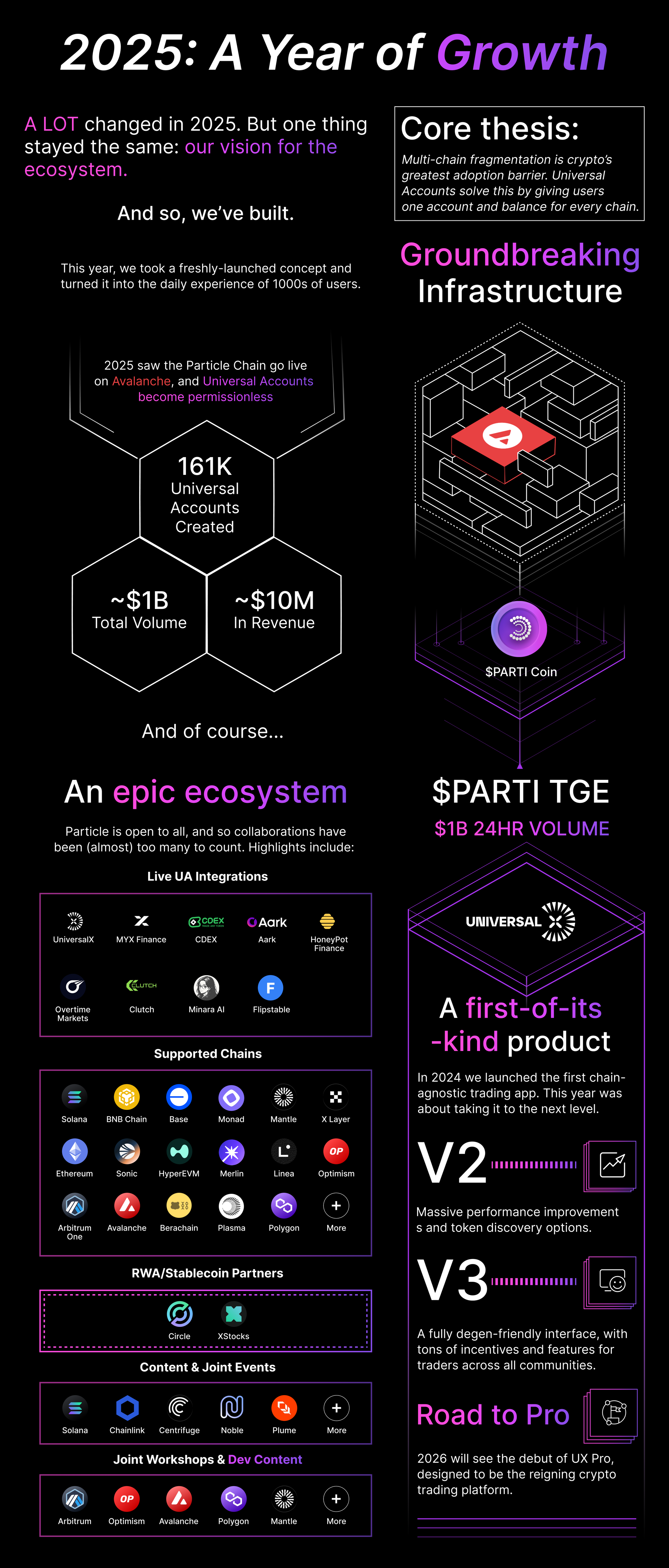

End of Year Update: Our 2025 In Review

Table of Contents:

We started 2025 with an unchanged thesis:

Crypto’s multi-chain fragmentation creates a user experience barrier for true adoption.

This creates the need for chain abstraction (ChA): a user experience exempt from the manual steps required to navigate such a panorama.

To be widely adopted, a ChA solution needs to be designed to meet the needs of users, blockchain ecosystems, and product builders alike—adapting to real-world scenarios rather than forcing participants to adapt to it.

The year started with our chain abstraction solution, Universal Accounts, already a reality. UAs were presented to the market via UniversalX, the first chain-agnostic trading platform, and were about to launch as an SDK for any app to integrate. 2025, therefore, was a year for us to focus on collecting market feedback, fine-tuning our infrastructure and product, and work towards spreading chain abstraction as far as possible.

Let’s review how 2025, the biggest growth year for Particle Network, went… plus, of course, our takes on 2026.

Starting the year with a bang

The year kicked off by building upon 2024’s foundations.

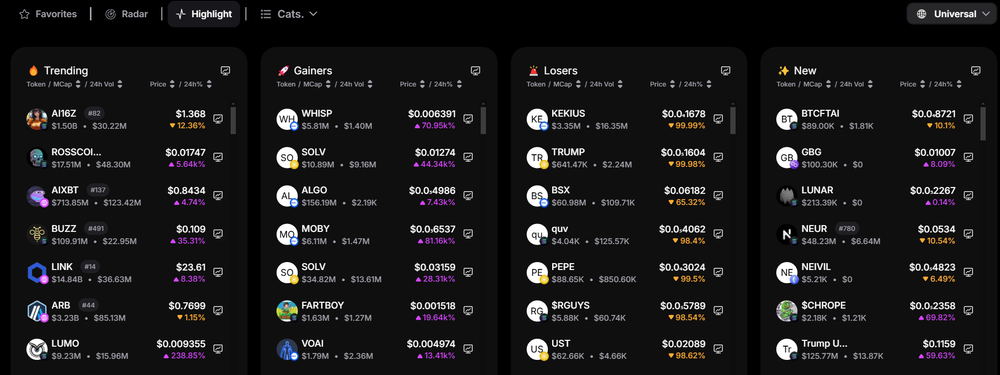

UniversalX V2 was launched, featuring professional-grade interfaces, real-time token discovery, and portfolio tracking. This made UniversalX not only the first chain-agnostic trading platform, but a viable alternative to CEXs.

February saw continued emphasis on ecosystem preparation, with the announcement of the first Universal Accounts integrations. This effort to build a chain-agnostic ecosystem, spearheaded by UniversalX as a flagship product, culminated with the launch of $PARTI in March, concluding multiple ecosystem- and community-building programs launched in 2024.

$PARTI’s TGE generated $1 Billion in spot trading volume within 24 hours, with listings on Binance, OKX, Bybit, MEXC, Bitget, and Gate.io. This immediately established the core economic mechanism behind the Particle Chain: the L1 powering Universal Accounts.

$1 Billion in 24 hours. Communities speak (and drive) volumes. pic.twitter.com/3j6sfHwlhC

— Particle Network (@ParticleNtwrk) March 26, 2025

Y’all drove $1B in $PARTI trading upon its TGE, making it one of 2025’s most successful launches.

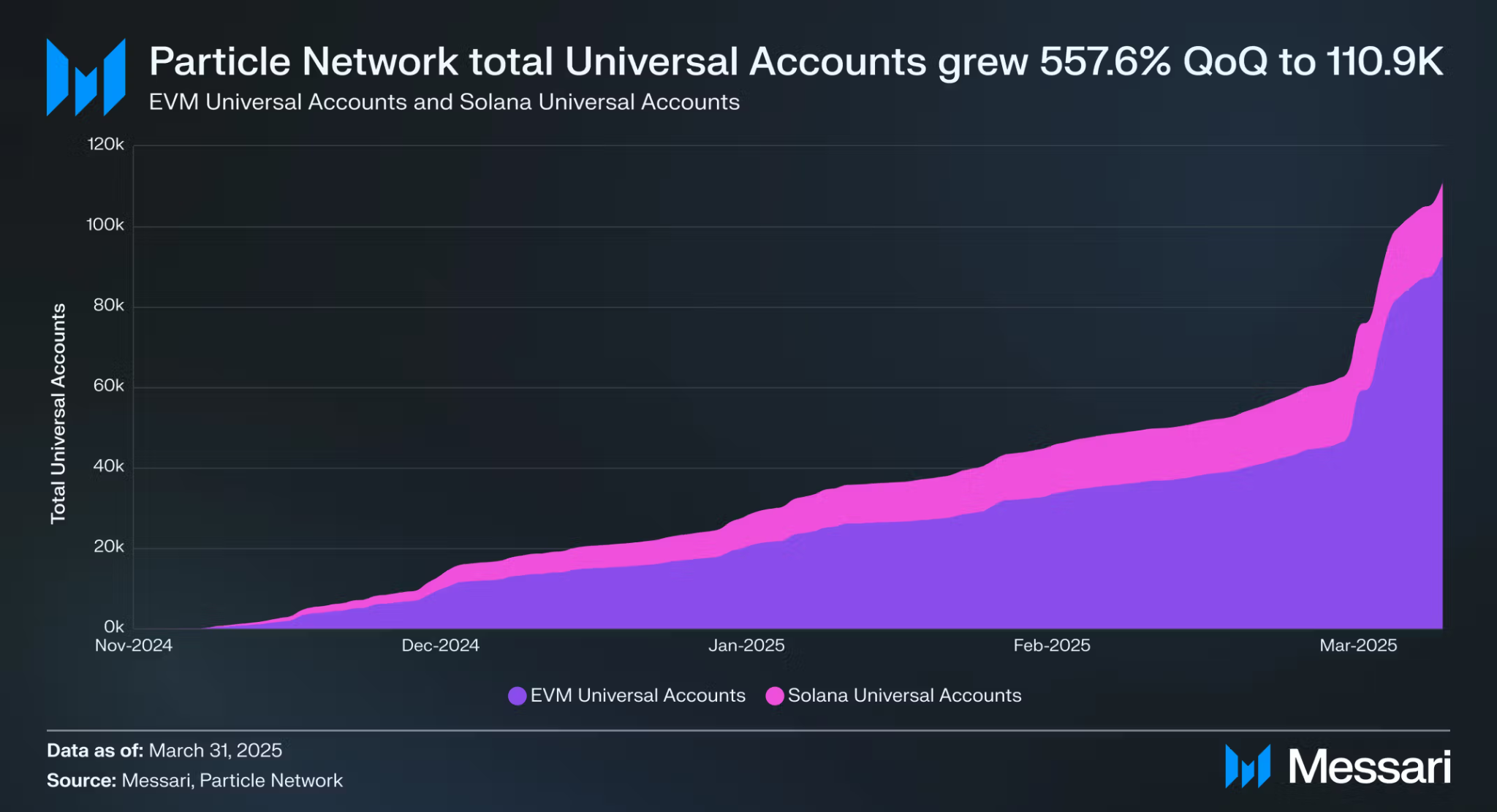

This same quarter, Messari's Q1 2025 report on Particle showcased our progress, featuring:

- 110,900 Universal Accounts (a 557.6% quarter-over-quarter increase) and average daily transactions of 27,100 (up 806.5%).

- UniversalX also shone with $5.9 million in average daily trading volume (a staggering 15,154% QoQ increase), $59,400 in daily fees, 19,300 daily trades, and 1,640 daily users.

Mid-year: Ecosystem expansion and product upgrades

With our core financial mechanism live, and a fully-fledged professional-grade product out, it was time to push infra to the spotlight.

As such, Q2 focused on driving UA adoption.

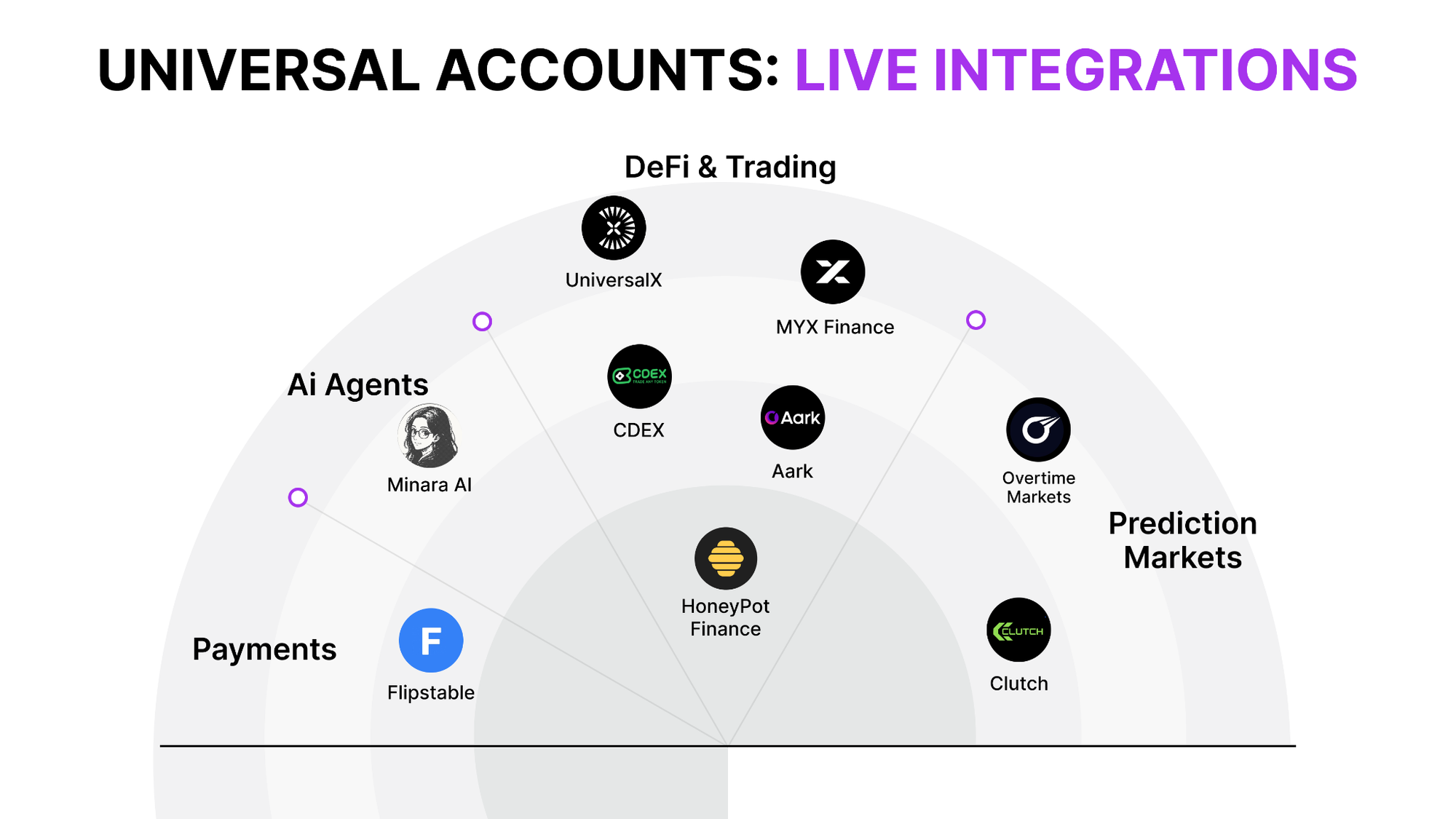

In May, we announced the first cohort of live chain-agnostic dApps, including Overtime (prediction markets), ClutchMarkets, Honeypot Finance (DeFi), MYX Finance (perps DEX), and others. This enabled frictionless multi-chain access at scale for the first time, and allowed us to have external proof of UAs’ power beyond UniversalX

We said we’d bring chain abstraction to every vertical, and we meant it.

— Particle Network (@ParticleNtwrk) May 13, 2025

Last week, we announced the first 10 dApps integrating Universal Accounts.

Here's how @Overtime_io uses Universal Accounts to create a chain-agnostic onchain sportsbook. 🏀👇

1. Account creation

Upon… pic.twitter.com/57hEJ9rJv3

Overtime was the first live implementation of UAs by an external team.

June turned around with another big UniversalX update: V3 launched with the motto “Getting the trenches paid”, and brand new features with cash rewards, $PARTI Diamonds, group trading features, and accelerated rewards to boost engagement. V3 also shone with a smoother interface and MEV protection, a much-needed feature for the Solana ecosystem.

V3 IS A NEW BEGINNING

— UniversalX (@UseUniversalX) June 26, 2025

THIS TIME, WE'RE GETTING THE TRENCHES PAID

paid for trading

paid for starting trading Cabals with friends

paid via our new airdrop

we also now have 1-click limit orders, mobile price alerts, TWAPs, and are faster than ever

(1/5) pic.twitter.com/AvPn7KiXzP

V3 was all about getting trenchers paid.

July 23 marked the public release of the Universal SDK, enabling developers to build chain-agnostic apps easily. At this time, we also got confirmation from other projects, like Aark and Minara, for their own integrations. We started clearly seeing the importance of ChA as a moat for apps, while receiving feedback on how to improve our offering as we seeked to refine the Universal SDK.

Meanwhile, in August, we celebrated UniversalX clearing $670 million in volume, while we aggressively pushed Universal Accounts’ vision, giving ecosystem workshops on how to integrate them alongside Avalanche, Arbitrum, Polygon, and many others.

Trying a new app on a new chain shouldn’t mean converting assets or bridging.

— Particle Developers (@ParticleBuild) November 19, 2025

Universal Accounts let users tap into all their tokens (Solana, Base, etc.) instantly.

Straight to the app, no prep.

Get started here: https://t.co/fZwNRPi1lX pic.twitter.com/Jm7HEgnhiZ

One of our core developer efforts this year was to create tutorials and workshops for builders in every ecosystem.

Late 2025: Partnerships, the Particle Chain, and forward momentum

Q3 and Q4 saw many efforts come to fruition.

In August, we announced two key partnerships in the Real-World Assets and stablecoins space: Circle Gateway and xStocks. This month, $PARTI listings also expanded to Revolut and Kraken.

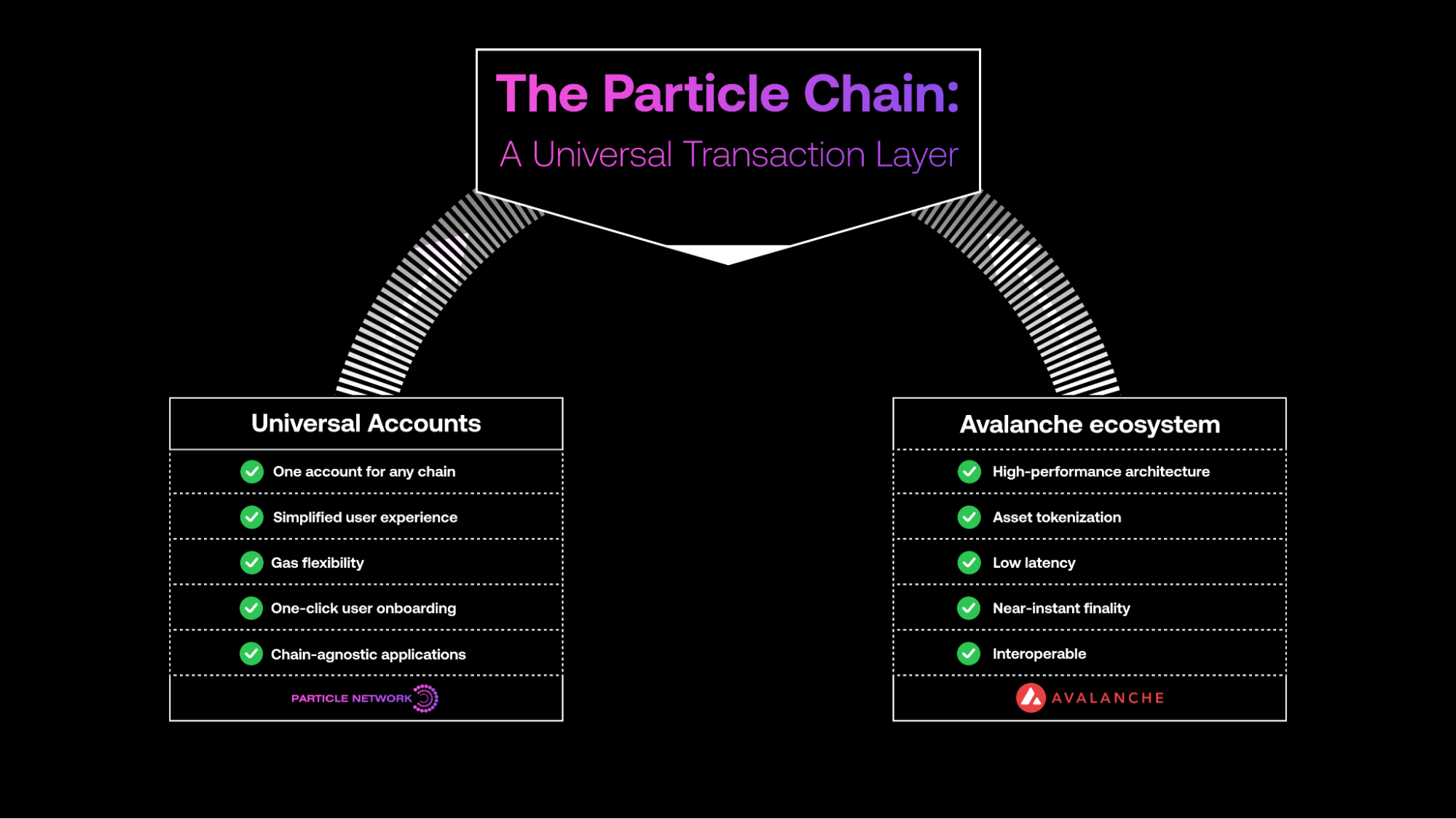

September's highlight was the Particle Chain’s launch on Avalanche. The Particle Chain is a high-performance coordination and settlement layer that enables us to power chain abstraction at scale, with 20+ genesis validators.

As for UniversalX, September saw BNB meme trading driving a 6x spike in daily trading volume. Furthermore, events like KBW Korea and Token2049 Singapore featured panels, workshops, and the launch of the Real-World Value podcast series, interviewing leaders from Chainlink, Solana, Noble, Centrifuge, and others.

Our podcasts have been making waves across CT, and can also be found on our Youtube channel.

October and November marked a steady build toward UniversalX Pro’s early-2026 launch, with major chain integrations: Mantle, Plasma, and Monad went live in quick succession, launches supported by the chains themselves. Our developer content presence also accelerated, with new guides and demos going live, along with partnerships with infrastructure providers Alchemy and Magic.

Furthermore, new Universal Account integrations went live: CDEX, Galaxis, and Aark debuted in succession, alongside Minara, a UA-native AI product offering a unique service and interface. On the UniversalX side, our extended BNB Week campaign helped spark a surge in trading volume on this chain, with zero-gas fees and jackpots.

During December, we’re preparing for a new overhaul of the Universal SDK—one featuring a key addition that will supercharge UAs’ chain-agnostic experience and will be covered in future announcements. Meanwhile, on the UniversalX side, we wrapped up the year with a major update, the final one before Pro.

UniversalX also closed the year with a major update leading up to our Pro release!

Overall, the end of the year focused on deepening integrations, lowering developer friction, and proving chain abstraction in production across DeFi, AI, and RWAs.

But what about the external? Crypto’s 2025, and our plans beyond it

2025 was anything but the expected.

It gave us ATHs and severe downturns. Positive regulation, but greater correlation with risk-on macro environments. Memecoin manias, but “majors” majorly disappointing. Better tech, often met with silence.

Amidst all this, it’s clear that something is changing: It’s now a given that crypto as a technology is here to power a technological upgrade of the world economy, and that stablecoins and other tokenized assets are here to stay. It’s also noticeable that, for the first time, crypto projects are being judged by their business merits, not just their hyped potential.

With adoption accelerating, all factors point to:

- Crypto-native, successful products beginning to prioritize their user experience amidst fierce competition.

- An increased industry-wide practice of delivering chain-agnostic products.

- Better technology leading to deeper, more seamless integrations across Web2, Web3, and even deep financial rails.

- Upgrades to blockchains leading to overall greater flexibility and capabilities for blockchains.

As mentioned above, our core thesis remains intact. Amid an environment striving to become more competitive, powerful, and legitimate, user experience and fragmentation remain fundamental challenges. Our mission, then, is to continue finding ways to accelerate the development of chain-agnostic and user-friendly dApps, leveraging new and existing technologies towards this goal.

As such, for us, 2026 will be about:

- Making chain abstraction more powerful, further eliminating manual processes from Web3’s user experience.

- Making chain abstraction simpler and easier to integrate into dApps.

- Striking partnerships with the ecosystem’s leaders to increase Universal Accounts’ and chain abstraction’s reach.

- Expanding UniversalX’s capabilities to make it competitive with centralized financial platforms of all kinds—not just crypto trading terminals.

- Strengthening the decentralization and core economics foundations of the Particle Chain by making the chain permissionless, enabling $PARTI staking, enhancing its value capture mechanisms, and expanding chain abstraction’s adoption.

Rest is in the details. Here’s to a great 2026!

Particle Network's Chain Abstraction solutions are 100% free for developers and teams. By integrating them, you can set your project in a path to leveraging chain abstraction.

About Particle Network

Particle Network powers chain abstraction, addressing Web3's fragmentation of users and liquidity. This is enabled by Particle's Universal Accounts, which give users a unified account and balance across all chains.

Share this article

About the author(s)