Universal Accounts: Introducing Chain Abstraction's First Movers

Table of Contents:

Universal Accounts are getting ready to take the world by storm.

To date, over 90 teams across every major Web3 ecosystem have lined up to integrate chain abstraction via Universal Accounts—opening themselves to users from all ecosystems.

The frontier of decentralized products and services is moving to become borderless. So, for this article, we want to highlight three of the first movers in this realm: Taker Protocol, IVX, and KiloEx.

We talked to these projects about their goals for Universal Accounts, their understanding of the overall ecosystem, and the opportunities they’re taking advantage of by being first movers in the Abstraction Era. We also took the time to analyze their answers, aiming to understand whether they could be indicative of an overall paradigm shift.

What are Universal Accounts, and who is integrating them?

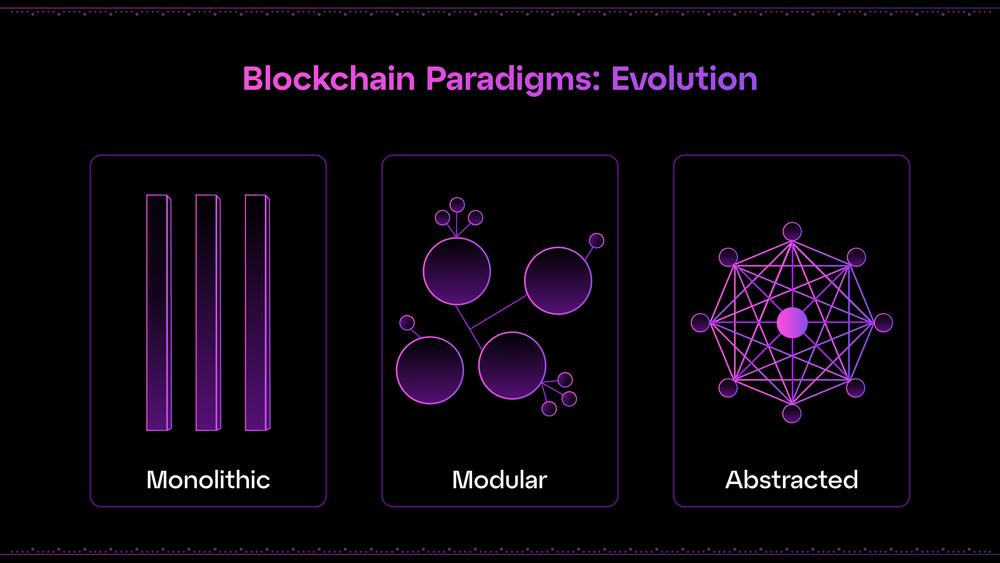

Before moving onto the teams’ answers, let’s quickly run over the concepts to be discussed here, starting with UAs.

If you’ve never heard of Universal Accounts, their function is simple: enabling developers to build chain-agnostic applications. Within these applications, users don’t need to think about which chain their assets are at, or what chain the dApp is built on. Instead, they can simply think about enjoying products with a single account and balance.

(INFOBOX: If you’re interested experiencing Universal Accounts, UniversalX (also built by Particle Network!) allows you to trade across all chains without ever bridging.

Out of the projects adopting Universal Accounts as they launch, we have selected three for this article, namely:

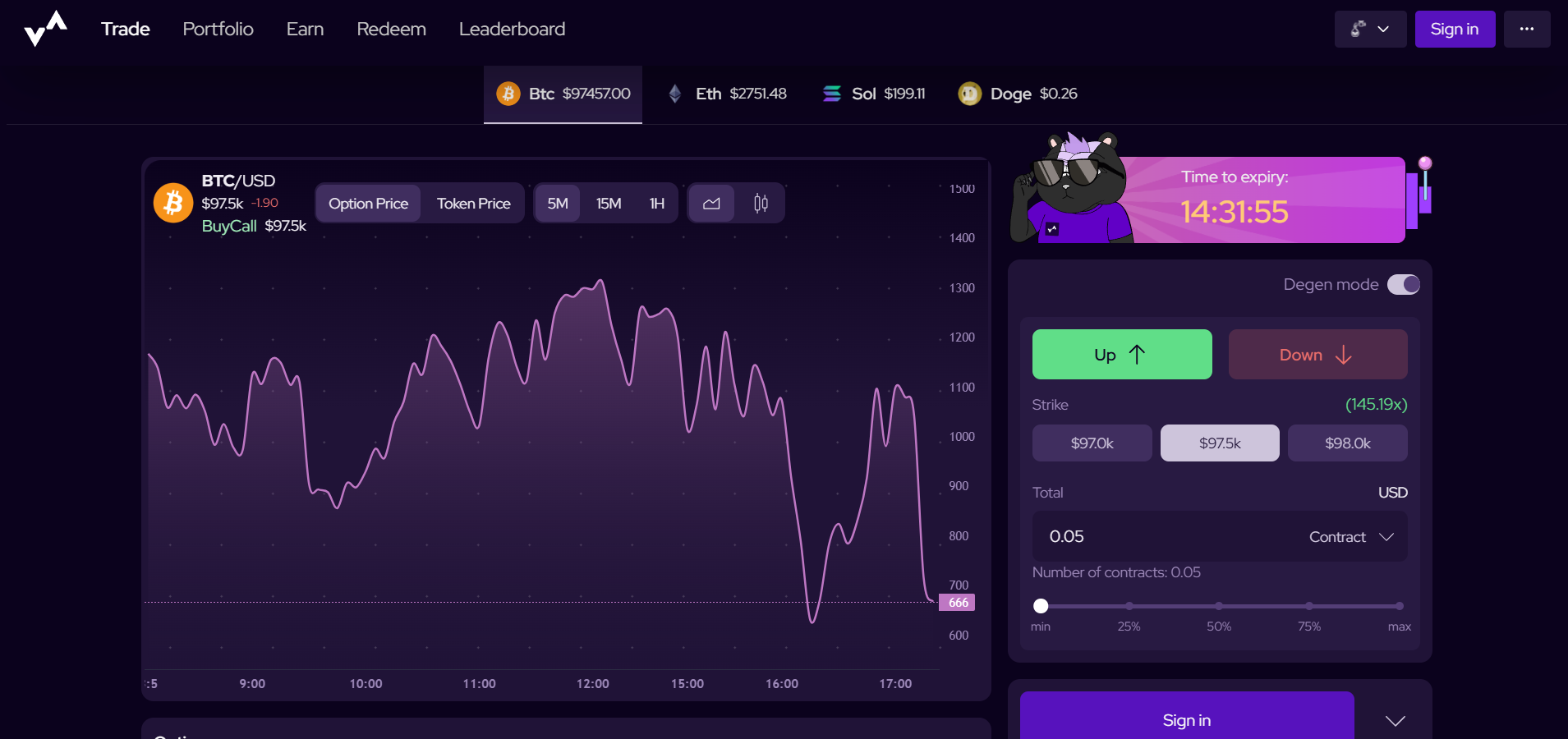

IVX

IVX is a Decentralized options AMM tailored for zero-days-to-expiry contracts, with a primary focus on crypto and real-world assets, providing high-leverage exposure. Its protocol design leverages Smart Accounts to allow users to access exotic, dynamic financial products.

IVX is a project native to the Berachain ecosystem, which will transition to Mainnet around the time of publication of this article.

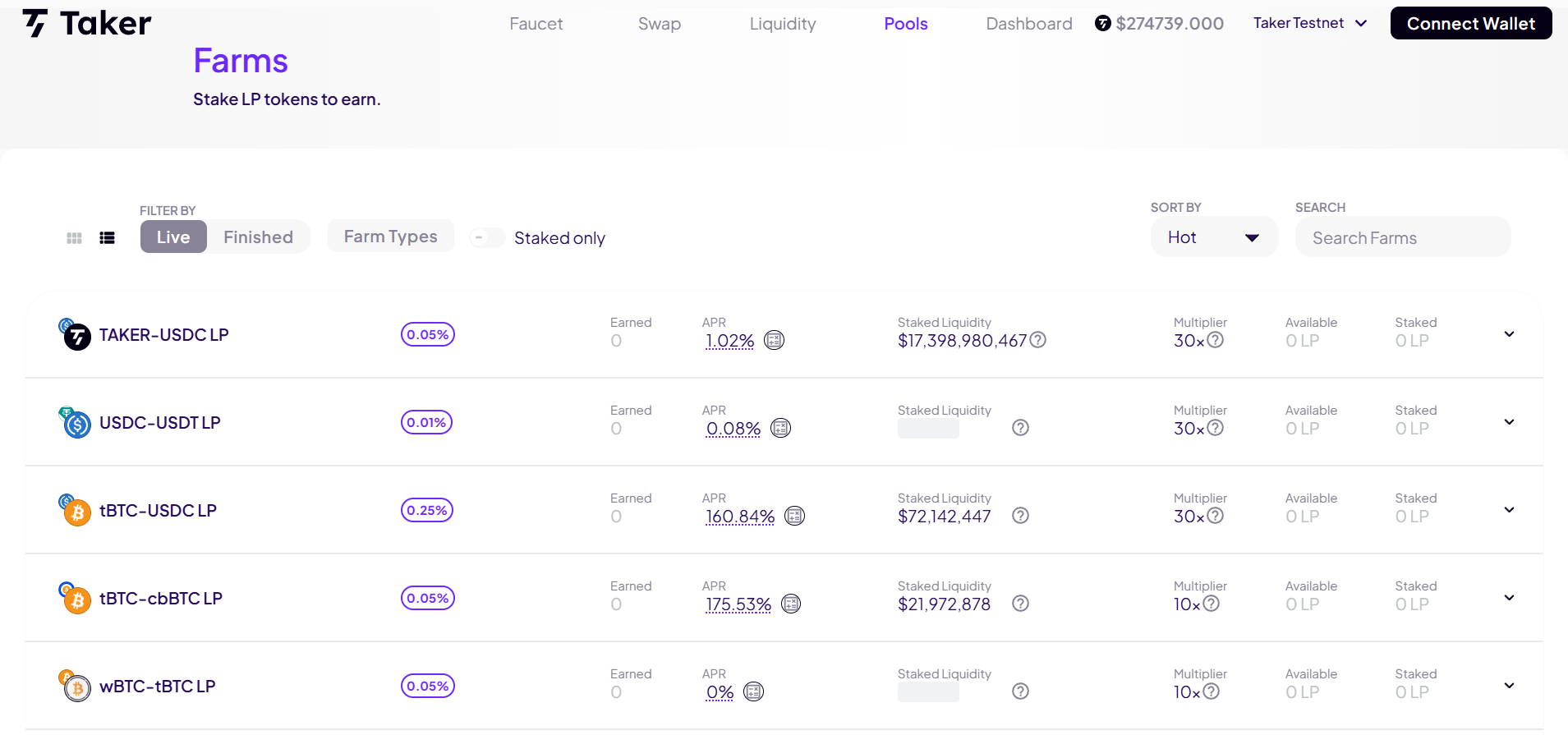

Taker Protocol

Taker Protocol is a liquidity layer designed for Bitcoin and its derivatives. By integrating a novel consensus mechanism known as Nominated Proof-of-Liquidity (NPOL), Taker enables the creation of products that take advantage of Bitcoin’s native utility, accelerating the ecosystem’s liquidity and scalability.

As an EVM-compatible protocol, Taker is also well-positioned to unify the Ethereum and Bitcoin worlds. Its Mainnet is currently live.

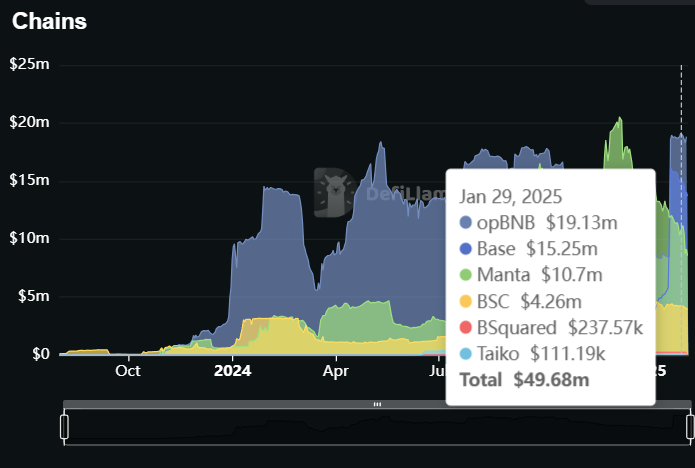

KiloEx

KiloEx is a community-governed decentralized exchange, designed to introduce high-leverage trading through a peer-to-pool perpetual trading mechanism. Unlike traditional exchanges, KiloEx combines the benefits of peer-to-peer trading with the liquidity of pooled funds, offering traders unparalleled flexibility and efficiency.

KiloEx focuses primarily on the opBNB and Manta communities, although it’s also grown significantly on Base over the last quarter.

Thoughts on the Abstraction Age: IVX, KiloEx & Taker

Ambition

Although all projects originate from specific ecosystems (IVX on Berachain, and Taker on Bitcoin, and KiloEx on Manta/opBNB), they all see integrating Universal Accounts as a path to tapping into larger markets.

IVX explains:

“Our primary identity is as a hub for derivatives. As such, we want users from every chain to be able to access our innovation without the hurdle of bridging to Berachain. And in reality, we see that people don’t want to care about L1s and L2s. They want to use products, so our focus is for our product to meet retail expectations”.

On the other hand, Taker seeks an equally ambitious role, but with an infrastructure-oriented spin:

“We see Taker becoming one of the supporting projects in a borderless universe. We want to be one of the backbones allowing users to access liquidity and assets for trading, while supporting other functionalities. Here, removing bridging as an obstacle for users is key to unifying liquidity and fostering growth.”

Meanwhile, KiloEx remarks:

“We see a disconnected market, with the potential to become truly global through ChA. Moving fast on integrating it will allow us to onboard more traders, increase their trading conversion, reduce fragmentation, and tap into diverse ecosystems without forcing users to move assets manually. Eliminating friction is the road to growth.”

Opportunity

More interesting insights appear as we look into the underlying problems and opportunities these projects see in Web3—particularly those that they seek to address with Universal Accounts.

In particular, all three projects refer to fragmentation and its side effects as deep problems.

IVX mentions:

“Fragmentation is still a huge issue for a product like ours: we still have 20 different pools for the same asset types across chains, and we still have to constantly have gas on 20 different chains. Bridging assets outside of stables can often still be tricky. For DeFi, more chains means the need for more fragmented liquidity, driving this problem.

However, beyond UAs, we see many opportunities. Apps like Moonshot are cracking the code for mass onboarding, and for financial apps like ourselves, this is the direction we need to go to be competitive. Frictionless onchain usage—in the form of better gas systems, simpler chains, and even better fiat ramps—can make a huge difference.”

Taker adds:

“Secure and fast automated (not manual) bridging needs to be cost-effective and secure. In this regard, Universal Accounts really lower the barrier. Thanks to this, a borderless Web3 will be a major impulse for trading and DeFi. Particularly as these systems prove themselves and eliminate safety concerns. Once again, as infrastructure, this will allow Taker to serve more users and expand its applications.”

Meanwhile, KiloEx seems to take ChA to heart as a way to step ahead of its leveraged trading competitors, with clear, specific ideas for how to improve its service through UAs:

“We want to use UAs to enhance user convenience and capital efficiency in several ways. Two of them are:

Cross-chain margin trading: Allowing users to use collateral from one chain while trading perpetual contracts on another, eliminating the need for manual bridging.

Optimized gas management: Enabling transactions without requiring users to hold gas tokens on each chain, improving the onboarding process.”

Innovation

Finally, all three projects have unique takes on the future of the decentralized web within an abstracted paradigm.

For KiloEx, it’s clear that chain abstraction will become a non-negotiable experience for users:

“Projects that fail to adopt borderless frameworks may struggle to retain users as traders will naturally gravitate toward platforms that offer seamless multi-chain experiences.”

Taker, in particular, sees the Abstraction Age as the beginning of a new era for Web3, one where successful projects expand to reach higher grounds. In their words:

“We will begin to see more mergers and acquisitions, a result of a greater ability for products to grow and sustain this growth.”

Meanwhile, IVX highlights the opportunities that chain abstraction opens for innovation itself:

“When you have no borders, you don’t have the security of a single ecosystem to be your niche. You're kind of just out there in the open and competing with applications across all chains. Your product has to be much stronger if you want to compete… but this is a good thing as competition drives more innovation.”

Universal Accounts are coming

As we mentioned in this article's introduction, KiloEx, Taker, and IVX are just three out of 90 projects lined up to integrate Universal Accounts as we launch.

Chain abstraction is set to massively disrupt the Web3 mainstream, and will be everywhere before you notice it. In fact, in an ideal world, most users won't even know they're using it to begin with. They'll just feel at ease in Web3.

Stay tuned for more updates!

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)