MetaMask's Growth Flywheel is Faltering: Pan-User Applications Emerge as the “Hub” of Web3

Table of Contents:

MetaMask, renowned as the industry's leading wallet product, has extended its influence far beyond the wallet realm, exuding an aura of almost unassailable dominance in the market.

With a first-mover advantage within the developer community and a collaborative approach towards the dApp ecosystem, MetaMask has built a growth flywheel, allowing it to become the entry point for most new Web3 traffic.

This article will analyze the initiation and operation of MetaMask's growth flywheel, and why it might be faltering

A brief review of MetaMask's development history

Let's take a moment to look back at MetaMask's trajectory and growth.

MetaMask was co-founded by Kumavis (also known as Aaron Davis), along with several other core members, with the primary aim of simplifying user interaction with dApps through a browser extension plugin. Few remember this but, before 2016, interacting with Ethereum-based dApps was relatively intricate, requiring users to run a full Ethereum node.

Contrary to the perception of most, MetaMask's initial impetus leaned more towards the developer tool spectrum, aiming to provide developers with a user-friendly access interface.

The initiation and operation of MetaMask's growth flywheel, as gleaned from its history

During 2020-21’s rapid evolution of DeFi and NFT explosion, MetaMask's advantages in terms of assets and user scale meant that more dApps opted for it as the default choice to link users to on-chain business scenarios. This further boosted MetaMask's asset and user scale.

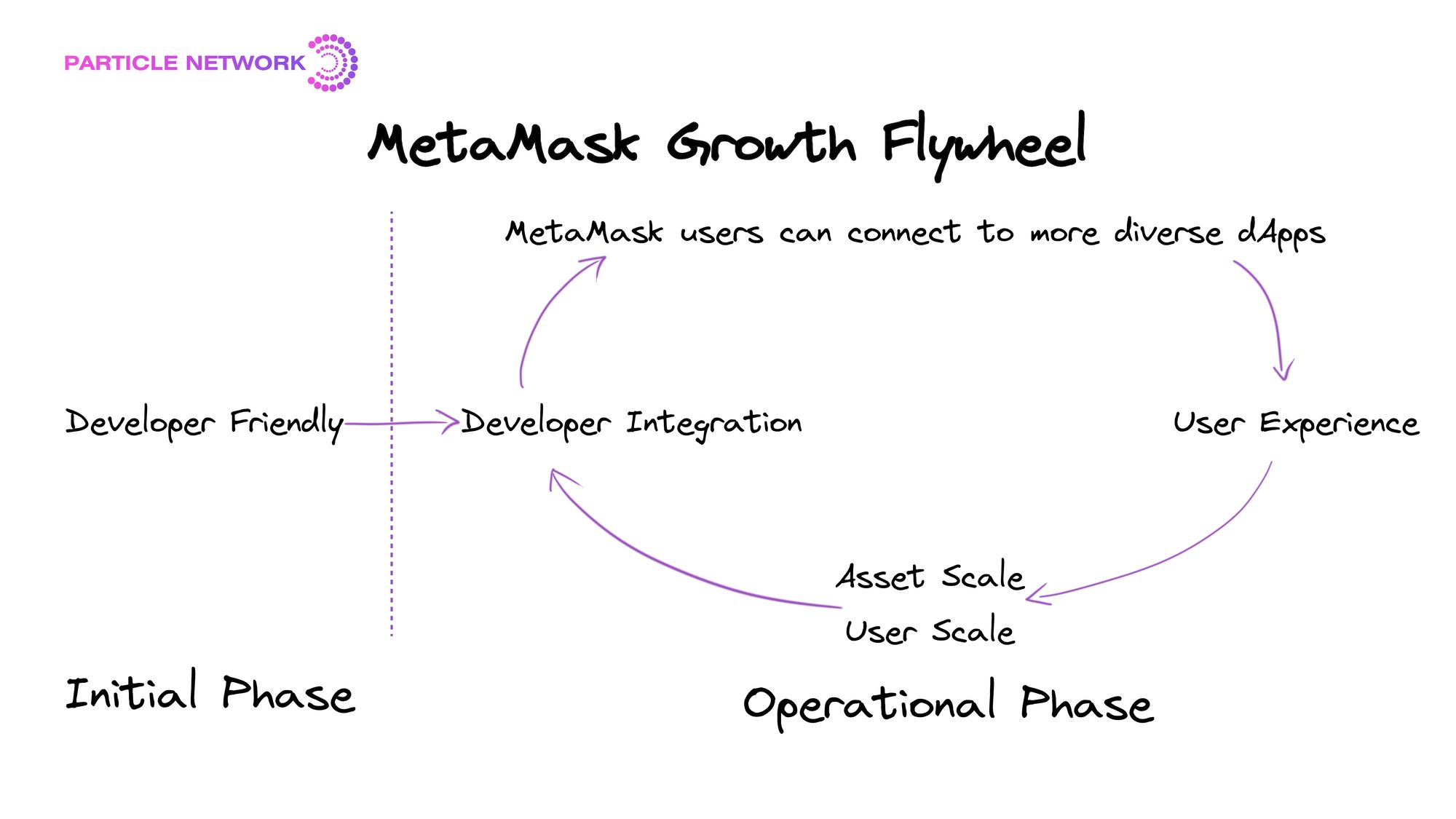

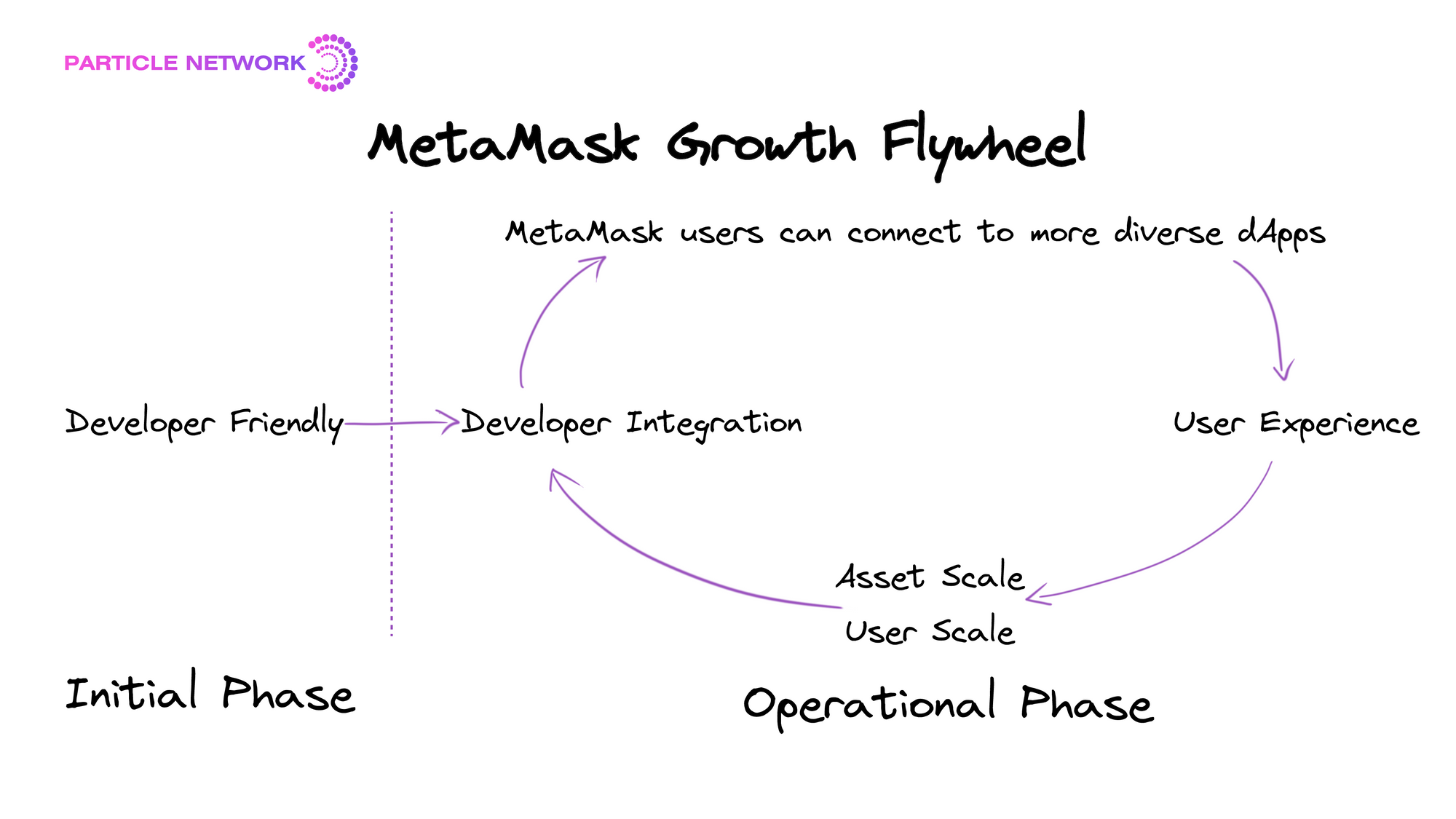

From its development trajectory, we can deduce the key stages of this virtuous cycle: the initiation, ignition, and operation of MetaMask's growth flywheel:

- Flywheel initiation: With its developer-friendly features, MetaMask became the most popular user access tool for early dApps.

- Flywheel ignition: Becoming the industry leader in user scale and asset magnitude, MetaMask quickly became a defacto solution.

- Flywheel operation: The industry's "wealth effect" (its ability to drive newcomers via economic growth) led to an increment in on-chain products (primarily DeFi products, mainly interacting through web interfaces) usage. These products, by default needing users to connect with MetaMask, increase the number of users and the asset scale of MetaMask, allowing it to evolve from a single-user access tool to a complete user ecosystem, subsequently attracting more developers to use it.

Why this growth flywheel is faltering

I believe this to be the case for the next few reasons:

- Failure to become a"hub" that would make the growth flywheel more stable.

Throughout the entire traffic pathway, MetaMask is not the primary driving force for users to enter; it is merely one of the places where they access Web3 under the influence of the wealth effect. In terms of traffic interaction, MetaMask acts as a one-way absorption without any distribution or feedback. Another characteristic is that the proportion of users who use MetaMask as a starting point for active demands (other than transfers) is minimal. I believe a hub should be the starting point for the collection and distribution of active demands, not merely a place to receive traffic. For instance, Google is a hub, but the event management platform Lu.ma, often used by Web3 enthusiasts, is not. In fact, MetaMask's recently released Snaps aims to undertake the role of transitioning from traffic reception to traffic distribution.

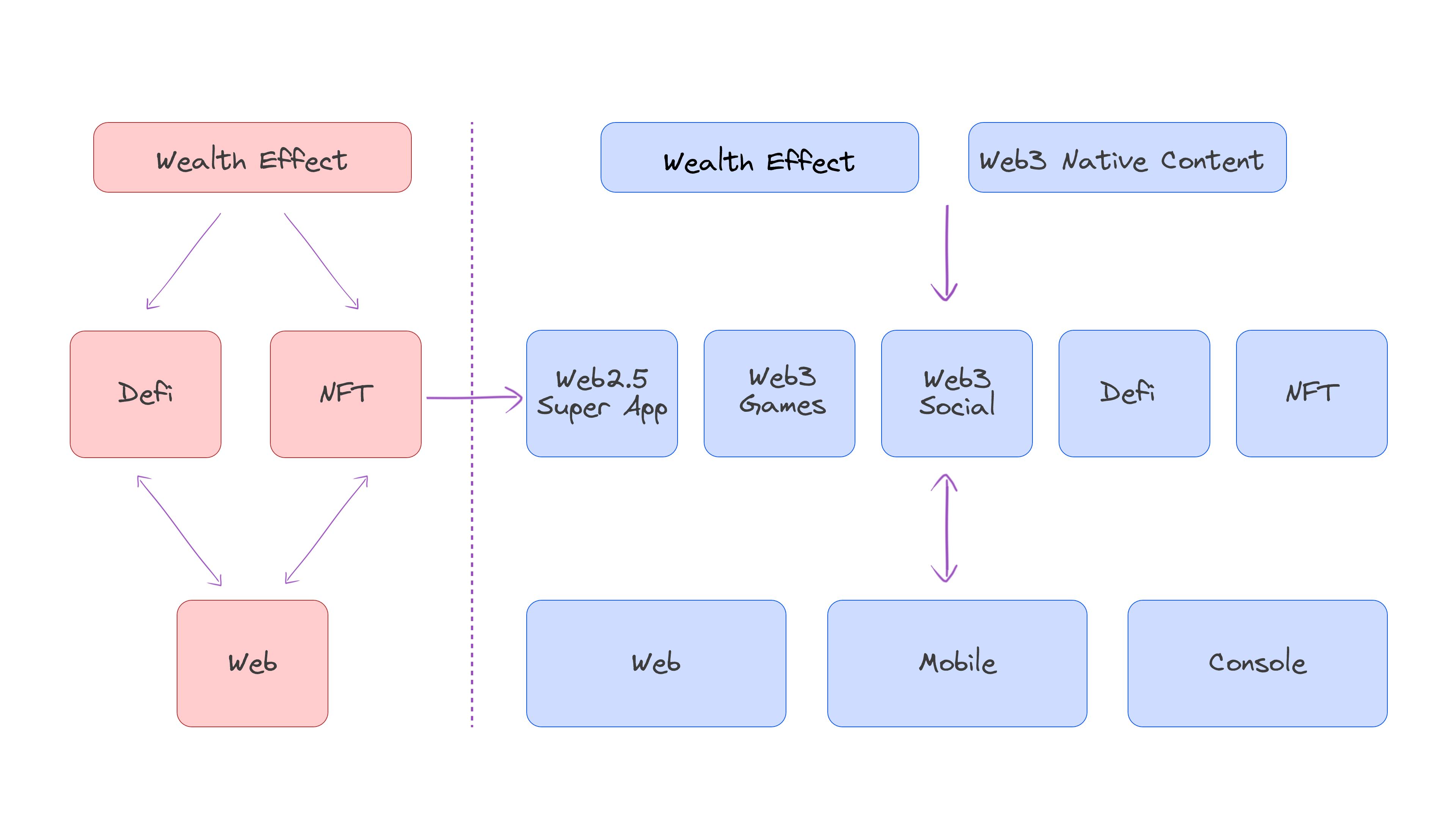

- On-chain core business scenarios are migrating: “Pan-user” application-layer projects are rapidly emerging.

The migration of core business scenarios (from primarily DeFi products accessible through a web interface, to pan-user applications) alters the underlying driving forces for attracting new users. The term “pan-user”, in this case, refers to Web3 applications directed at the mass market, with a focus on end-users and their experiences. In the past, the primary impetus for nearly all new on-chain users came from the wealth effect of leading assets like Bitcoin and Ethereum. But with the rise of pan-user application layer projects, this has shifted to a dual drive, with both headliner assets driving a wealth effect and native Web3 applications attracting users. The path of entry for new users has distinctly changed.

In the business scenarios of pan-user application layer projects, user interactions with the chain are cross-platform, low-value, and high frequency. This contrasts with the web-based interactions of DeFi products, which are of high value and moderate- to low-frequency. The standard configuration for pan-user application layer projects will be mobile-first, utilizing a cross-platform product matrix. This is, once again, in stark contrast with MetaMask, where mobile access to business scenarios can feel disjointed. Product data clearly reflects this, showing a low conversion rate for new user registrations and low completion rates for MetaMask signatures on mobile. The adverse impact on the end-user experience in such scenarios is significant, and MetaMask's asset and user scale advantages can no longer compensate for this failure to retain and onboard users.

- Hesitation in the realm of account abstraction.

Some application-layer projects have entered complex smart interaction phases leveraging the capabilities of account abstraction. Yet, MetaMask hasn't reinforced its role in these scenarios and merely acts as a Signer. The essence of account abstraction is the generalization of account types, with the ultimate goal of eliminating EOAs (Externally Owned Accounts). Since MetaMask is the leader in the EOA account system, its current position conflicts with the fundamental goal of account abstraction, conflicting its business strategy, making it not aggressive enough.

- Misalignment between iterative approach and product essence: The largest customer-facing Web3 on-chain product has a developer-first approach.

MetaMask's overarching success has been due to its strategy as a developer-first product. This proved an excellent strategy in the industry's early days since nearly all users were developers and vice-versa. While it also worked during the DeFi boom, as the need for pan-user application layer projects rises rapidly, and the crypto industry shifts from only being degen-friendly to a mass consumer industry, its current approach is disconnected from the current needs of end-users.

Given the two core reasons for the failure of the growth flywheel, what changes might occur in the "hub" landscape?

We can analyze the potential changes in the hub landscape based on the two core reasons for MetaMask’s failure to achieve this status.

- As we’ve seen, MetaMask has failed to become a hub of Web3 and, on the mobile side, it has lost the flywheel effect that enhances asset size and user scale with dApp.

This might imply more opportunities for other retail wallets, as it turns the competition back to being product-centric. However, it does not decrease the difficulty for other retail wallets to become Web3’s entry point

On mobile devices, competitive barriers are low. Because, unlike in the past, retail wallets are no longer competing with an ecosystem built jointly by MetaMask and its backing DeFi products and web-first dApp. Currently, they’re competing against a sub-optimal but well-known standalone wallet product –MetaMask on mobile. The arena has leveled out, allowing products to compete against other products, not against products and their ecosystems.

However, this does not mean that other retail wallets have increased chances of becoming Web3’s “hubs”. As analyzed previously, retail wallets must carry forward traffic and actively distribute demand. On mobile devices, this challenge hasn't lessened for other wallets. Even though MetaMask doesn't have a unique growth flywheel on mobile, it simply places everyone on the same competitive plane, with MetaMask retaining a clear first-mover advantage.

Even on this basis, the existing opportunities may only be seized by a handful of retail wallets, which may have the following characteristics:

- Mobile-first retail wallets with unique insights into the native needs of end-users in mobile scenarios, and that can meet them.

- Mobile retail wallets that operate with a positive economic model throughout the entire user lifecycle:

- As independent wallets, they should be able to complete a commercial closed loop, e.g. via integrating on-chain contract transactions which may achieve commercial closure within a certain user scale.

- These wallets may also enhance monetization capabilities for the entire ecosystem. Currently, monetization capabilities are centered around exchange-type products, relying on strong operations to produce high TVL, plugging into leading decentralized exchanges and centralized exchanges. Examples include Uniswap's mobile wallet, OKX's OKX Wallet, etc.

3. Integrating an underlying approach to optimizing on-chain transactions at every opportunity. Such products may not even currently be classified as “wallets”, being categorized as optimizing Mempools, MEV, or managing authorizations.

2. The migration of core on-chain business scenarios is a more critical reason for the failure of MetaMask's growth flywheel.

Next, we will discuss the changes this factor will bring to the "hub" landscape.

The migration of core on-chain business scenarios will have a lasting impact on the "hub" structure. Its most profound effect is not just causing MetaMask's growth flywheel to falter, but more importantly, it has shifted the primary driving force for new on-chain users.

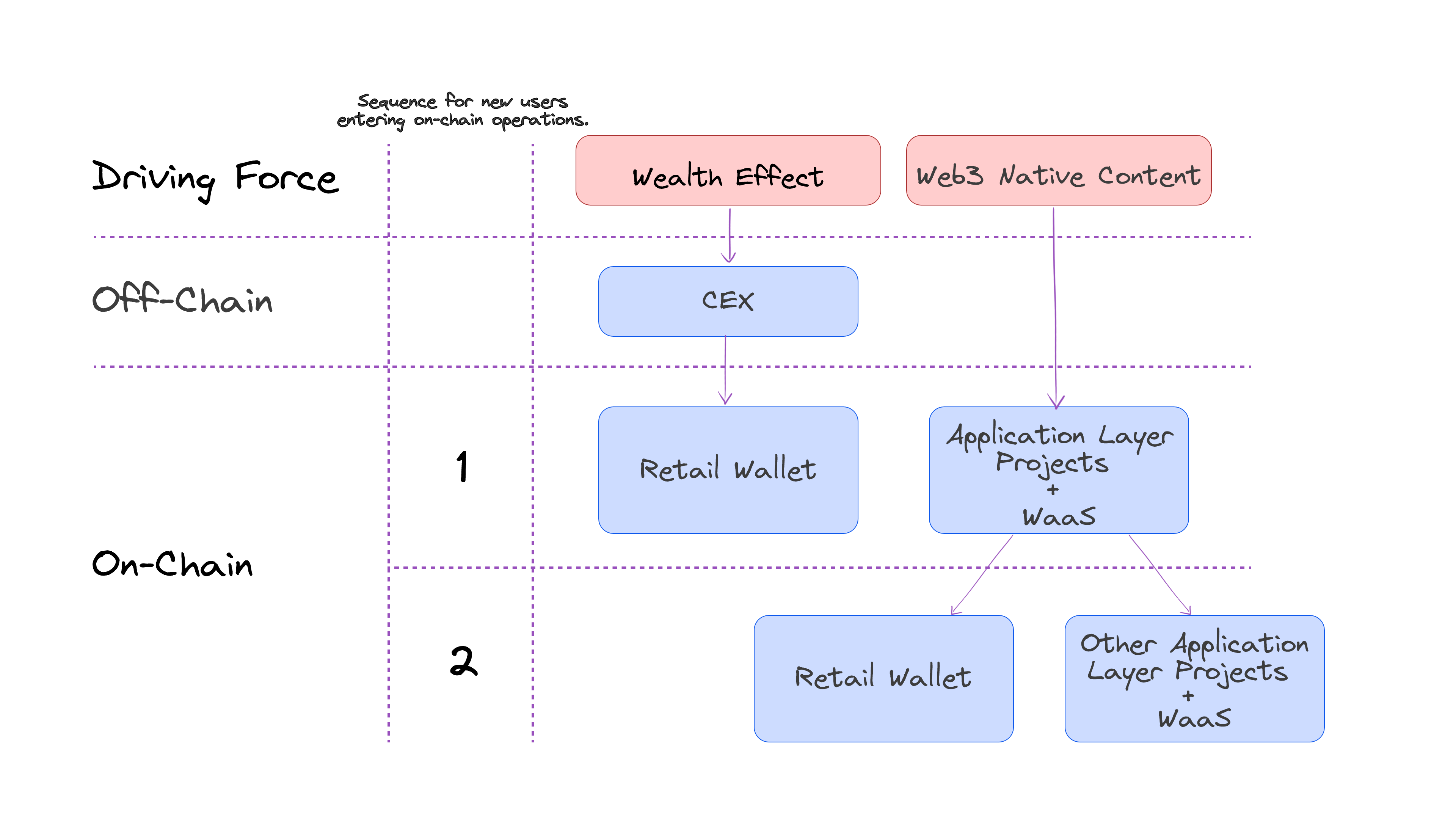

Before the rise of pan user application-layer projects, the main driving force for new on-chain users was the wealth effect of leading assets. However, with the emergence of application-oriented projects, this force has now transitioned to being dual-driven by both the wealth effect of top assets and native Web3 content.

Therefore, to more clearly understand the potential changes in the "hub" landscape, we should pay closer attention to how pan-user application-layer projects will handle new user interactions with the blockchain. This includes: public key generation, private key management, initiating signatures, completing signatures, and feedback after signing.

Pan-user application-layer projects have three choices when handling new user interactions with the blockchain:

- Integrating with high market share retail wallets like MetaMask / Coinbase Wallet.

- Building their own wallet.

- Integrating WaaS (Wallet-as-a-Service) tools.

Within the "build their own wallet" option, there are four specific approaches:

- Building a custodial in-app wallet.

- Building a mnemonic-based, non-custodial in-app wallet.

- Building a social login-based, non-custodial in-app wallet.

- Building a standalone retail wallet.

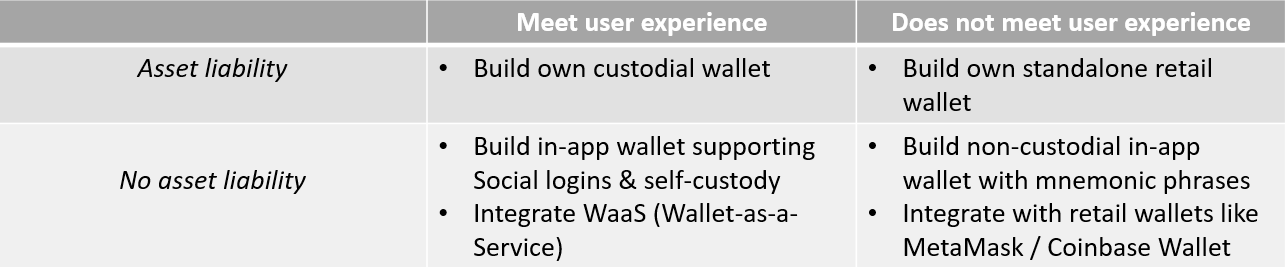

Based on two dimensions –user experience (conversion rate of new users, efficiency of completing signatures within dApp) and asset responsibility, combined with the interaction characteristics of pan-user application layer projects (universal users, cross-platform, low-value, and high-frequency), the following comparison chart can be made:

First approach: Integrating with high-market share retail wallets such as MetaMask / Coinbase Wallet.

Under the dual drive of wealth effects and Web3 native content, this approach is not feasible. It results in high-friction scenarios. Imagine, e.g., a new user trying to play a new game attracted by its content and gameplay. Under this setting, the user would then download a mobile client for it, and then be asked to go to the app store and download a second app (Coinbase Wallet or MetaMask mobile version).

Second approach: Building your own wallet.

Building a standalone retail wallet is a relatively poor choice because, compared to integrating with high-market share retail wallets (such as MetaMask/Coinbase Wallet), it neither solves the problem of disjointed user experience nor adds responsibility for user assets.

The advantage of building a mnemonic wallet is that one less mobile application needs to be downloaded. However, the issue of low user registration conversion rates brought about by the mnemonic itself has not been resolved. Generally speaking, for pan-users (those without much Web3 product experience), the mnemonic phase (understanding and memorization/storing) results in the loss of over 60% of users.

Building a custodial in-app wallet is a relatively feasible short-term solution that can solve user experience issues. However, a drawback is that the independent user's on-chain behavior is not traceable, and as the business grows, the asset responsibility of the application layer project continues to increase.

Building a non-custodial in-app wallet that supports social logins is the relatively best solution. However, for the vast majority of project parties, considering the costs of building and operating, this solution is not cost-effective.

Third approach: Integrating WaaS (Wallet as a Service) tools.

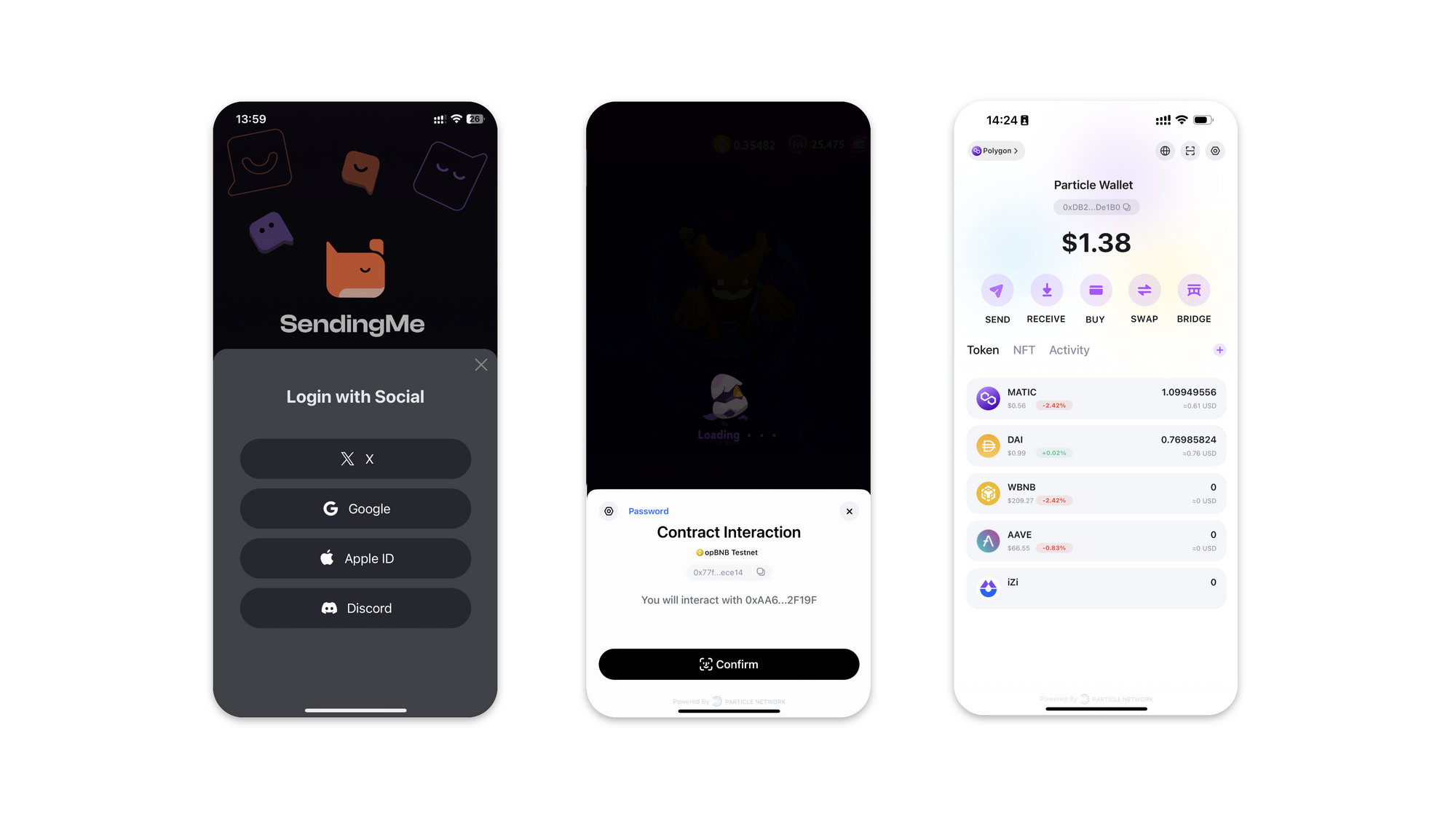

The core services provided by Wallet-as-a-Service products are twofold: Firstly, they offer a social login solution for the dApps they serve, which significantly boosts the registration conversion rate of new users. Secondly, they generate a built-in full-featured wallet within the dApp, allowing for on-chain signatures related to the business to be completed within the dApp without leaving it.

This differs fundamentally from the SDKs of retail wallets: First, the onboarding process must be non-mnemonic-based; otherwise, it contradicts the purpose of improving new user registration conversion rates through social login. Secondly, there's no requirement for an independent wallet product to facilitate the signing process. Moreover, Wallet-as-a-Service products differ from retail wallets in terms of their business models and product evolution paths.

This method can address issues related to asset responsibility and user experience, but the risk lies in the dependency on the operational capabilities of the Wallet-as-a-Service company. However, I believe that the core risk is not in the business itself, but in selecting the right partners.

Considering cost and efficiency, under the industry landscape where pan-user application-layer projects are rising, the standard setup for handling interactions between new users and the blockchain will be WaaS (Wallet as a Service). Therefore, after the migration of core scenarios, a large proportion of new users will be able to interact on-chain directly through application-layer projects leveraging WaaS. They will only be redirected to other application-layer projects or independent retail wallets after completing a significant number of business scenarios.

Based on this line of thought, we can outline the potential development trend of the "hub" landscape.

What is the new "hub" for Web3?

Does this trend suggest that application-layer projects have become the new “hub” of Web3?

Let's return to the definition of a hub: A hub is the starting point for actively gathering and distributing demands, not merely a receptacle for traffic.

Under this trend, pan-user application-layer projects have essentially taken over MetaMask's role in capturing traffic. Furthermore, one advantage they have over MetaMask is that they themselves serve as one of the underlying driving forces growing the industry’s user base.

However, even if a single application-layer project possesses the potential to increase this user base, it won't directly become a hub because two issues still need to be addressed:

- The halo effect (or head effect);

- Redistribution capability.

In the traffic path influenced by these two driving forces, the halo effect determines the scale of the traffic that pan-user application-layer projects can capture, while the redistribution capability decides whether a benign two-way interaction with traffic can be formed based on the captured audience.

The determination of the halo effect seems to follow a certain path, but in reality, it's highly uncertain. The only products that are widely recognized in this context are those Web2 super-apps that have continuously invested in Web3 businesses and have clear objectives (e.g. Telegram). The question arises: will Web3-native pan-application products with the power to drive incremental users be a revolution taking place within centralized exchanges, or will they emerge from Web3 social communication protocols or gaming platforms?

Redistribution capability is one of the intrinsic characteristics of a hub. However, in the Web3 industry, I believe the concept of redistribution capability has a broader meaning. It doesn't solely pertain to traffic distribution, but also includes the distribution of capabilities and consensus. Traffic distribution is straightforward –it's about actively directing the attention of a vast number of end-users to upstream or downstream products. Capability distribution encompasses the operational ability of on-chain assets and the management of user communities. Meanwhile, the distribution of narratives and consensus is essentially catering to the top-tier users.

The combination of the halo effect and redistribution capability determines whether a sustainable hub can be established.

Additionally, we mustn't overlook two roles:

- Centralized exchanges. Leading centralized exchanges will participate in redistributing traffic to on-chain businesses. Mobile retail wallets, WaaS (Wallet-as-a-Service), and on-chain contract trading will likely become standard features of these top exchanges.

- Entities unique to Web3: Unlike Web2, characterized by data insularity and limitations on user rights, Web3 transactions and authorizations are entirely controlled by end-users. As application-layer projects emerge, there may be a need for a platform to centrally manage the authorizations and signatures of end-users, spanning various business scenarios. Opportunities might arise for a new hub regarding end-users' on-chain asset management, authorizations, and transaction statuses.

Parting thoughts

In summary, MetaMask's growth momentum might be waning. The rise of pan-user application-layer projects is driving this shift, transitioning core on-chain business scenarios from web interactions to mobile-first, cross-platform interactions. The Web3 industry is evolving from being a degen-friendly financial sector to becoming more accessible and user-friendly in the consumer sector. In this transformation, pan-user application-layer projects with significant halo effects and redistribution capabilities emerge as the driving forces.

The envisaged Web3 hub might not be a result of planned production, but rather a reward for the role that contributes the most during this evolution.

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)