Entering the Abstraction Era: (Optimistic) Predictions for Crypto's Future

Table of Contents:

Everyone’s an oracle in crypto. Predictions of future trends—or the outcome of current ones—can be found pretty much everywhere.

And yet, there are currently two ideological camps in Web3:

- Those who vouch for the "crypto is scaling faster than the Internet" thesis and think we're still early to a proverbial mass adoption party. This camp feels like Web3's main problem is a lack of infrastructure that can support serious growth—but thinks we’ll get there, eventually.

- The "we don't have mainstream products yet" camp. Those here think Web3 is plagued with infrastructural solutions but lacks serious products that can drive meaningful adoption.

Both stances are grounded in reality: Web3 has better infrastructure and more blockspace than ever. It is also expanding quickly, but not without its hiccups.

This article will make the case that it’s precisely at the intersection of these ideas where things may just be turning around—slowly at first, then all at once.

But be warned: we’ll mostly focus on the infrastructure and technological milestones shaping our ecosystem. If you’re looking for crypto predictions of price targets and “can't-miss investment opportunities”... well, better to go look someplace else.

Entering a new era

Before jumping into predictions, let’s set the context for the driving force behind them.

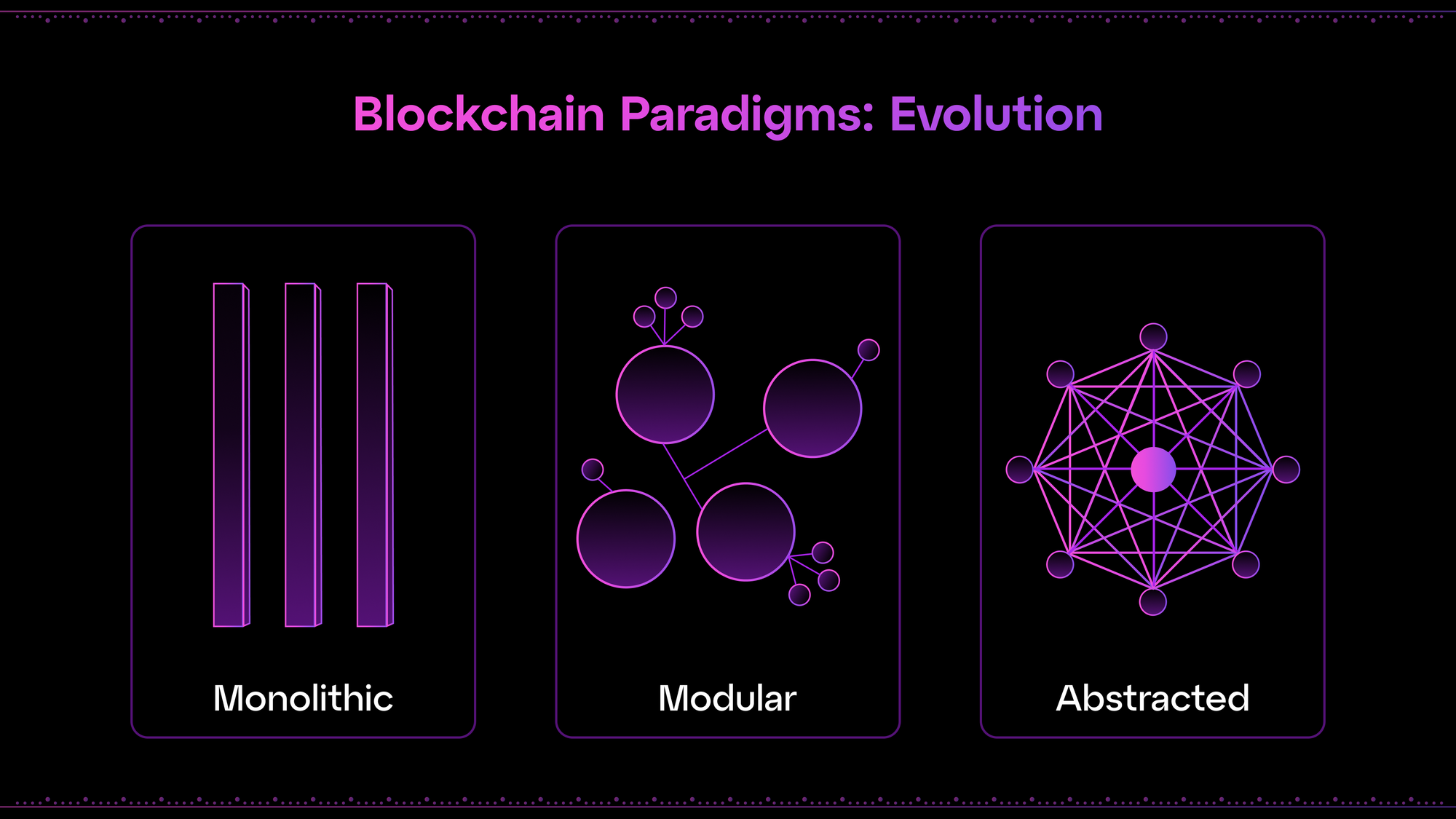

Web3 started out as a collection of single-purpose systems that do one thing well—storing and transferring value. However, in the span of just a few cycles, the ecosystem has evolved into a complex array of (somewhat) connected networks able to handle complex operations, going through all the ugly phases of puberty in the process.

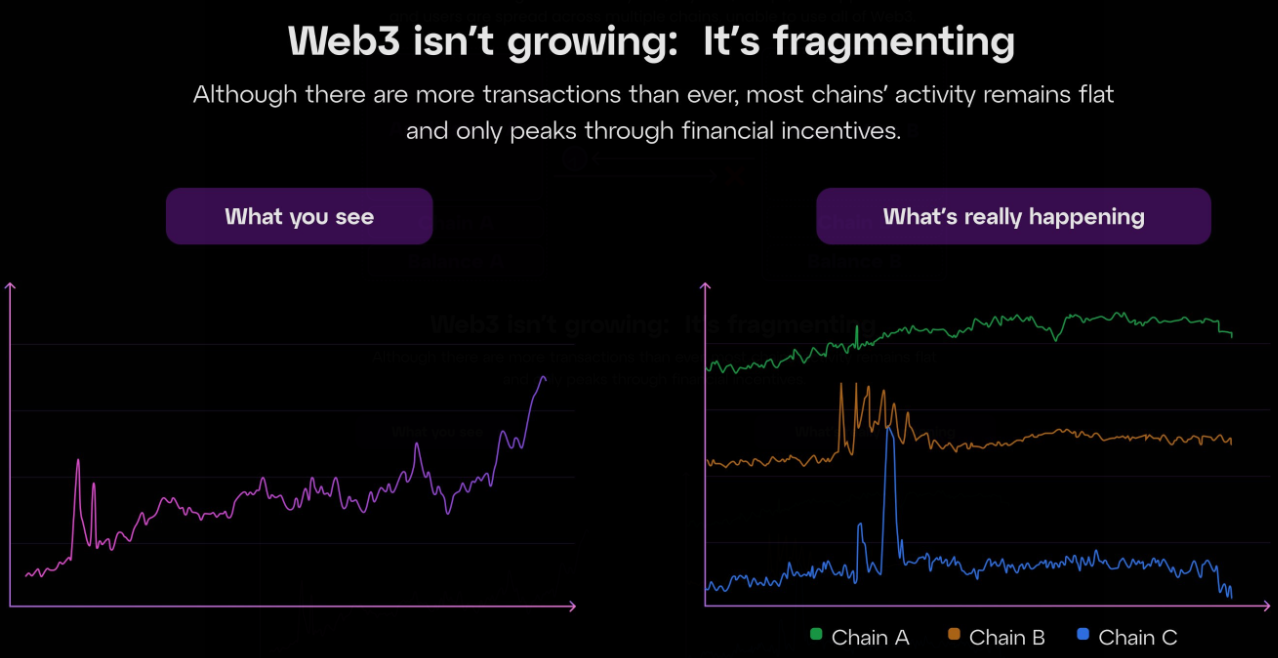

We believe Web3 is in the final stage of its modular era, entering a unification stage. With chain abstraction, we are approaching a turning point where our fragmented ecosystem can begin operating as a cohesive space.

This isn’t just about making things easier—it’s about fundamentally changing how everyone interacts with decentralized applications and digital assets. Instead of managing multiple wallets, tokens, and networks, users will engage with a unified system that operates seamlessly in the background of dApps. To be attractive as a solution, this system needs to be chain-abstracted —that is, devoid of the manual processes required to interact with multiple chains. This shift could redefine what it means to participate in Web3 and open new possibilities for developers and users alike.

What makes chain abstraction an era of its own is that it’s not just another layer of infrastructure: it’s a step toward making Web3’s multi-chain complexity virtually invisible. ChA focuses on creating an experience where blockchains are still diverse, modular, and decentralized, but the broader ecosystem feels uniform and interconnected. This can only lead to more and better products leveraging Web3, which in turn leads to broader adoption and intuitive user experiences.

But keep in mind: In a new era, old rules cease to apply.

Chain abstraction will undoubtedly turn a few things upside down.

Our predictions, as such, are centered on the massive changes we believe can happen as a unified, unfragmented Web3 becomes a reality. As certain basic conditions for the Abstracted Era, we’ll assume:

- Any user, from any chain, can access any application.

- Applications themselves may simultaneously span multiple chains through chain-abstracted workflows, have diverse components spread across many of them, or even reside in multiple chains.

- Any asset can be used across any chain.

What follows are our predictions, starting out with the most “obvious” ones and dialing up in eccentricity as we go.

Prediction #1: The emergence of the true chain agnostics

Crypto is currently divided into near-religious, “maxi” camps. No need to elaborate there.

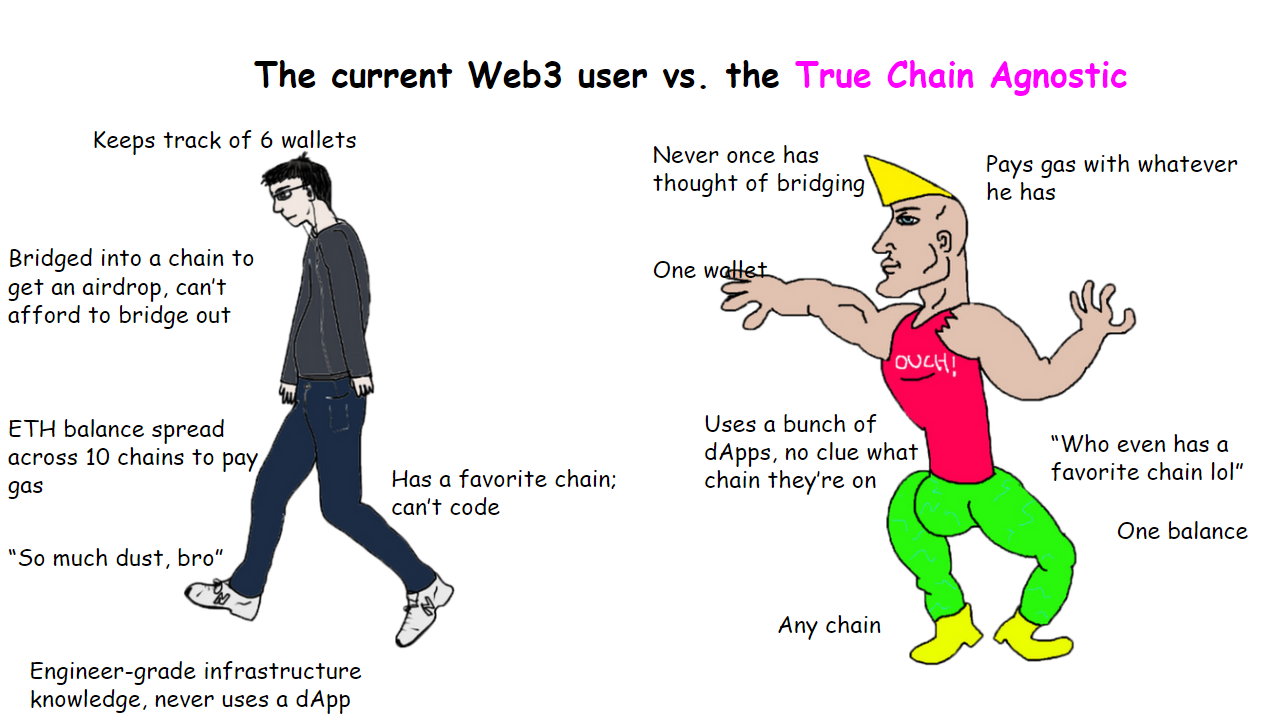

However, our prediction is that, once all barriers are gone, we’ll see the rise of a new species: The true chain agnostics.

The true chain agnostic doesn't know what chain(s) his coins are on. In some cases, he might not even know what coins he has, just his USD balance. And he certainly won’t care much about the underlying chain of a product he uses. This information is still available to him, though, so he might check out of curiosity if he’s tech-inclined.

But otherwise? Just enjoy the new shiny thing on the Internet, bro.

"Is this actually crypto?"

Similarly, we will see the emergence of "Is this actually crypto?" dApps.

You go in and do your business. At some part of the process, an in-game item or concert ticket might be an NFT. You may even deal with a zero-knowledge proof-powered decentralized ID that only reveals as much information as you want to anyone you choose to interact with. All on-chain, cryptographically secured by state-of-the-art tech.

But you won’t need to know what goes on behind the scenes, though. And most won’t care. As long as things work, that is.

So, want to know when “retail is priced in”? Keep track of the chain agnostic population.

Prediction #2: Long live the Abstraction Age projects

We also predict we will see a radical change in the way Web3 projects fund, market, and manage themselves and their communities.

Let’s start with the money.

Less freebies, but better business

Through 2023 and 2024, the game for Web3 projects has been simple: Get funding, pay (or promise to, anyway) people to use your product, leverage traction to raise more money, repeat. This is especially true for blockchains, which dedicate great sums toward their dApp ecosystem in an effort to attract users and lock liquidity. Once users are in, the friction of bridging in and out is typically enough to retain both users and their funds.

Of course, once bridging stops being a manual process, users can’t be easily siloed into an ecosystem, which in turn will shift the game of raising and spending money. The Abstraction Age, as such, will bring about a race for quality and better technology among ecosystems.

Needless to say, in this context, “give away as much free money as possible” becomes (even) less sustainable of a strategy for user capture. Product-Market Fit becomes king. This means that VC and “real money” investments flow towards products and ideas with PMF and positive flywheels, and projects need to find new ways to appeal to those outside the crypto bubble. Highly targeted, high-quality airdrops might still exist, but, without the guarantee that a user might be stuck within a given chain, prioritizing real usage will have to become the norm.

Bad news for get-rich-quick schemes banking on inflated future prices, for sure.

Communications and community

The Abstraction Age will also have repercussions outside of fundraising.

There are currently four main project “personality types”:

- The serious-serious: Talk about stuff most don’t understand. Like to flex equations and formulas. Usually developer-targeted solutions (i.e., infrastructure). E.g. Chainlink.

- The memes: Just in for the memetic potential. Goal is to make some money and have fun along the way. Some might be rug pulls, which is socially accepted and assumed. E.g. every memecoin ever.

- The laid-back but serious: A hybrid of the two above. Recognizes the potential of memes in Web3 and tries to use it to build serious, high-quality stuff. To a degree, most Web3 projects want to fall somewhere here. E.g. Berachain.

- The visionaries: Seeks to seriously innovate through new use cases for decentralized technology. Strong street-cred and OG endorsement, but usually struggle with hype. Deeply care about internal economics. E.g. Kleros.

Our thesis is that these personalities are all a result of Web3’s current stage, and as such, the Abstraction Age will bring about a change in the way even non-infrastructure players do business. Degeneracy will always find ways to live on but, within a highly-competitive, borderless, and Web2-like environment, competition will inevitably become about offering a better service and experience, as explained next.

Prediction #3: The conversation permanently becomes UX-dominant (and “crypto” more nerdy)

A positive for the “too much infra” camp: Eventually, infrastructure begins to feel “solved.” A couple of solutions are known by the public, but most aren’t, and it takes serious geniuses to figure out what else is needed. Time to build consumer products.

This shift brings discussions around Decentralized Identity (DID), composable products, and privacy (all big needs and key use cases) to the forefront. Anything that creates a better experience or service becomes king.

Here, we also predict the "de-nerdification" of the crypto workforce. Your UX designers, product managers, and marketers will no longer need to know 10 years of historical data and have engineer-grade infrastructure knowledge to contribute to Web3. In an industry that combines tech and finance, this means lower friction to attract top talent, and more products with the non-crypto-native in mind.

Visionaries get their chance in the spotlight.

Following up on our point on visionaries from Prediction 2, we believe true innovation will shine brighter than ever in the Abstraction Age.

Our prediction is that we’ll finally see a lot of the ICO-era promises (“decentralize insurance/video streaming/reforestation/create markets for XYZ!”) come to reality. Decentralized alternatives to digital products that do not require customer service, with novel business models, will become more attractive, feasible, and likelier to receive/sustain a constant stream of users.

This is, to a degree, something we are beginning to see with use cases such as Polymarket, and that will only accelerate through chain abstraction.

Prediction #4: Sustainability brings in the mainstream

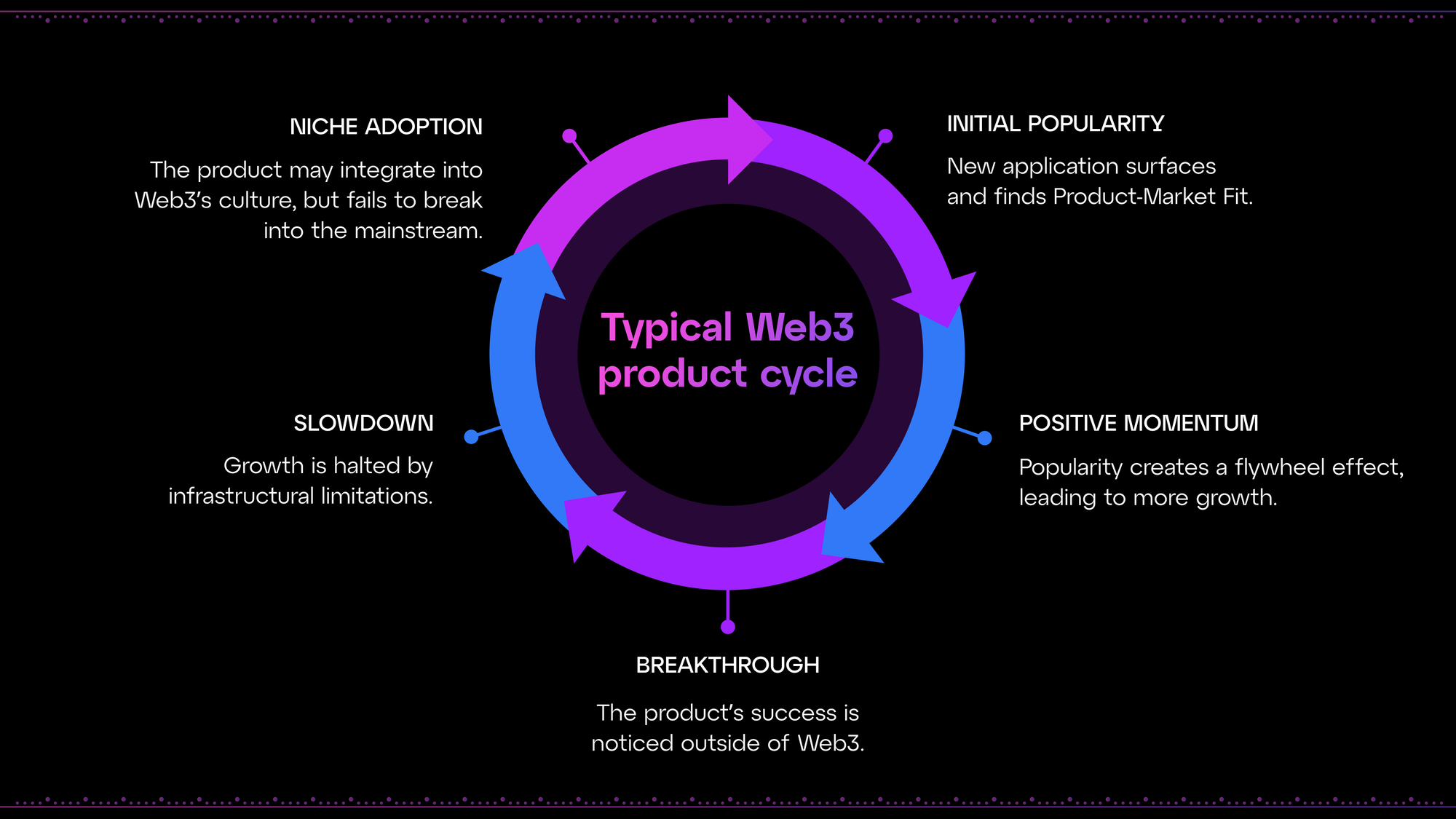

Something interesting has happened every Web3 cycle thus far. It goes something like this:

- For whatever reason, a product catches on. It could be a game, NFT collection, or even a memecoin. Why? Who knows. Right timing, manipulation, or great marketing. Maybe all at once.

- Web3 goes nuts. Everyone wants in.

- The story breaks into the mainstream. A celebrity jumps in. It's on TV. Your mom knows about it. Someone you know from high school asks you whether they should buy. Slowly, non-crypto people try to find a way in.

- Faced with unforeseen demand, something breaks: Perhaps, fees get too high. Transactions take hours. The hype also spills over to related products, as it can’t be contained in a single place (e.g., one NFT collection catching up might make all NFTs seem more desirable).

- Now, that's news, too! Desirability reaches an ATH. Hype creates hype, even across the entire ecosystem.

- Something goes seriously wrong. Chains may halt. Fake decentralization might be exposed. The hype machine is forced to cool down. Gradually or just as fast. But it happens.

- By the time we're back to "normal," the hype has dried up and the old complaint surfaces: "No real use cases."

So, what happens when infrastructure is no longer a limitation for adoption? We predict that, within the Abstraction Age, once a product finds PMF (covered above), its momentum won’t be killed just before mainstream adoption can begin. This, in turn, will attract more chain-agnostic newcomers to the ecosystem—all the while, ideally, the ecosystem itself is a lot friendlier to explore and thrive on.

It's a fair criticism of Web3 to say that it hasn't produced mass-scale products. However, in the spirit of fairness, it's also important to point out that its infrastructure hasn't entirely given it the chance to, either.

Money begins to feel real

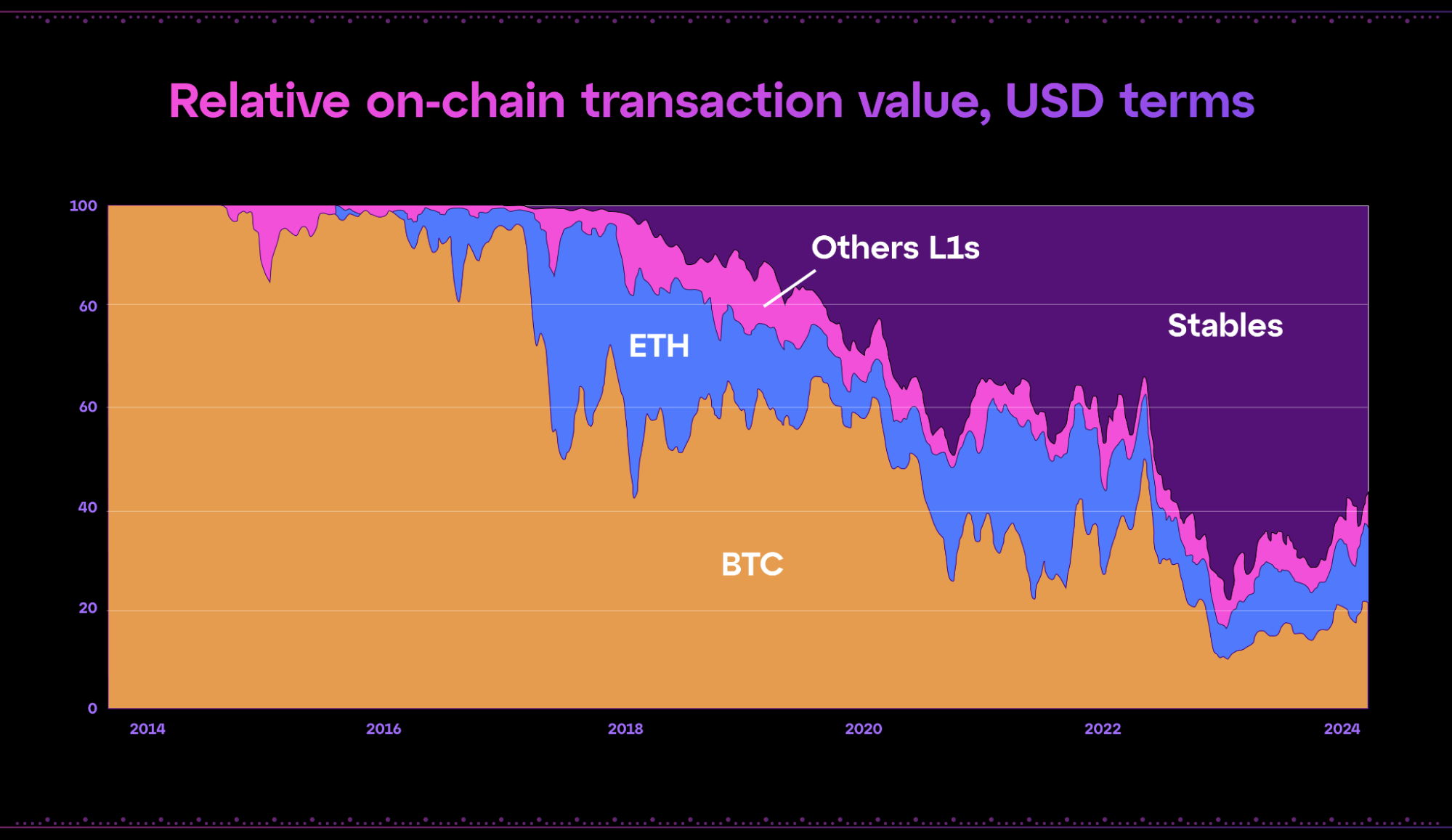

To add to the above point, with scalability solved and seamless interconnectivity, a third factor accelerates adoption: Stablecoins.

Stablecoins are crypto’s silent killer app. Increasingly, they have grown in legitimacy, becoming recognized by companies and government at an impressive speed (especially considering how long it took for spot Bitcoin and ETH ETFs to be approved).

Within the larger picture, this brings about a perfect storm: as better products position themselves in the crypto market, truly decentralized services find PMF, and the market recognizes the value of a crypto economy based on the USD (not obscure, volatile tokens), both building in and using Web3 will become more attractive.

Prediction #5: Interoperability with the traditional becomes ever more important

As more legacy players recognize the potential of Web3 solutions, the frontier between decentralized and “traditional” systems will become the new battleground for innovation and adaptation.

With easier-to-use infrastructure and, as better developer tools to bridge this gap emerge, this will become an opportunity too good to be ignored. The obvious starting place for this is finance, with a steady spill-over toward other domains.

At this point, legacy companies might even realize what crypto realized years ago, and start pushing decentralization as the main advantage of new or hybrid products. This is already, to a degree, happening with BlackRock’s RWA plans, and will only accelerate.

Prediction #6: No changes without turmoil

Every new era ushers in new winners, and someone has to lose.

With changing tides, Web3’s leading ecosystems and projects will face a new kind of pressure to adapt, find product-market fit, or showcase their value. Less friction and isolation will also inevitably lead to a distribution readjustment of both users and assets, with many failing along the way.

Crypto being crypto, you know what happens next: A cascading effect, which can impact anything from the economic security of less popular chains to the viability of certain projects and products. Furthermore, as Web3 becomes unified, multiple points of failure or centralized chokepoints could become glaringly apparent.

The abstraction layer itself is also not without its challenges, introducing a new potential attack surface. A vulnerability in a widely adopted abstraction protocol could have far-reaching consequences across multiple chains and applications. Furthermore, the interconnectedness of solutions might turn previously isolated risks into systemic ones. Meanwhile, culturally, introducing the paradigm of self-custodial assets and fewer intermediaries to a new broad new audience could also spark multiple new deception and scam tactics, exploiting new and existing users’ ignorance.

At the end of the day, this is still Web3. The emotional rollercoaster is part of the fun.

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)