Beyond UX: dApps On The Need For Chain Abstraction

Table of Contents:

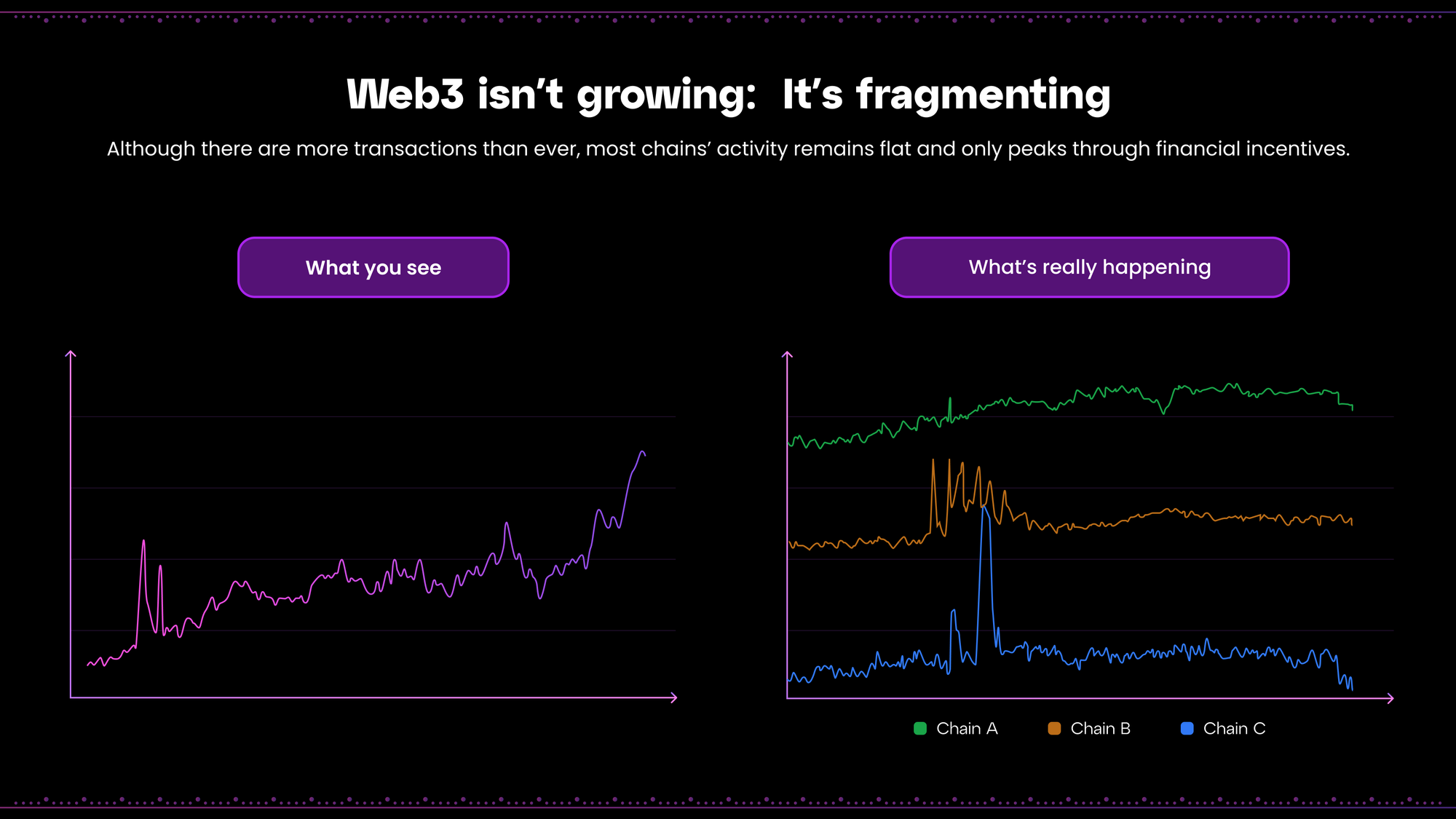

We’ve highlighted this over and over again: Fragmentation is the single largest issue standing between Web3 and consumer adoption.

Usually, we focus on the ecosystem-wide imbalances that fragmentation creates: By altering the incentives of different Web3’s participants, it makes users’ experience more difficult—and, by extension, stops new users from entering the ecosystem.

However, it’s about time we tackle this topic from a different angle.

Today, we’re giving a voice to those responsible for driving the adoption of the decentralized world: application builders. We spoke to THENA, Overtime Markets, and Moonveil about fragmentation to better understand how it affects their respective niches, how it shapes their experience as dApp creators, and the repercussions that solving it may have—on their projects and Web3 as a whole.

Let’s hear it from them.

But first, some ground concepts

Before fully diving into our conversations with these projects, let’s set the stage by answering two key questions:

#1: What do we refer to when we talk about “fragmentation”?

Fragmentation refers to the splintering of users and liquidity across isolated blockchains. This creates a fractured ecosystem where users struggle to access the full potential of Web3, and limits their assets and activities to specific chains and their dApps.

Fragmentation also results in a disjointed user experience where users are forced to juggle multiple wallets, gas tokens, and bridge across chains. As such, it tends to lead to redundant development, misaligned incentives, and wasted resources.

#2: Why do we consider dApps to be Web3’s main growth drivers?

While digital assets (including “regular” cryptocurrencies, NFTs, stablecoins, etc.) gained initial traction as mediums of speculation and store of value, they cannot be adopted by the masses without being integrated into everyday transactions of all kinds.

By embedding digital assets into practical applications, dApps take crypto beyond theoretical benefits and into real-world use cases. Notably, the fact that these applications are decentralized not only enhances digital assets’ utility, but also leverages the inherent advantages of blockchains: censorship resistance, composability, transparency, and user ownership of data.

As a result, dApp creators have tremendous responsibility over the ecosystem’s growth: On the one hand, they are responsible for finding use cases that leverage Web3’s properties. On the other, their own sustainability depends on attracting interest from both existing ecosystem users and those outside of it.

Having established this, let’s now try to understand the problems fragmentation creates for dApps, from their own perspective.

Simplification? More like complication

When it comes to user experiences, less is more. Helping a user fulfill their goals in as few steps as possible is the essence of product design. And yet, in Web3, fragmentation makes it near-impossible to do this.

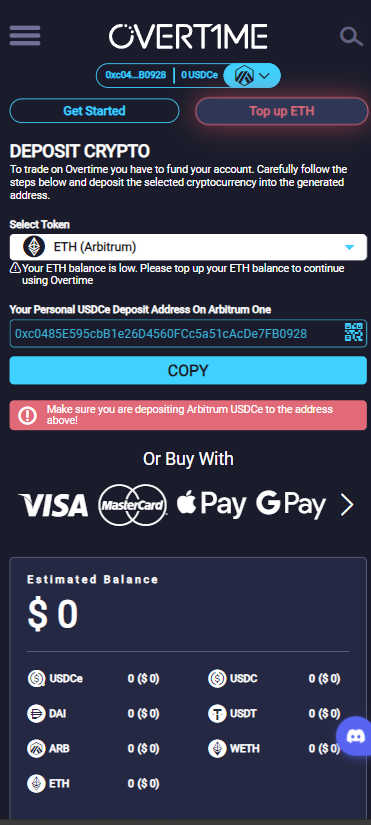

Overtime Markets, a decentralized sports-focused prediction market, speaks about how fragmentation complicates product design:

“We have focused on multi-chain deployments to capture attention and users from multiple ecosystems. However, being present on multiple networks has a couple of serious downsides. Liquidity is completely fragmented and the UX friction is notable among users navigating the app layer across different networks and different wallets. Adapting the UI to these adverse circumstances has been a challenge. As a retail-facing product that requires an intuitive and spotless UX for all demographics and their devices, cross-network issues do impede growth heavily.”

In the past, we’ve covered Overtime Markets’ integration of Particle Networks’ Wallet Abstraction services to improve their onboarding process for non-Web3 users. However, the realities of needing to appeal to users from multiple blockchains—and the subsequent product design needs that ensue based on this—present painfully obvious difficulties.

Simply put, products cannot be as simple as possible if they need to account for the possibility of users needing to deposit assets and bootstrap internal economies from multiple blockchains, as well as the different infrastructures (wallets, bridges, etc.) attached to these networks.

Overtime elaborates on this:

“Our main target users are not necessarily crypto native. This kind of users just want to deposit, trade and cash out as simply as possible. Currently available EVM onboarding infrastructure is not exactly plug-and-play for everyday retail users. There needs to be a solution that abstracts away the on-chain transaction executions and cross-chain onboarding, while preserving the decentralization and permissionless nature of the Ethereum Network. This is the precondition required if our niche is expected to reach the next stage of adoption.”

Overtime’s answer here illustrates some of the ramifications of fragmentation: it tends to result in overly complex onboarding flows, overcomplicated interfaces, and strenuous demands for developers’ time and resources. This perpetuates a vicious cycle where dApps are forced to choose between spreading themselves thin or catering to a single ecosystem, making dApps that conform to fragmentation more likely to triumph due to (not despite) their lack of innovation and ambition.

Slowing down growth and segmenting liquidity

And so we arrive at finance.

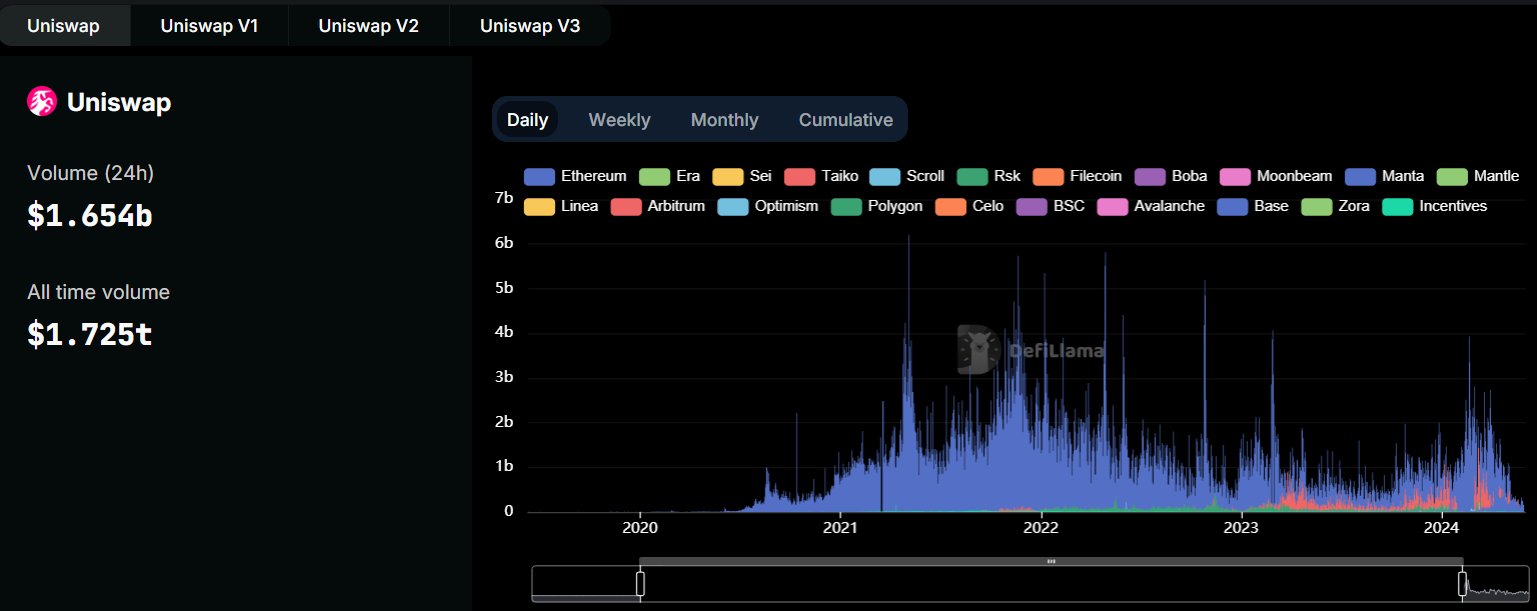

Web3’s most successful use case is, without a doubt, DeFi. And yet, this is one of the segments most affected by fragmentation, which takes a direct toll on projects’ liquidity. THENA, a leading BNB Chain exchange, explains:

“THENA faces the same liquidity fragmentation challenges as every other DEX, even with major assets like Bitcoin and Ethereum, which have large liquidity pools on other chains. While we excel at providing liquidity on BNB Chain, this fragmentation limits our ability to fully serve all traders.”

Bootstrapping liquidity is often the most difficult task for DEXs. Doing so in multiple chains at the same time, on the other hand, brings along even greater difficulties, resulting in a competitive landscape that’s more ecosystem-based than universal. This is even the case for the industry’s top players, as shown below:

Undoubtedly, DEXs like THENA have evolved to be a fundamental part of the Web3 landscape. Their permissionless nature clearly illustrates the benefits of decentralized services over centralized ones, especially in a low-fee environment. And yet, the project recognizes, the difficulties of interacting with a multi-chain ecosystem tend to push users towards centralized alternatives:

“Fragmentation reduces THENA's competitiveness in multiple ways. CEXs continue to dominate, despite DEX trading share being on the rise. The issue is amplified in assets that have already thinner liquidity then spread across multiple chains. Leading to worse pricing for users.

It's the same for all DEXs. And asking users to use multiple platforms to do their trading means some will just opt to trade at a CEX. People navigate towards the easiest and simplest experience. Thankfully DEXs have many advantages, and the gap in UX is closing. And problems like liquidity fragmentation are being solved.”

Crucially, THENA points out, liquidity fragmentation ends up impacting assets and DEXs. This drives liquidity out of the decentralized panorama, as users end up utilizing CEXs as both bridges, on/off ramps, and trading platforms, even when they’d prefer to use non-custodial solutions. Should DEXs be able to easily offer seamless interactions across multiple chains to users from all across the ecosystem, the network effects resulting from additional liquidity would be beneficial not just for them, but for the entirety of DeFi.

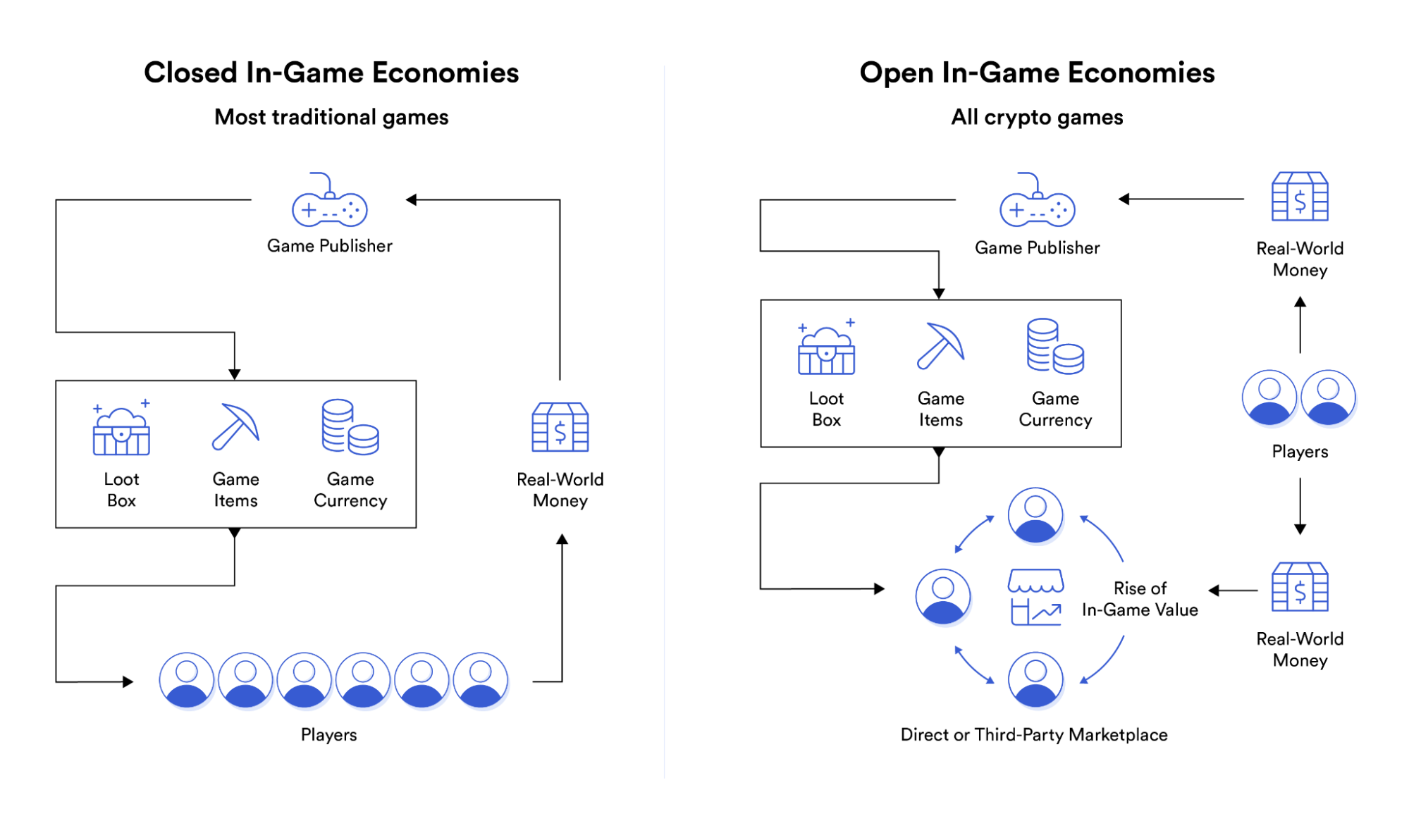

Fragmented utility

Another typically overlooked angle when covering how fragmentation hurts Web3’s adoption is the disparity of experiences for the same product across chains. Moonveil, a Web3 gaming studio, cites this problem as both a pain point for existing Web3 users and an obstacle to onboarding new ones:

“Players should be free to choose in which ecosystem they enjoy their gaming experience without being constrained by platforms, channels, or chains. Although the Web3 gaming ecosystem grants players ownership of immutable on-chain assets, the current fragmentation across different chains makes this experience very disconnected. As a player, even if I dedicate a lot of time, energy, and even spending on a particular game ecosystem or product, I still cannot realize the external value of my identity information, which brings unnecessary constraints.”

Moonveil refers to a player’s “identity”—including on-chain assets and data—being stuck in a single chain, as opposed to being part of a unified ecosystem. Due to this, two options are available for Web3 gamers:

- Using chain-specific games, undergoing the onboarding difficulties of fragmented chains.

- Using games present on multiple chains, where they will face a considerably different experience from players of the same game on different chains.

In both cases, fragmentation trumps the ability of games to expand to new users, imposes limitations upon their players, and, overall, makes them a less attractive alternative to Web 2.0 games. Without this Product-Market Fit, Web3 will continue to be unable to compete with centralized alternatives—much to the detriment of the decentralized economy.

Is chain abstraction enough for dApps to succeed?

By creating a unified ecosystem where dApps can build for users of all kinds and onboard new ones more easily, chain abstraction aims to impact all areas of Web3—not just its usability.

In this article, we’ve seen repeated examples of how fragmentation affects Web3 projects—and the ecosystem as a whole—from the lens of dApps creators. However, as we enter the Abstraction Age, dApps will be able to compete more effectively with their Web2 counterparts.

Nonetheless, while chain abstraction is a crucial step forward, it's not a silver bullet for dApp success. Rather, it levels the playing field and allows them to truly showcase their unique advantages. With fragmentation issues solved, dApps can focus on leveraging the benefits of decentralized technologies to create compelling, truly innovative value propositions—all of this without the troubles fragmentation causes for users.

Ultimately, chain abstraction provides the foundation for dApps to compete with Web2 products on equal footing. It's up to builders to seize this opportunity.

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)