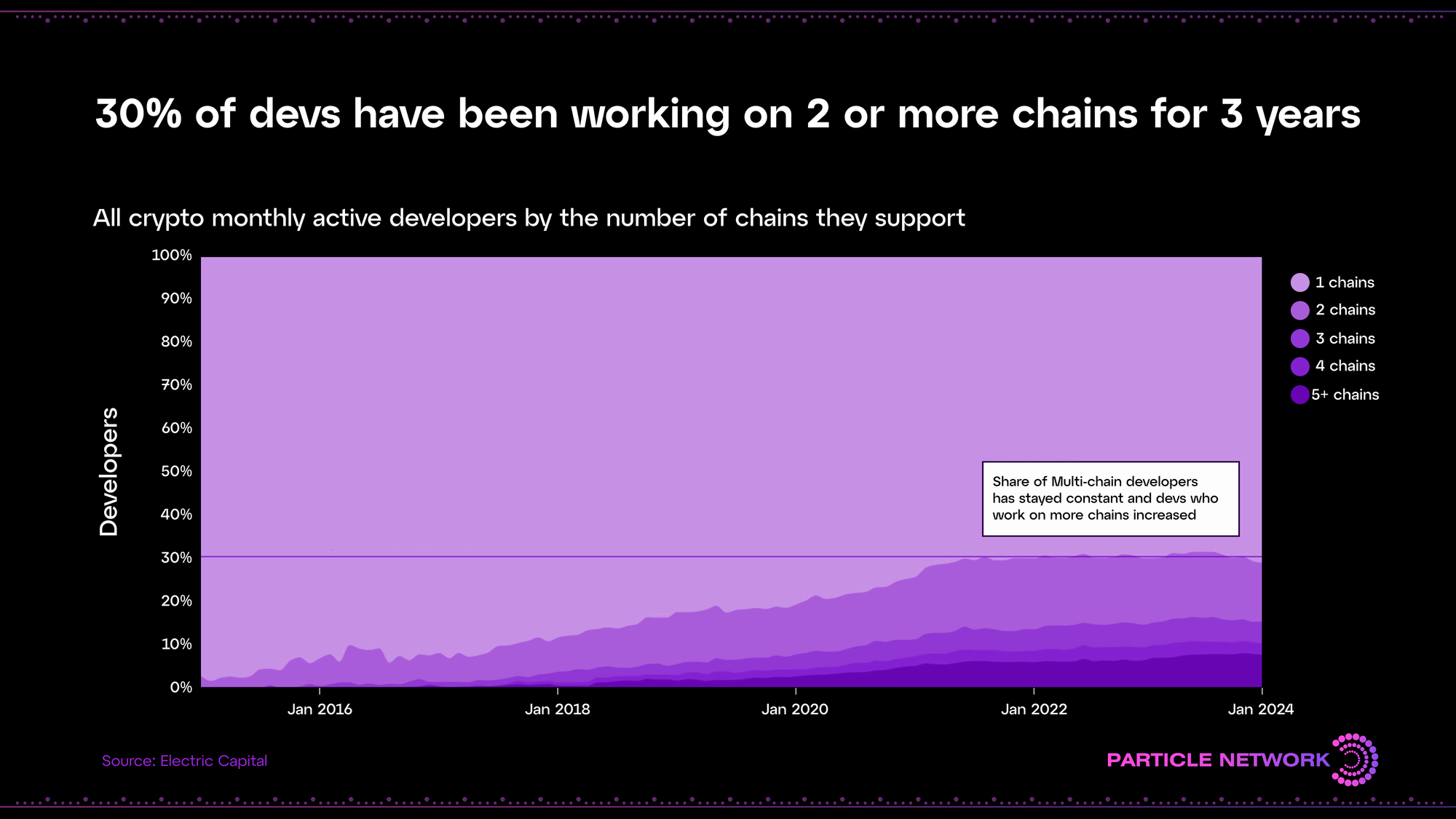

However, the realities of fragmentation not only push most developers to silo themselves into an ecosystem: they also force a growing base of the workforce to spread their time and input across multiple chains –often to replicate their work in an effort to fully leverage several at once.

To paint a complete picture of how much multi-chain expansion impacts development activities by introducing redundancies, it’s important to consider that this forces projects to:

- Devote significant time to researching, understanding new ecosystems, and planning deployments.

- Duplicate their existing coding, maintenance, documentation, user support, and documentation efforts. This might even result in the hiring of additional personnel.

- Choose and integrate adapters from local infrastructure providers (oracles, liquidity pools, bridges, etc).

- In the case they’re introducing their own cross-chain functionalities, conduct additional smart contract audits, which may cost tens of thousands of dollars each.

- Devote marketing resources to understand and capture users of new chains. This might also include applying to grants, diversifying capital, etc.

The key question to answer to better understand where inefficiencies might be present then becomes

“If the developer and user base are fragmenting, how is this impacting the products users receive?”

It’s clear that users are driven from ecosystem to ecosystem in search of the best incentives, which also influences development decisions. It’s also fair to assume that talent is driven toward ecosystems with aggressive marketing strategies rather than ecosystem placement being a decision centered around technology. To then estimate the degree to which this misalignment hampers genuine innovation, it’s key to spot where and which redundancies ecosystems introduce.

To look into redundancy, we’ll start where most of Web3’s liquidity is concentrated –financial applications. DeFi is typically the only activity where users actively seek to make the most out of their tokens, as opposed to just seeking exposure to assets’ appreciation or paying gas fees. As such, DeFi metrics can be useful proxies to understand how much capital is “used” within Web3 (i.e., optimized in some form within the decentralized services industry) vs the amount that simply sits as spot assets.

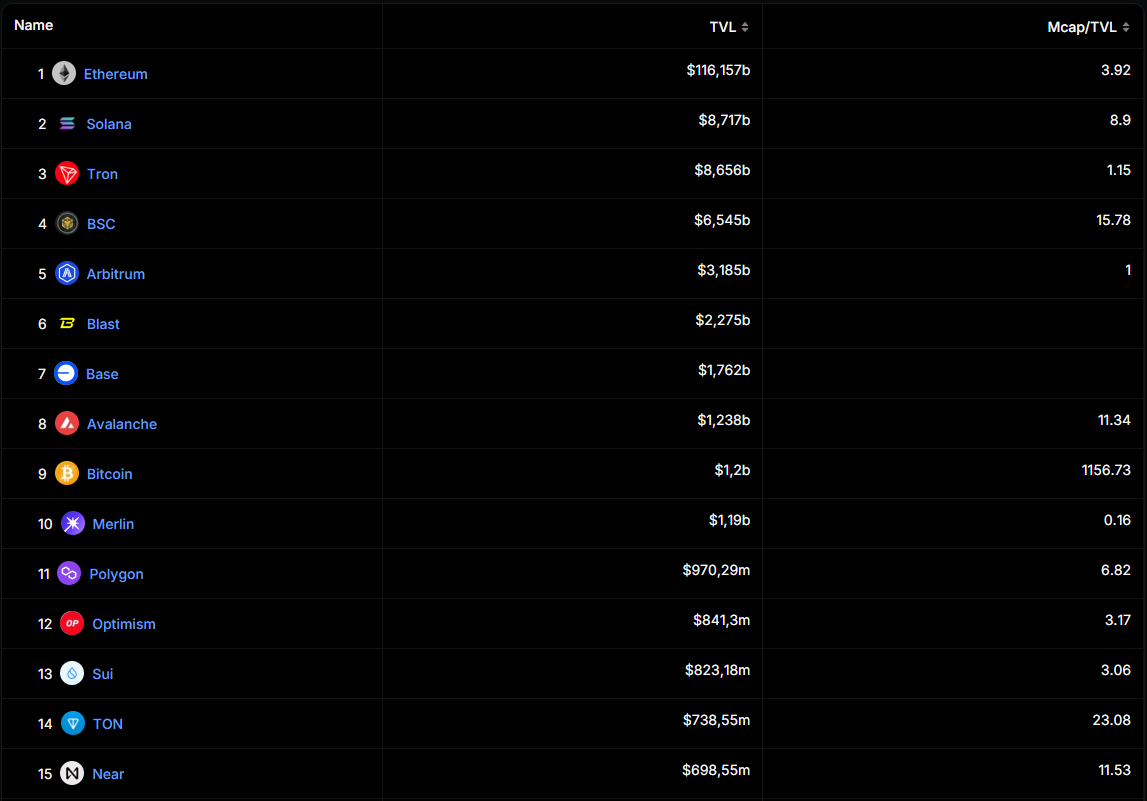

DeFi TVL indicates that roughly 1/20th of assets are “productively” used in some way (close to $100B within a $2.1T industry). And, furthermore, the below picture showcases that some ecosystems are clearly preferred by users to leverage the potential of their assets:

While the chart above offers us a wide range of MC/TVL ratios, it can be immediately interpreted that some chains (e.g. Arbitrum) are very actively used for their ecosystem of dApps, while others (such as TON, and BSC), although they tend to be perceived as high-value as chains, don’t have high ecosystem adoption.

Critically, in a fragmented Web3, it’s somewhat safe to assume that non-”productively used capital tends to stay within its origin chain. This opens the question of how optimized this same capital would be should it be easy for users to deploy their assets toward the most valuable/reputable products in a fully decentralized way regardless of the chain these protocols are deployed on.

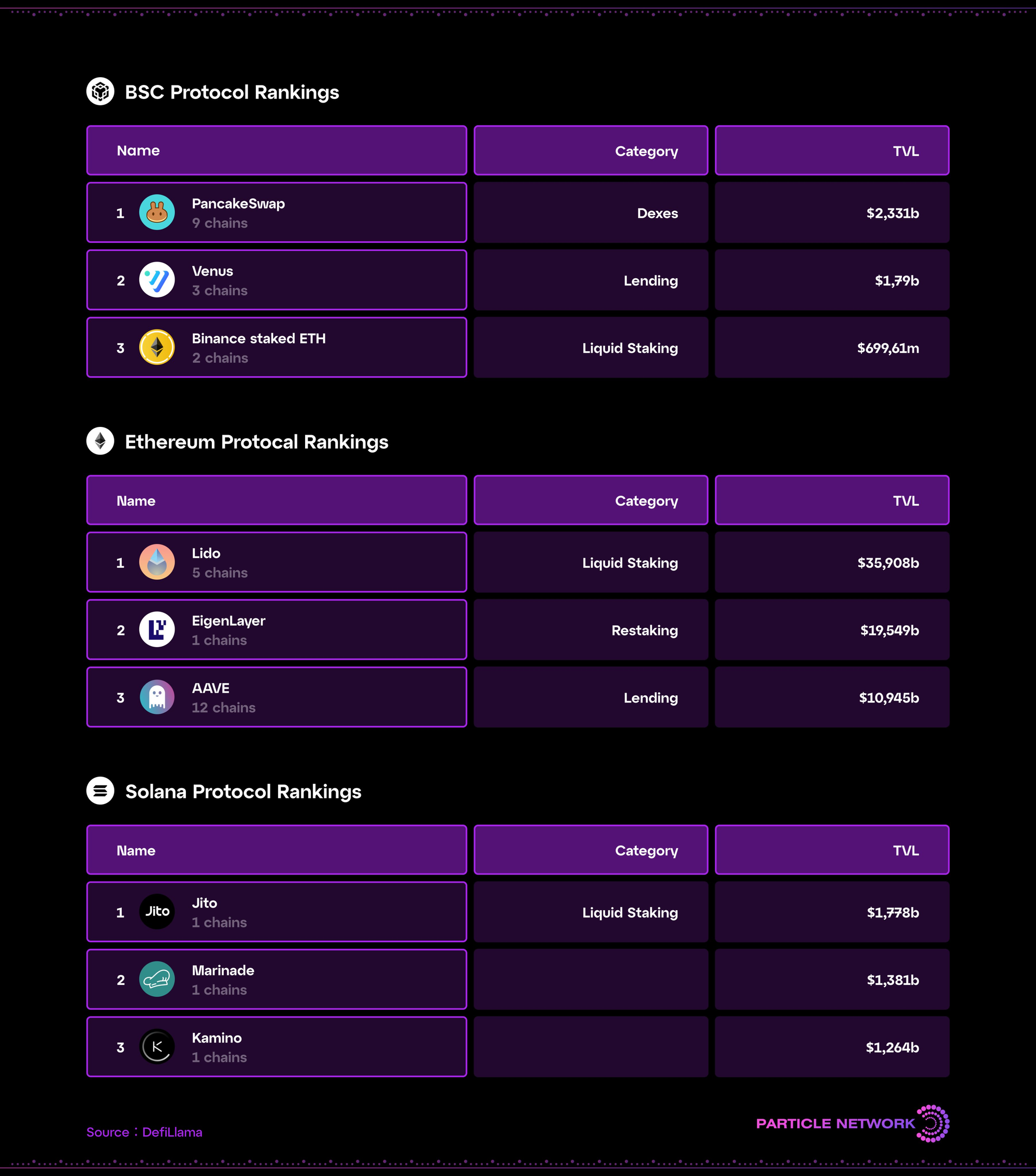

It’s also rather interesting to consider that, for most chains, the top 10 dApps usually represent over 75% of its TVL—even reaching 85+% in Ethereum's case. These dApps often include quintessentially similar lending, yield farming, launchpad, DEX, yield, and staking protocols, mostly followed by a long tail of products that offer similar (or duplicated) services. The concentration of TVL in the top dApps in each chain, as well as the repetition of use cases, can be seen at a glance in the images below:

The above, along with our conclusions from looking at incentive inefficiencies, confirms that most value is directed towards a handful of popular use cases and that fragmentation creates the incentive to replicate these products across ecosystems rather than innovate.

However, it’s also worth pointing out that non-financial applications are currently rising in popularity, although in their case, it’s clear to see how they suffer from Web3’s fragmentation.

The image below showcases that gaming, social, and NFT dApps contribute a significant (and growing) number of Web3 users, with gaming and social in particular outperforming DeFi’s recent growth by a wide margin. These two verticals do not have a purely financial speculation use case, consume fewer assets, don’t primarily seek TVL (i.e. don’t drive large-scale fragmentation on their own), are suited to experience high growth, and seek to be original as a modus operandi (especially games). As such, it’s fair to say that they sit within a rare category that benefits the most from solving –and manages to grow despite– fragmentation.

However, as mentioned, it’s clear that the categories more prone to innovation also suffer the most because of fragmentation, as their target users are typically not comfortable experimenting with new games and casual consumption dApps that require a considerable bridging and interaction setup process. Within an industry that favors fragmentation and steers incentives to the adoption and development of financial products as a way to solidify ecosystems, it’s clear that these solutions, which have the highest potential of attracting Web 2.0’s user base, can’t succeed at scale.

Next, and to finalize our analysis before arriving at chain abstraction, let’s consider ecosystem inefficiencies related to cross-chain services.

Factoring in cross-chain inefficiencies

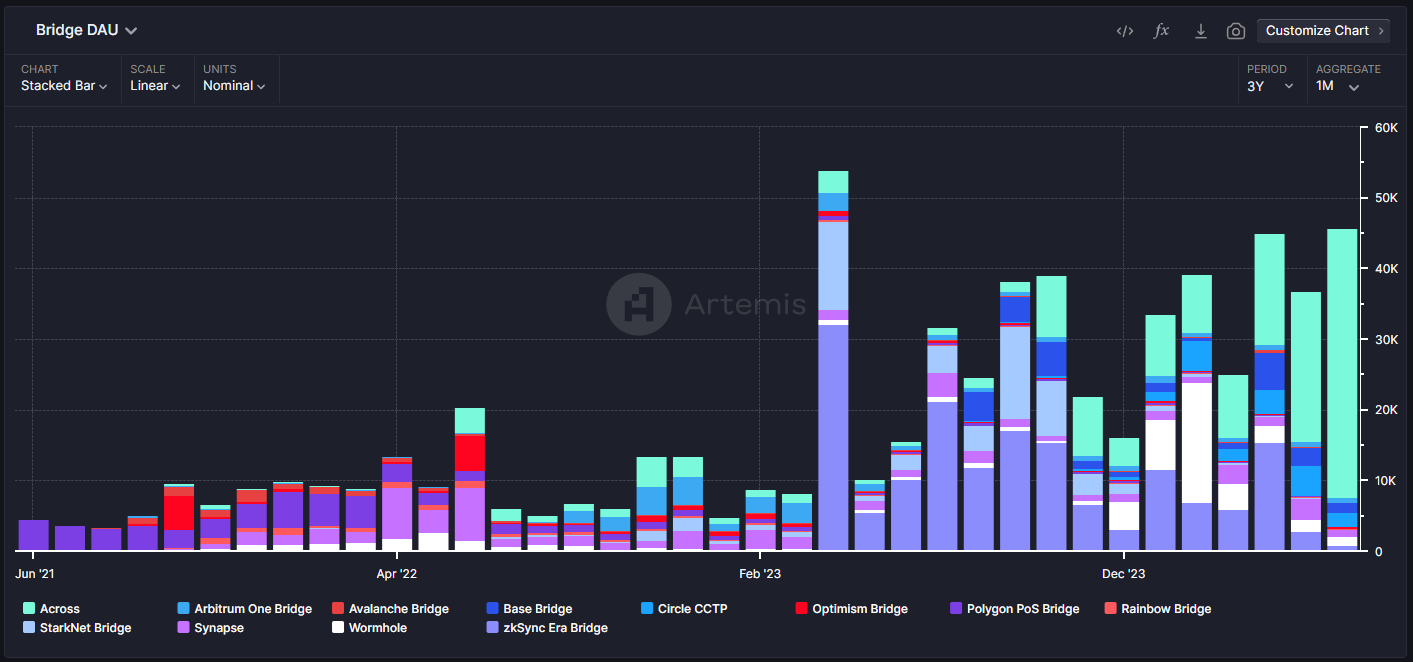

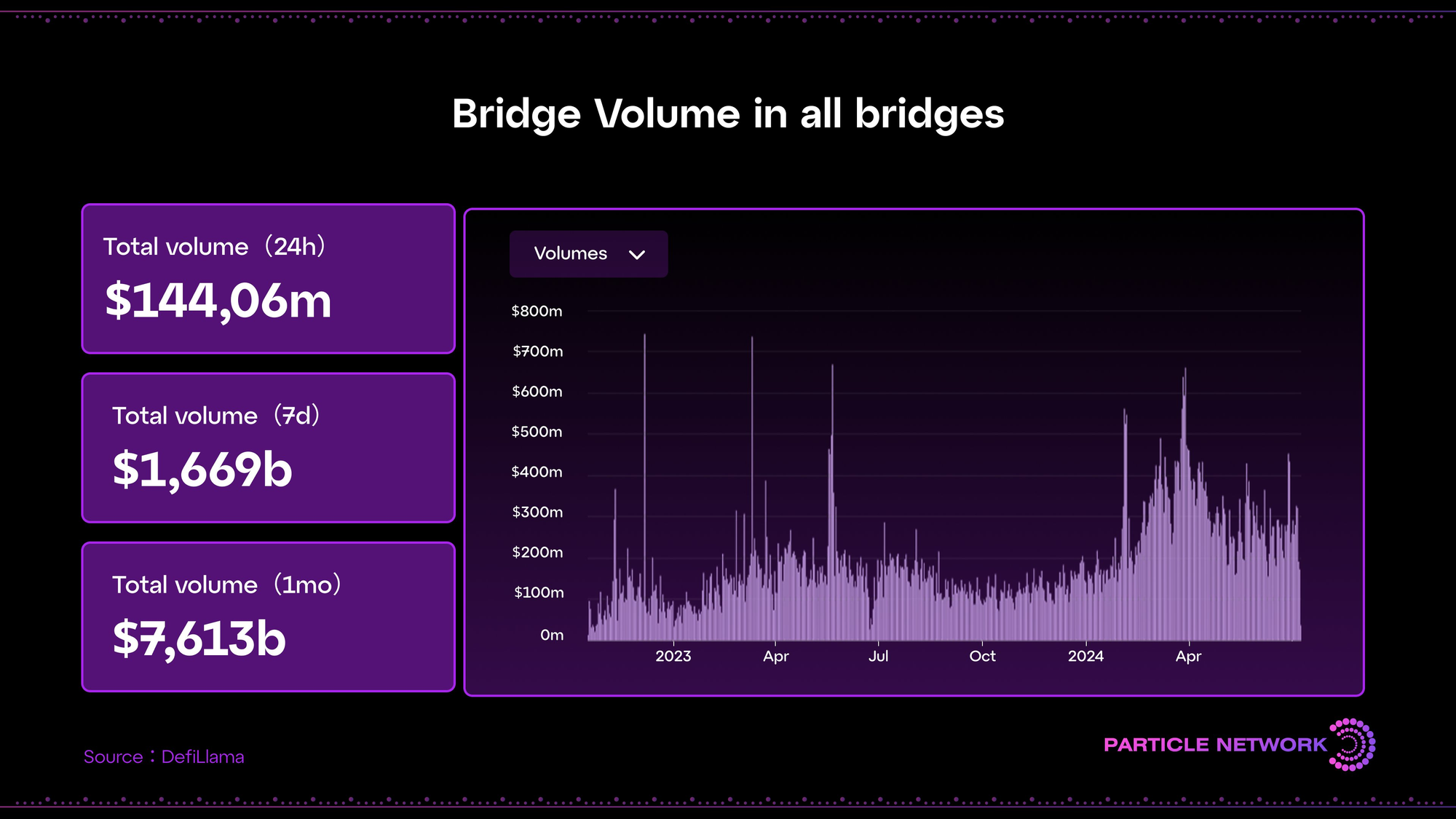

When it comes to cross-chain activity, bridges are undoubtedly the most popular solution. As the need for cross-chain interactions grows, bridging is still widely cited as users’ biggest pain point, given its costly and time-consuming nature. The annoyances associated with bridges can also very well be considered another cause of fragmentation –as users typically try not to use bridges repeatedly or back and forth.

The data below seems to support this, with certain chain-exclusive bridges going in and out of use around the times these chains host incentive programs, only to then lose this activity—which falls in line with the data across this report.

Another key data point to understand cross chain activity is bridging volume. This figure, roughly $144M+ daily, represents 1/35th of DeFi’s ($5B+ daily, i.e. 1/700th of all assets), which could hint that, even at peak activity, users try to avoid directly or indirectly using bridges, adding to the fragmentation of the industry as a whole.

With this in mind, it’s worth wondering how much the difficulties of managing different assets in a fragmented ecosystem hurt the larger decentralized Web. The best single data point for this piece of analysis is to compare the dominance of CEXs –which offer many financial services, such as lending, and typically allow for the trading of assets that can be found on many chains– to that of DEXs. In this regard, decentralized services’ numbers pale against that of centralized ones. This number can’t be assumed to only be related to fragmentation, but can certainly be improved by addressing it.

So far, we’ve presented plentiful data showcasing the areas where Web3’s fragmentation is causing inefficiencies. And, given the multifaceted nature of assessing the overall user experience across a complex industry, it’s safe to assume that these inefficiencies can only compound, causing significant harm to Web3's utility and adoption.

Next, let’s look at how introducing chain abstraction can impact these same areas.

So, what happens as chain abstraction is introduced?

Chain abstraction offers a remedy for Web3's fragmentation issues. It is precisely defined as “a user experience exempt from the manual processes required to interact with multiple chains,” providing infrastructure that eliminates most of the complexities of interacting with a fragmented ecosystem from users’ and developers’ experience.

In more practical terms, chain abstraction seeks to eliminate activities such as holding the gas token necessary to interact with a specific chain, manually moving assets between networks, or being aware of balances spread across multiple chains, from the user experience. As the industry recognizes the pitfalls of fragmentation, many different implementations have begun their development, taking approaches that range from the automation of bridging assets across chains to complex account-level solutions that give users the ability to interact with any dApp from any ecosystem.

Chain abstraction’s impact on Web3’s inefficiencies

In an ecosystem with multiple live implementations that coexist, the inefficiencies we’ve mentioned can be addressed by chain abstraction in the following ways:

At an incentive level, chain abstraction can create a landscape where Web3’s most popular applications are accessible from any chain. This results in a panorama where different products are forced to compete in equal conditions, moving the competition and incentives to be centered on quality of service and technology, eliminating the attractiveness of creating redundant products across chains. In practice, it also results in chains no longer needing to market toward users, forcing them to focus on technology and developer onboarding while giving the latter more power to adjust incentives to their use cases.

By aligning incentives to produce an efficient ecosystem, chain abstraction can then help tackle the analyzed ecosystem-level inefficiencies. Within a chain-abstracted ecosystem:

- The underutilization of assets in certain ecosystems is solved by giving users direct, instant access to decentralized applications regardless of the chain they’re deployed on. This allows them to access products based on their own merit and have access to every one of them without incurring difficult manual processes –not only boosting utility for the products themselves but also for the industry as a whole.

- Users’ aversion to bridging/cross-chain activities largely disappears, as these processes are integrated directly into their activities without them even noticing them.

- Other manual activities and cognitive processes (such as accounting for multiple gas units) disappear from users’ experiences.

- Decentralized products become more competitive against centralized alternatives due to their permissionless nature and the ability for users to have full control of their own assets without relying on third parties.

- Users find a reduced management overhead that allows them to casually and freely use different verticals due to the improved user experience of having a single balance for all chains.

- Applications with a high growth potential are no longer bound to the confines of the chain they were originally deployed on, allowing them to capture users more easily –which applies to both existing Web3 users and external ones.

- Wasteful, repetitive development and maintenance can be reduced, freeing up development resources to be directed toward creativity, research, and innovation.

Chain abstraction emerges as a critical solution, eliminating a myriad of complexities that lead to—as we have seen—major inefficiencies. As comprehensive chain abstraction solutions are developed and released, we'll likely see an accelerated change in the Web3 experience for all of its stakeholders and in its multiple internal dynamics.

Particle Network's Wallet Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)