Transcending Onchain: Announcing the Universal Layer for RWAs, Stablecoins & Digital assets

Table of Contents:

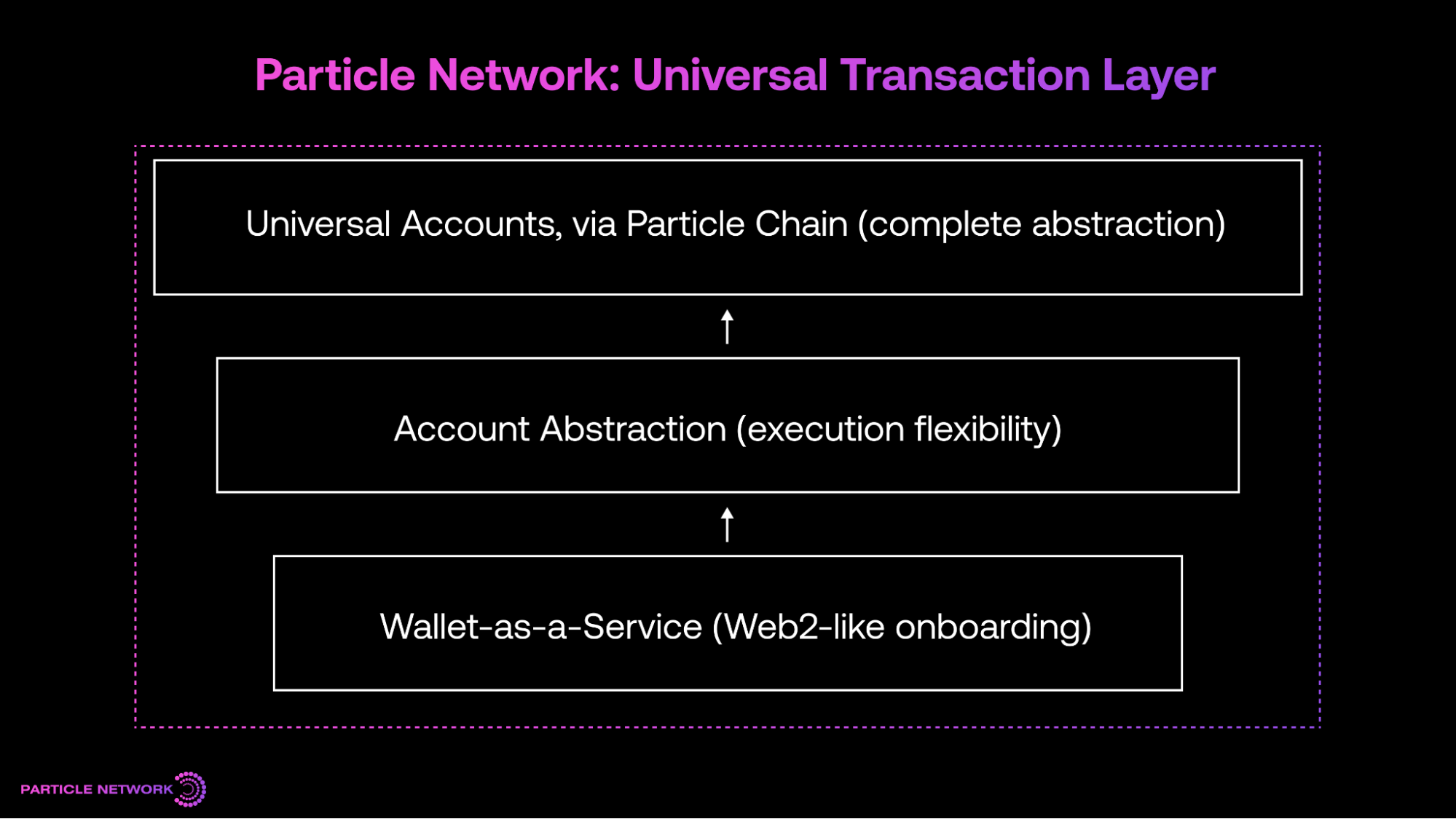

Between 2023 and 2024, we solved social onboarding and in-app wallets. Then account abstraction. And lastly, we unified all chains and shipped chain-agnostic trading.Easier said than done. But done nonetheless.

So now, we’re taking on our most ambitious project to date.

We’ve shown that chains can be invisible. And that Web3 is finally at a point where developers and users can focus purely on functionality. But even with these achievements, two adoption barriers remained unsolved:

- Web3 dApps still struggle to attract mainstream users.

- Traditional applications and FinTechs still struggle to integrate crypto without introducing custody or sacrificing user experience.

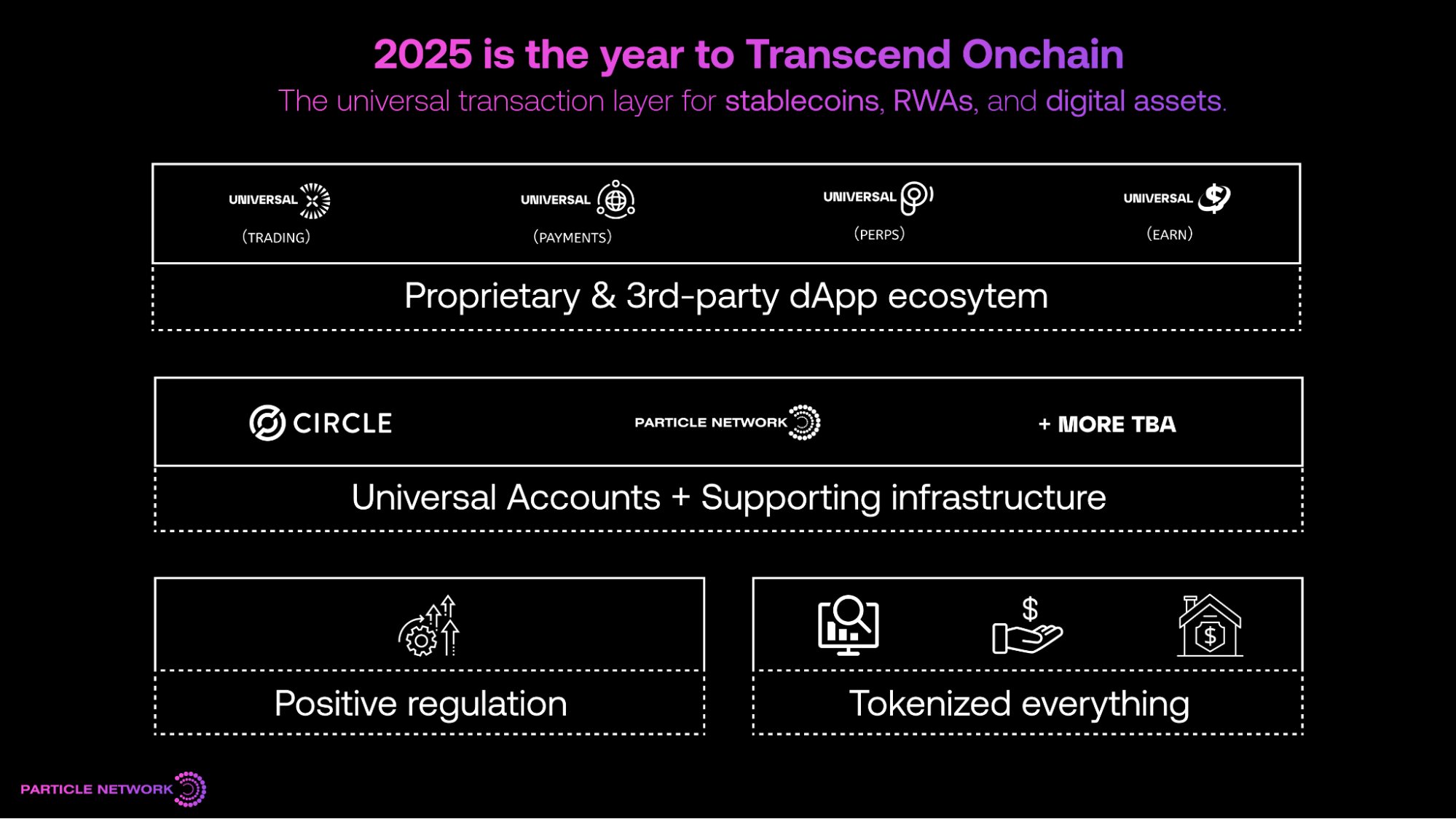

But, as we’ll cover below, the times are changing. Positive regulation and unparalleled industry momentum show that, through stablecoins and RWAs, the world’s economy is moving onchain.

And with the perfect product to facilitate this economy, we’re pushing forward stronger than ever.

The pieces are coming together

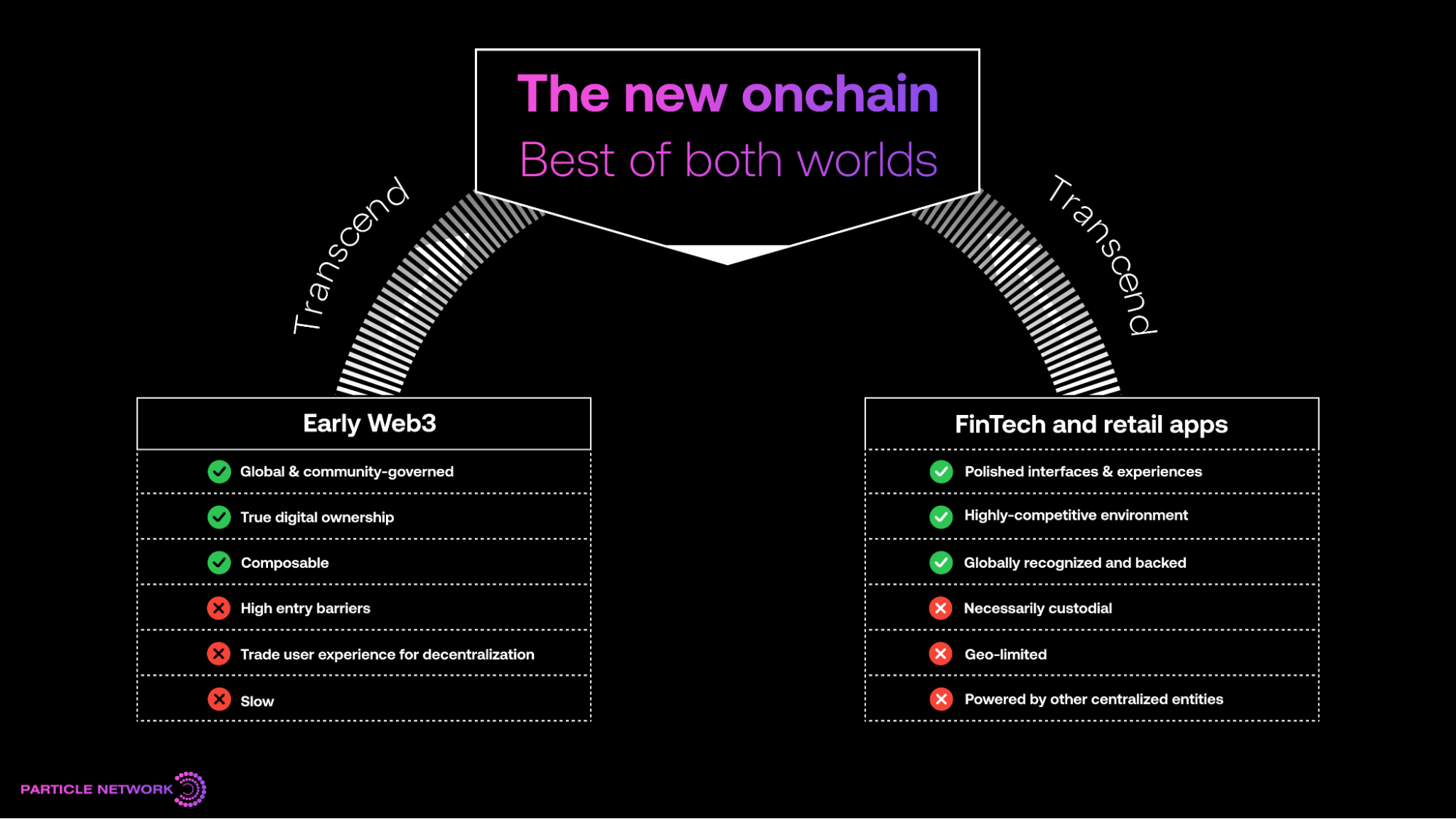

So far, Web3 hasn’t been an evolutionary step over Web2; but rather, both have evolved in parallel.

Despite the industry’s best efforts to “onboard retail”, the onchain experience is still far from the simplicity of Web2. Or, in the rare case it isn’t, it involves a degree of custody or centralization that has historically backfired for crypto, resulting in reputational and financial damages for the industry.

In other words, up until now, crypto hasn’t managed to produce functional, attractive decentralized alternatives to custodial products.

However, two factors indicate that the Web3/Web2 dichotomy is nearly dead.

First, the world is ready for crypto

You can feel it in the air. The late innings of the crypto cycle have brought almost exclusively good news, with traditional finance and governments getting involved in our industry in unprecedented ways. Furthermore, this activity has gone beyond just Bitcoin and moved into smart contract chains, with tokenization, RWAs, stablecoins, and onchain trading finally making the agenda.

If you ever want to remember to be bullish, just remember that:

- The EU’s MiCA regime just entered stage in December 2024, while the U.S. House passed the Digital Asset Market CLARITY Act as recently as 17 July 2025. Yes, two weeks feel like a long time in crypto.

- With “Project Crypto”, the U.S. Securities and Exchange Commission created a commission‑wide programme to rewrite securities rules so tokenized stocks and crypto assets can trade on SEC‑regulated venues.

- Even traditional payment rails now embrace stablecoins. Visa now settles USDC, PYUSD, USDG and EURC across four blockchains and 80‑plus markets.

- Some of the world’s biggest commerce platforms have announced plans to embrace stablecoins. Meanwhile, stablecoin monthly on‑chain settlements have recently hit $1.39T.

- Stablecoin runway extends to trillions. Citi Institute forecasts outstanding stablecoin supply could swell to $3.7T in a bull‑case by 2030, making dollar‑pegged tokens one of the world’s largest cash‑equivalent markets

- Tokenized Treasuries exceed $6.7B. Total on‑chain RWAs stand at $25B. And this is only the very beginning of a trend estimated to be worth $30T in 2034.

- The slowest-growing RWA trend, tokenized real estate, has the potential to bring $380T onchain.

In summary, the world seems ready to transcend Web2. But is Web3 ready to transcend onchain?

Short answer? Yes. Crypto is finally ready for the world

Our core thesis was always fairly simple:

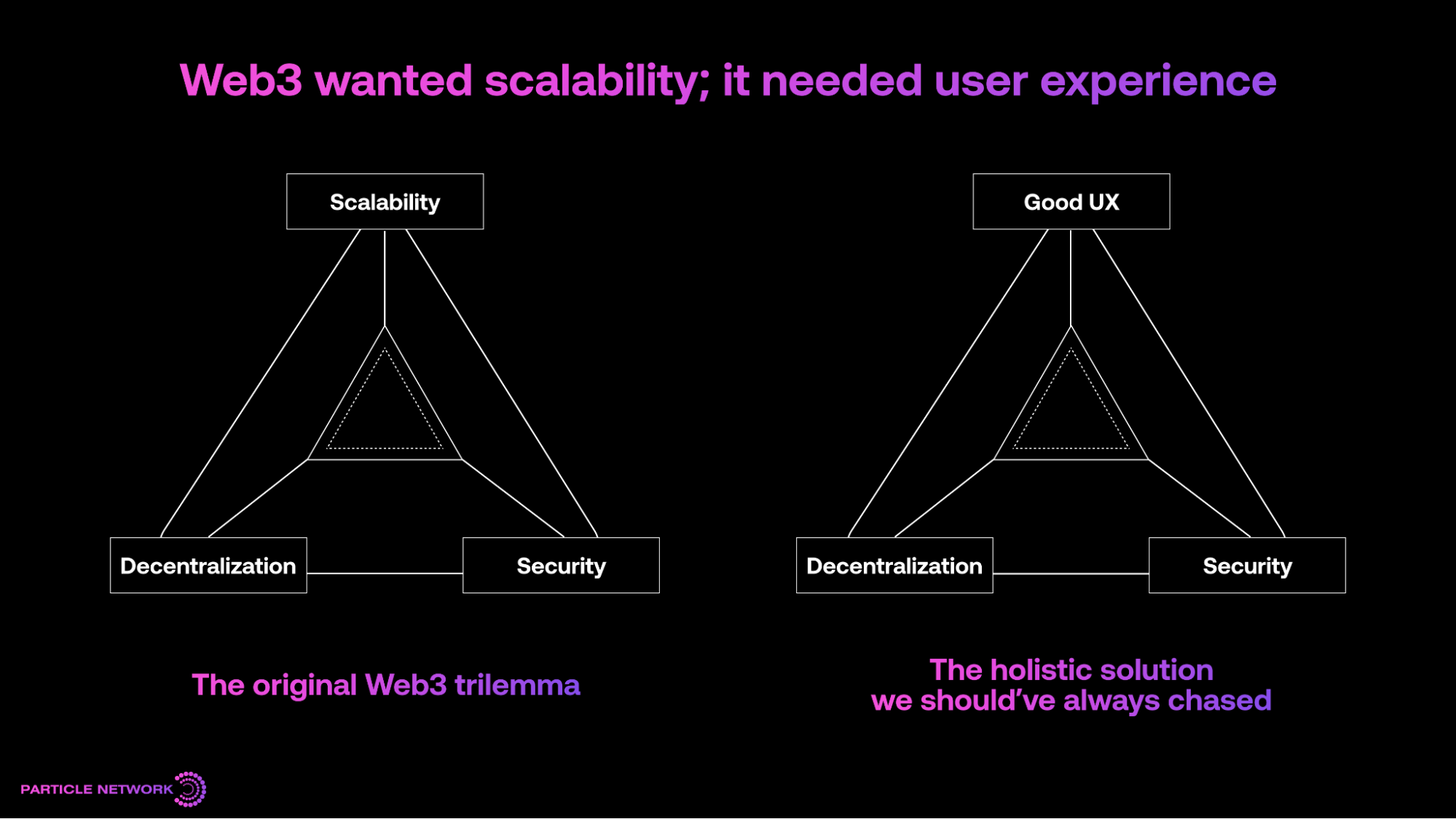

Without Web3 feeling like a single ecosystem, there would be no chance to bring the world onchain. L2 scalability works, but at the cost of fragmentation. Without solving this problem, truly decentralized networks would not suffice to bring the financial system onchain.

The final piece of the puzzle was never scalability: it was cohesiveness. Web3 should feel like a single ecosystem, not just be fast.

And in 2025, we crossed this milestone.

Universal Accounts debuted as the first technology bundling every user experience innovation in Web3 history to allow for fully non-custodial, Web2-like user experiences.

This technology was then battle-tested, handling over $670M worth of high-frequency onchain trades via UniversalX, and then released to the world via the Universal SDKs.

The result? An application-ready, universal transaction layer for consumers to interact with the new era of onchain assets in a retail-ready environment.

Simply put:

The world has a clear appetite for onchain assets. And Universal Accounts make the technology hosting these assets friendly enough for literally anyone to use.

Universal Accounts break the tradeoff between user experience and custody, finally allowing decentralized products to match or rival their Web2 counterparts. This sets the stage for the final transition between Web2.0 and Web3—powered by the RWA revolution.

The rails for Everything Onchain

As said at the beginning of this article, every time we solve a problem, we go harder on a bigger one.

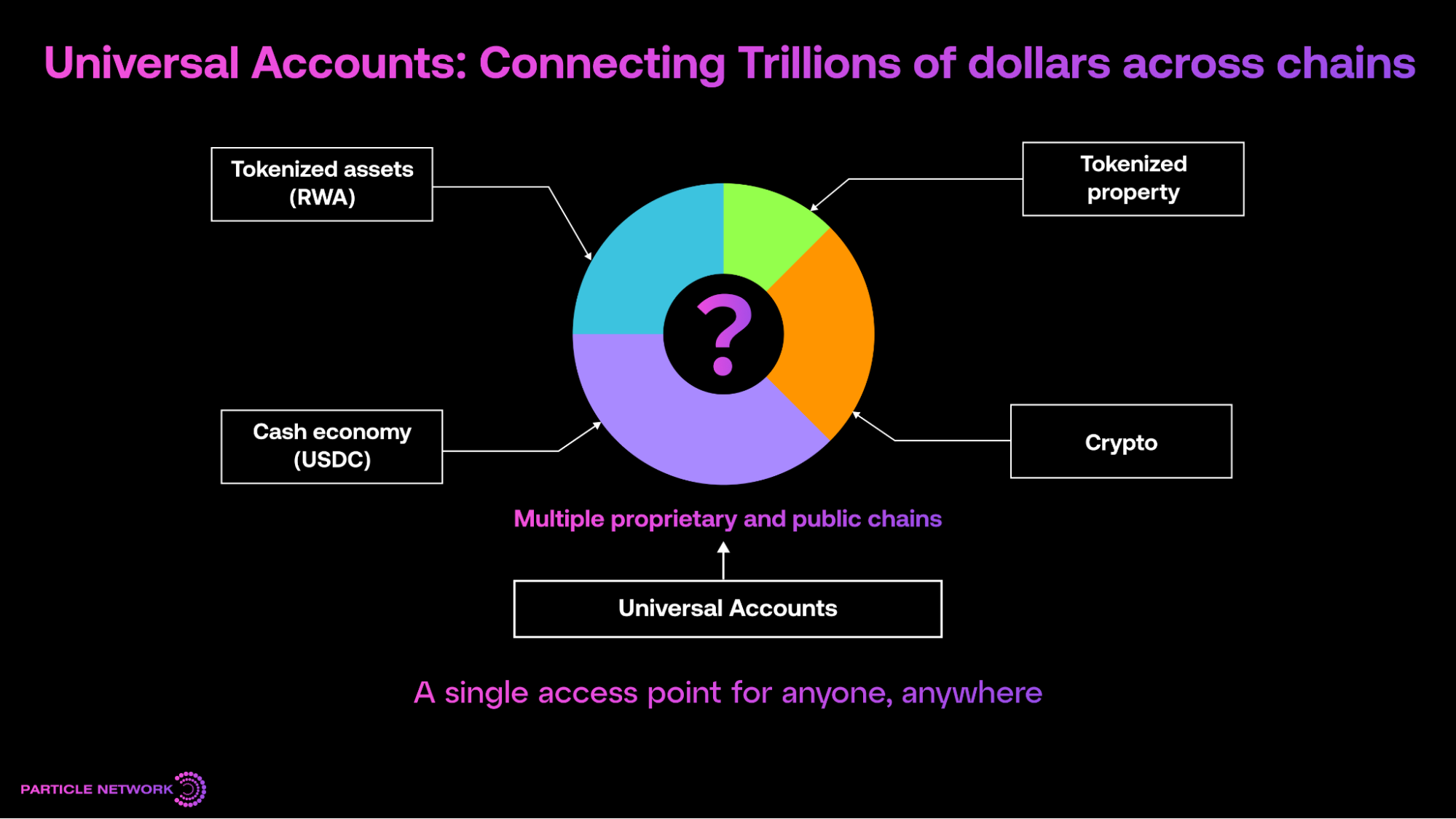

In this case, the opportunity ahead is too big to ignore: Trillions are about to flow into our ecosystem.

Meanwhile, thousands of businesses are positioned to gain immediate access to a retail-ready user experience through Particle and Universal Accounts. As the infrastructure hosting a new era for Web3, Universal Accounts will allow ANYONE to go onchain… and those already onchain to transcend.

So we’re doubling down on striking collaborations with Web3 and legacy players alike to interconnect retail services with Web3.

Because crypto is ready. The world is ready.

If every property is tokenized, you need Universal Accounts to access them all.

If every dollar is a stablecoin, all commerce can flow through the Internet via Universal Accounts.

If every app uses crypto, Universal Accounts make them all compatible.

If trillions of dollars come onchain, Universal Accounts become the settlement layer for the world’s economy. And that’s why we’re strongly going for this market.

And we’re not alone in this, either

To enable RWAs, stablecoins, and all digital assets to reach the masses (both crypto-native and from legacy markets), key technologies and partners will be progressively announced over the next few weeks.

The first one of these announcements, in fact, is happening right now. As Universal Accounts become the defacto infrastructure for the mass market to embrace the new onchain era, we’re joining forces with Circle, through Circle Gateway, to help abstract USDC transactions right on its issuer’s own chain-agnostic layer, therefore facilitating retail-ready onchain commerce.

As we go deeper into this era of digital assets, you’ll progressively see Web2 and Web3 names embrace it, without explicitly making it about their home blockchain. More on this and other partnerships, soon!

TL;DR

We’re plunging into a world where RWAs and stablecoins result in anyone having full access to any asset, anywhere, instantly. This means trillions coming onchain.

In an everyday present where blockchains and digital currency are fully integrated into every product, users will be able to seamlessly transact, invest, and use digital assets anywhere—thanks to Universal Accounts.

The ability to transcend onchain is the defining factor. It’ll be powered by the first-ever universal transaction layer for RWAs, stablecoins, and everything in between, covering our whole stack: Universal Accounts, the Particle Chain, and you guessed it, $PARTI.

We’re just starting to plant the seeds of what will grow into a vibrant, next-generation ecosystem.

Crypto is ready.

And the world is ready to transcend onchain.

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)